Firm value reflects the total worth of a company, incorporating its assets, earning potential, and market position. Evaluating firm value is essential for investors and management to make informed financial decisions and strategize growth. Discover how understanding firm value can enhance your investment approach by exploring the full article.

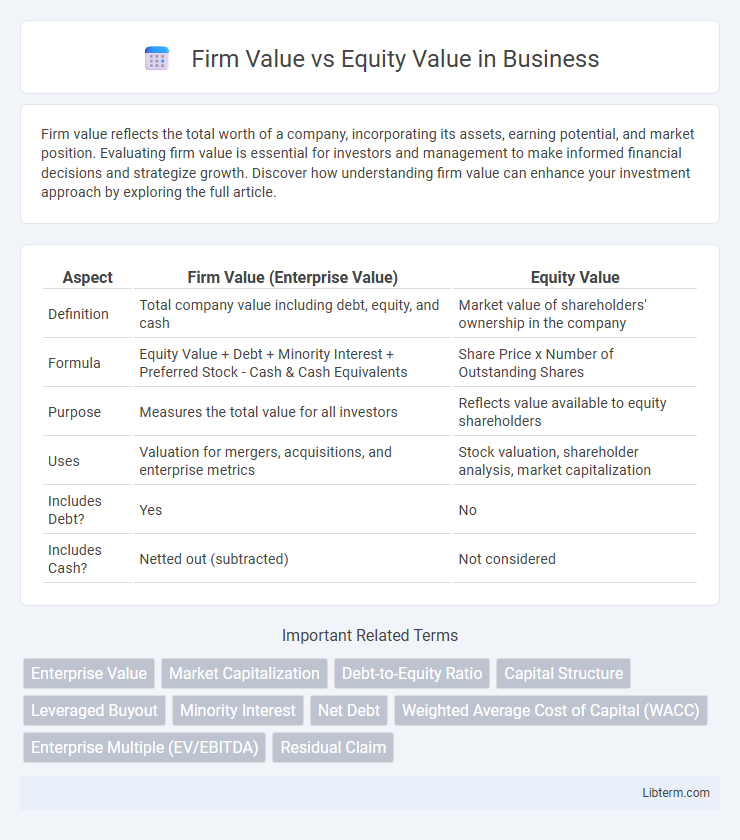

Table of Comparison

| Aspect | Firm Value (Enterprise Value) | Equity Value |

|---|---|---|

| Definition | Total company value including debt, equity, and cash | Market value of shareholders' ownership in the company |

| Formula | Equity Value + Debt + Minority Interest + Preferred Stock - Cash & Cash Equivalents | Share Price x Number of Outstanding Shares |

| Purpose | Measures the total value for all investors | Reflects value available to equity shareholders |

| Uses | Valuation for mergers, acquisitions, and enterprise metrics | Stock valuation, shareholder analysis, market capitalization |

| Includes Debt? | Yes | No |

| Includes Cash? | Netted out (subtracted) | Not considered |

Introduction to Firm Value and Equity Value

Firm value represents the total economic worth of a company, encompassing both its debt and equity components, reflecting the enterprise's overall market capitalization and debt obligations. Equity value, also referred to as market capitalization, specifically measures the value attributable to shareholders by calculating the current stock price multiplied by the total outstanding shares. Understanding the distinction between firm value and equity value is critical for accurate financial analysis, mergers and acquisitions, and investment decision-making.

Definition of Firm Value

Firm Value, also known as Enterprise Value, represents the total market value of a company's operating assets, including equity, debt, and preferred stock, minus cash and cash equivalents. It reflects the comprehensive economic value available to all capital providers and serves as a key metric for assessing the overall worth of a business irrespective of its capital structure. Firm Value is critical for merger and acquisition analysis, valuation comparisons, and investment decisions.

Definition of Equity Value

Equity Value represents the total value of a company's shares outstanding, reflecting the ownership interest available to shareholders. It is calculated by multiplying the current share price by the total number of outstanding shares. This metric contrasts with Firm Value, which includes both equity and debt, capturing the overall value of the entire business enterprise.

Key Differences Between Firm Value and Equity Value

Firm Value represents the total value of a company, including equity, debt, and cash, reflecting its overall worth in the market. Equity Value, also known as market capitalization, signifies the value attributable solely to shareholders' ownership, calculated by multiplying the share price by the number of outstanding shares. The key difference lies in Firm Value encompassing debt and cash alongside equity, while Equity Value focuses exclusively on shareholder value.

Components of Firm Value

Firm value encompasses the total market value of a company's operating assets, including equity, debt, preferred stock, and minority interest, reflecting the enterprise value used in financial analysis. Components of firm value consist of market capitalization (equity value), net debt (total debt minus cash and cash equivalents), and non-operating assets, providing a comprehensive measure of corporate worth. Understanding these components is essential for accurate valuation methods such as discounted cash flow (DCF) and leveraged buyout (LBO) models.

Components of Equity Value

Equity value represents the total value attributable to shareholders and is calculated by multiplying the current share price by the total outstanding shares. Components of equity value include common stock, preferred stock, retained earnings, and additional paid-in capital. These elements together reflect the owners' residual interest after accounting for liabilities and debt, distinguishing equity value from firm value, which encompasses the entire enterprise including debt obligations.

Methods for Calculating Firm Value

Methods for calculating firm value include the Discounted Cash Flow (DCF) analysis, which estimates the present value of expected future free cash flows to the firm, discounted at the weighted average cost of capital (WACC). Another common approach is the Comparable Company Analysis, where multiples such as EV/EBITDA or EV/Revenue are applied based on similar publicly traded firms to derive the enterprise value. Asset-based valuation methods involve summing the market value of a company's tangible and intangible assets, adjusted for liabilities, providing a comprehensive measure of firm value distinct from equity value.

Methods for Calculating Equity Value

Equity value is primarily calculated by multiplying the current share price by the total number of outstanding shares, reflecting the market capitalization of the company. Alternative methods include the enterprise value minus net debt approach, where equity value equals firm value adjusted for debt, cash, and other non-equity claims. Analysts also use discounted cash flow (DCF) models to estimate equity value by projecting free cash flows to equity and discounting them at the equity cost of capital.

Importance of Firm Value vs Equity Value in Financial Analysis

Firm value represents the total value of a company's operating assets, including debt and equity, making it crucial for assessing the overall financial health and investment potential. Equity value reflects the shareholders' ownership stake, essential for evaluating stock price and shareholder returns. Understanding the distinction between firm value and equity value enables accurate valuation, merger considerations, and capital structure analysis in financial decision-making.

Practical Applications and Real-World Examples

Firm value represents the total value of a company's assets, including debt and equity, and is crucial for mergers and acquisitions when assessing overall purchase price. Equity value, reflecting only shareholders' ownership after liabilities, is key for stock valuation and shareholder returns analysis. For example, in an acquisition, buyers often analyze firm value to understand total enterprise worth, while investors focus on equity value to determine share price fairness.

Firm Value Infographic

libterm.com

libterm.com