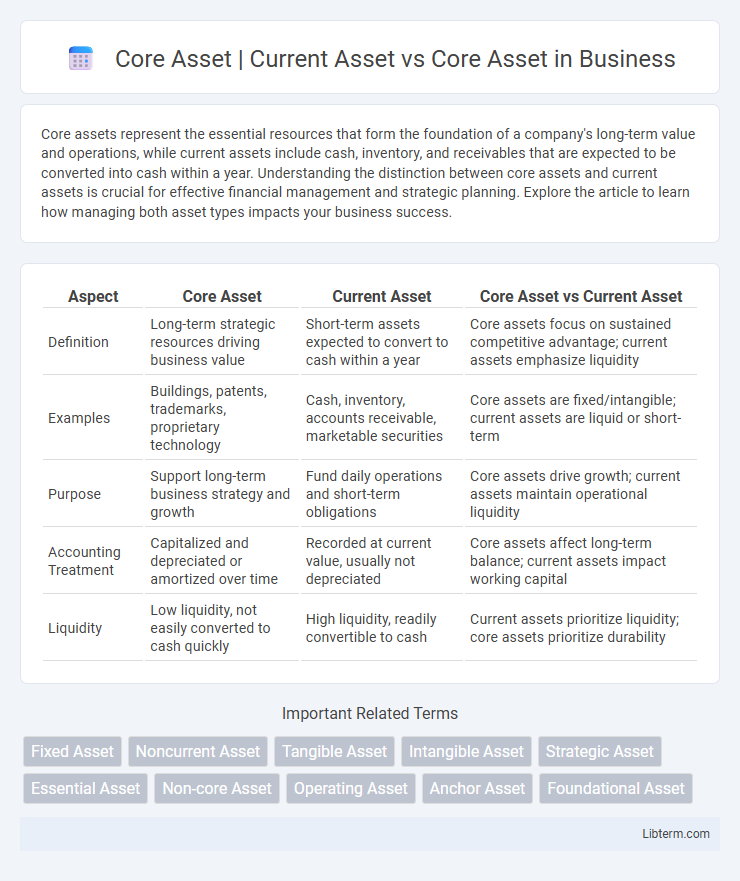

Core assets represent the essential resources that form the foundation of a company's long-term value and operations, while current assets include cash, inventory, and receivables that are expected to be converted into cash within a year. Understanding the distinction between core assets and current assets is crucial for effective financial management and strategic planning. Explore the article to learn how managing both asset types impacts your business success.

Table of Comparison

| Aspect | Core Asset | Current Asset | Core Asset vs Current Asset |

|---|---|---|---|

| Definition | Long-term strategic resources driving business value | Short-term assets expected to convert to cash within a year | Core assets focus on sustained competitive advantage; current assets emphasize liquidity |

| Examples | Buildings, patents, trademarks, proprietary technology | Cash, inventory, accounts receivable, marketable securities | Core assets are fixed/intangible; current assets are liquid or short-term |

| Purpose | Support long-term business strategy and growth | Fund daily operations and short-term obligations | Core assets drive growth; current assets maintain operational liquidity |

| Accounting Treatment | Capitalized and depreciated or amortized over time | Recorded at current value, usually not depreciated | Core assets affect long-term balance; current assets impact working capital |

| Liquidity | Low liquidity, not easily converted to cash quickly | High liquidity, readily convertible to cash | Current assets prioritize liquidity; core assets prioritize durability |

Introduction to Core Assets

Core assets represent the essential, long-term resources that drive a company's core business operations and sustain competitive advantage, typically including intellectual property, brand reputation, and proprietary technology. Unlike current assets, which are short-term and liquid such as cash, inventory, and receivables, core assets are strategic and contribute to long-term value creation and stability. Understanding core assets is crucial for effective asset management, investment evaluation, and assessing a company's potential for sustainable growth.

Defining Current Assets

Current assets consist of cash, accounts receivable, inventory, and other assets expected to be converted into cash or used within one fiscal year, essential for day-to-day operations. Core assets, in contrast, are long-term investments or properties critical for a company's strategic objectives and sustained growth, not intended for short-term liquidity. Defining current assets involves identifying resources that maintain operational liquidity and fund ongoing business activities while supporting company solvency.

What Are Core Assets?

Core assets refer to essential resources or properties that form the foundation of a company's operations and long-term value, often including key intellectual property, brand reputation, or critical infrastructure. Unlike current assets, which are short-term and liquid, such as cash or inventory, core assets are typically long-term and fundamental to sustaining competitive advantage and generating revenue. Identifying and managing core assets is crucial for strategic planning and investment decisions within an organization.

Key Differences: Core Asset vs Current Asset

Core assets refer to long-term, essential resources critical for a company's operations, such as machinery, buildings, and intellectual property, whereas current assets include short-term resources like cash, inventory, and receivables expected to be converted to cash within a year. The primary difference lies in their liquidity and usage; core assets support ongoing business functions and strategic growth, while current assets facilitate daily operational needs and liquidity management. Valuation and depreciation approaches also differ, with core assets typically subject to amortization or depreciation over extended periods, unlike current assets which are usually accounted at cost or market value.

Role of Core Assets in Business Sustainability

Core assets represent essential resources, such as intellectual property, brand reputation, and proprietary technology, that drive long-term business sustainability and competitive advantage. Unlike current assets, which include short-term resources like cash and inventory, core assets contribute to ongoing value creation and strategic growth. Their effective management ensures resilience, innovation capacity, and sustained market relevance in dynamic economic environments.

Importance of Current Assets in Operations

Current assets, including cash, accounts receivable, and inventory, are vital for sustaining daily business operations by ensuring liquidity and operational efficiency. Unlike core assets, which are long-term resources driving strategic growth, current assets allow companies to meet short-term obligations and manage working capital effectively. Maintaining adequate current assets prevents operational disruptions and supports continuous production and service delivery.

Examples of Core Assets vs Current Assets

Core assets include long-term resources such as real estate, patents, and machinery that provide ongoing value to a company, while current assets consist of short-term items like cash, inventory, and accounts receivable essential for daily operations. For example, a manufacturing plant building represents a core asset, whereas raw materials stored for production are current assets. Core assets are pivotal for sustained business growth, whereas current assets ensure liquidity and operational efficiency.

Financial Impact: Core Asset and Current Asset Management

Efficient management of core assets, such as property, plant, and equipment, directly impacts long-term financial stability by ensuring sustained operational capacity and minimizing depreciation costs. In contrast, current assets like cash, inventory, and receivables influence short-term liquidity and working capital optimization, affecting day-to-day financial operations. Strategic oversight of both asset types is essential for balanced cash flow, investment planning, and maximizing return on assets (ROA).

Strategies for Optimizing Core and Current Assets

Optimizing core and current assets involves aligning investment strategies with business objectives to enhance operational efficiency and financial stability. Core assets, typically long-term holdings critical to revenue generation, require strategic reinvestment and maintenance to maximize value over time. Current assets demand agile management techniques such as inventory turnover optimization and accounts receivable acceleration to improve liquidity and support daily operations.

Conclusion: Choosing the Right Asset Focus

Core assets represent long-term investments essential for a company's strategic growth, while current assets provide liquidity for day-to-day operations, emphasizing operational efficiency. Selecting the right asset focus depends on the business model and financial goals, balancing between stability through core assets and flexibility via current assets. An optimized asset strategy integrates both types to enhance overall financial health and support sustainable growth.

Core Asset | Current Asset Infographic

libterm.com

libterm.com