Signaling plays a crucial role in communication by conveying important information through various channels such as visual cues, sounds, and gestures. Understanding the different types of signaling mechanisms can enhance your ability to interpret messages accurately in both personal and professional contexts. Explore the rest of the article to uncover how effective signaling impacts your interactions and decision-making.

Table of Comparison

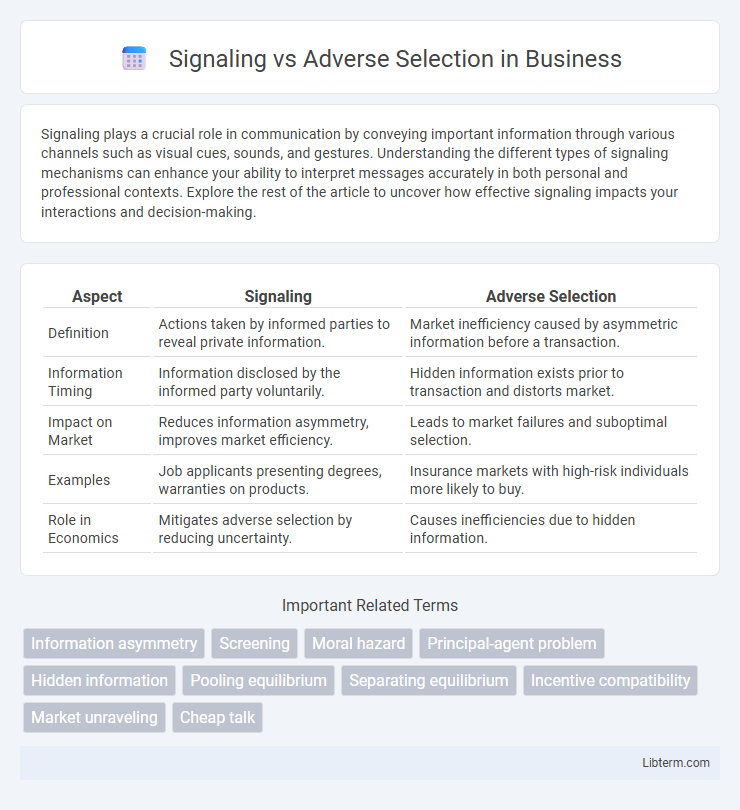

| Aspect | Signaling | Adverse Selection |

|---|---|---|

| Definition | Actions taken by informed parties to reveal private information. | Market inefficiency caused by asymmetric information before a transaction. |

| Information Timing | Information disclosed by the informed party voluntarily. | Hidden information exists prior to transaction and distorts market. |

| Impact on Market | Reduces information asymmetry, improves market efficiency. | Leads to market failures and suboptimal selection. |

| Examples | Job applicants presenting degrees, warranties on products. | Insurance markets with high-risk individuals more likely to buy. |

| Role in Economics | Mitigates adverse selection by reducing uncertainty. | Causes inefficiencies due to hidden information. |

Understanding Signaling and Adverse Selection

Signaling occurs when one party in a transaction credibly conveys information to reduce information asymmetry, such as a job candidate presenting a degree to demonstrate competence. Adverse selection arises when one party exploits hidden information before a transaction, leading to suboptimal outcomes, exemplified by sellers knowing product defects while buyers do not. Understanding signaling and adverse selection is essential in economics and finance to design mechanisms that improve market efficiency and reduce information imbalances.

Key Definitions: Signaling vs Adverse Selection

Signaling refers to actions taken by informed parties to convey credible information to uninformed parties, reducing information asymmetry, often through observable indicators like education or warranties. Adverse selection occurs when one party in a transaction possesses hidden information that negatively affects the other party, leading to suboptimal market outcomes, such as high-risk individuals disproportionately purchasing insurance. Understanding the distinction is crucial in economics and finance, where signaling mitigates adverse selection by improving transparency and aligning incentives.

The Role of Information Asymmetry

Information asymmetry plays a critical role in distinguishing signaling from adverse selection within markets. Signaling occurs when informed parties convey credible information to uninformed counterparts to reduce uncertainty, while adverse selection arises from hidden information that leads to suboptimal transactions and market inefficiencies. Effective mechanisms to mitigate information asymmetry can enhance market transparency and improve decision-making outcomes in economic and financial contexts.

How Signaling Works in Markets

Signaling in markets occurs when informed parties, such as sellers or job applicants, convey credible information to uninformed parties to reduce information asymmetry. For example, firms may invest in costly advertising or warranties to signal product quality, while job seekers use education credentials to demonstrate competence. This process improves market efficiency by aligning expectations and enabling better decision-making among participants.

Examples of Signaling in Real Life

In real life, signaling often appears in the job market where candidates use educational degrees to indicate competence and productivity to employers, reducing information asymmetry. Home sellers may invest in repairs or staging to signal the property's quality, reassuring potential buyers. Brands also use warranties as a signal of product reliability, influencing consumer purchase decisions.

What is Adverse Selection?

Adverse selection occurs when one party in a transaction has more information about a product or risk than the other, leading to an imbalance that can cause market inefficiencies. This phenomenon is common in insurance markets, where individuals with higher risk are more likely to purchase coverage, driving up costs for insurers. The resulting information asymmetry often causes the withdrawal of low-risk participants, worsening the overall quality of the market.

Adverse Selection in Financial and Insurance Markets

Adverse selection occurs when asymmetric information leads high-risk individuals to disproportionately participate in financial and insurance markets, causing market inefficiencies and potential losses for providers. In insurance markets, adverse selection manifests as individuals with higher risk profiles purchasing more coverage, resulting in increased claims and premium adjustments that may drive low-risk clients away. Financial markets experience adverse selection when borrowers or investment counterparties possess private information about their risk levels, leading lenders or investors to raise interest rates or demand higher returns to compensate for unseen risks.

Comparing Outcomes: Signaling vs Adverse Selection

Signaling improves market outcomes by reducing information asymmetry, allowing high-quality sellers or applicants to communicate their true value through credible signals, such as warranties or certifications. Adverse selection, however, leads to inefficient markets where buyers or employers cannot distinguish quality, causing good sellers or candidates to be driven out and resulting in a market dominated by lower-quality participants. The net effect of signaling is an enhanced allocation of resources, whereas adverse selection typically results in market failure or reduced overall welfare.

Strategies to Mitigate Adverse Selection

Employing comprehensive screening methods, such as detailed questionnaires and credit checks, reduces adverse selection by revealing hidden information about participants. Offering warranties and guarantees serves as a signaling mechanism, encouraging sellers to demonstrate product quality and build trust with buyers. Implementing risk-based pricing aligns premiums with individual risk profiles, discouraging high-risk applicants and promoting market efficiency.

Implications for Businesses and Policymakers

Signaling and adverse selection critically impact market efficiency, where signaling allows sellers to reveal product quality through credible indicators, reducing information asymmetry. Adverse selection leads to market failure by driving out high-quality products due to hidden information, imposing costs on businesses and distorting market outcomes. Policymakers must design regulations that enhance transparency and encourage reliable signal mechanisms to mitigate adverse selection and promote fair competition.

Signaling Infographic

libterm.com

libterm.com