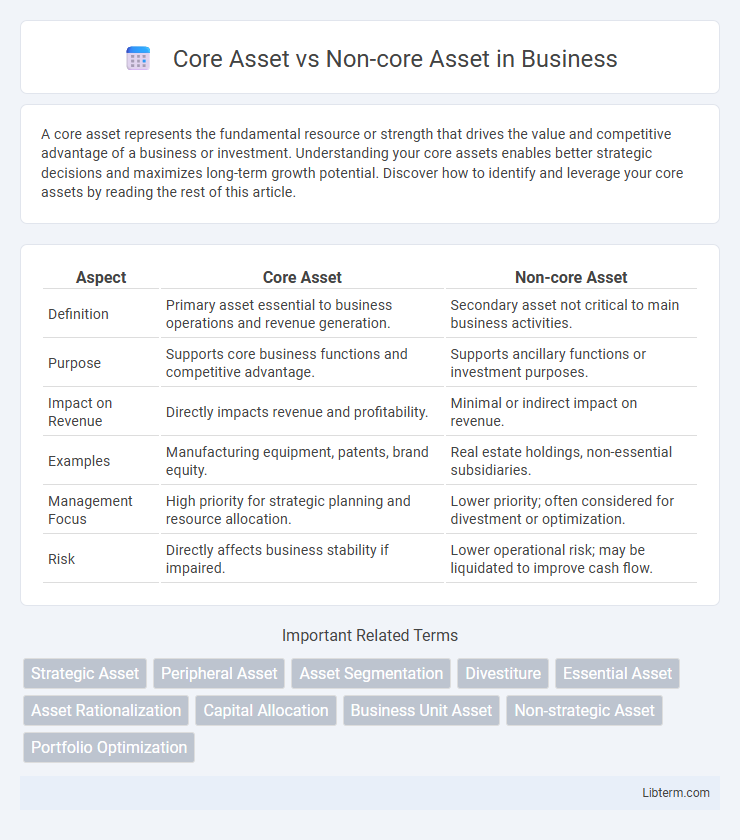

A core asset represents the fundamental resource or strength that drives the value and competitive advantage of a business or investment. Understanding your core assets enables better strategic decisions and maximizes long-term growth potential. Discover how to identify and leverage your core assets by reading the rest of this article.

Table of Comparison

| Aspect | Core Asset | Non-core Asset |

|---|---|---|

| Definition | Primary asset essential to business operations and revenue generation. | Secondary asset not critical to main business activities. |

| Purpose | Supports core business functions and competitive advantage. | Supports ancillary functions or investment purposes. |

| Impact on Revenue | Directly impacts revenue and profitability. | Minimal or indirect impact on revenue. |

| Examples | Manufacturing equipment, patents, brand equity. | Real estate holdings, non-essential subsidiaries. |

| Management Focus | High priority for strategic planning and resource allocation. | Lower priority; often considered for divestment or optimization. |

| Risk | Directly affects business stability if impaired. | Lower operational risk; may be liquidated to improve cash flow. |

Introduction to Core and Non-core Assets

Core assets represent essential resources or properties integral to a company's primary operations and long-term strategic goals, directly contributing to competitive advantage and revenue generation. Non-core assets consist of secondary or peripheral holdings that do not play a critical role in the main business functions and are often considered for divestiture to improve financial flexibility. Understanding the distinction between core and non-core assets is crucial for effective asset management, strategic planning, and optimizing resource allocation.

Defining Core Assets

Core assets are critical resources or properties that directly contribute to a company's competitive advantage, revenue generation, and long-term business strategy. These assets include key intellectual property, essential technologies, prime real estate, or major operational facilities that are integral to maintaining market position. Non-core assets, in contrast, are those not essential to the main business focus and can often be divested without materially affecting a company's profitability or strategic direction.

Understanding Non-core Assets

Non-core assets refer to business properties or investments that do not contribute directly to a company's primary operations or strategic goals, often considered non-essential for long-term growth. Examples include surplus real estate, non-operating subsidiaries, or underutilized equipment that can be divested to improve financial efficiency. Identifying and managing non-core assets allows businesses to streamline their portfolio, optimize capital allocation, and enhance shareholder value.

Key Differences Between Core and Non-core Assets

Core assets represent essential resources directly linked to a company's primary business operations and long-term strategic goals, such as manufacturing facilities or patented technologies. Non-core assets include peripheral or non-essential holdings like surplus real estate or unrelated business units that do not directly contribute to daily operations or core revenue streams. The key differences lie in their impact on competitive advantage, with core assets driving operational efficiency and growth, while non-core assets are often divested to improve financial flexibility and focus.

Importance of Identifying Core Assets

Identifying core assets is crucial for businesses to allocate resources efficiently and maximize long-term value creation. Core assets, which are central to a company's competitive advantage and revenue generation, require strategic investment and protection. Distinguishing these from non-core assets enables focused management, divestiture of underperforming units, and improved operational agility.

Strategic Role of Non-core Assets in Organizations

Non-core assets, often viewed as non-essential to a company's primary operations, play a strategic role by providing flexibility in resource allocation and opportunities for divestment to enhance financial health. These assets can be leveraged for capital infusion, enabling organizations to focus on core competencies and invest in high-growth areas. Managing non-core assets effectively supports risk mitigation and strategic realignment, crucial for sustaining competitive advantage in dynamic markets.

Criteria for Classifying Assets

Criteria for classifying assets as core or non-core primarily include their strategic importance to the company's main operations, contribution to revenue generation, and alignment with long-term business objectives. Core assets are essential for maintaining competitive advantage and supporting primary business activities, while non-core assets do not directly impact the core business strategy and may be considered for divestment. Financial performance, market position, and resource allocation efficiency also serve as key factors in this classification.

Impact of Asset Classification on Business Performance

Core assets, such as proprietary technology, intellectual property, or key production facilities, directly drive business performance by generating consistent revenue streams and competitive advantage. Non-core assets, including surplus real estate or secondary equipment, can dilute operational efficiency if mismanaged, but when optimized, provide liquidity and risk mitigation. Proper classification and strategic management of core versus non-core assets enhance resource allocation, maximize profitability, and improve overall corporate valuation.

Managing and Optimizing Asset Portfolios

Managing and optimizing asset portfolios requires differentiating between core and non-core assets, where core assets generate consistent revenue and align closely with strategic business objectives. Non-core assets, often underutilized or peripheral, should be evaluated for divestment or repurposing to enhance overall portfolio efficiency and liquidity. Effective asset management leverages performance metrics and market analysis to prioritize investment in core assets while streamlining or reallocating non-core holdings for maximum portfolio value.

Conclusion: Maximizing Value from Assets

Maximizing value from assets requires identifying core assets that directly contribute to a company's competitive advantage and long-term growth, while non-core assets should be optimized for short-term liquidity or divestiture to streamline operations. Effective asset management focuses on allocating resources to core assets that drive revenue and innovation, enhancing overall portfolio performance. Strategic decisions on asset classification enable businesses to improve capital efficiency and fuel sustainable value creation.

Core Asset Infographic

libterm.com

libterm.com