A management buyout (MBO) occurs when a company's existing managers acquire a significant portion or all of the business, leveraging their insider knowledge to drive future success. This strategic move often enhances operational control, aligns managerial incentives, and can unlock significant value for both buyers and sellers. Explore the rest of the article to understand how a management buyout might transform Your business landscape.

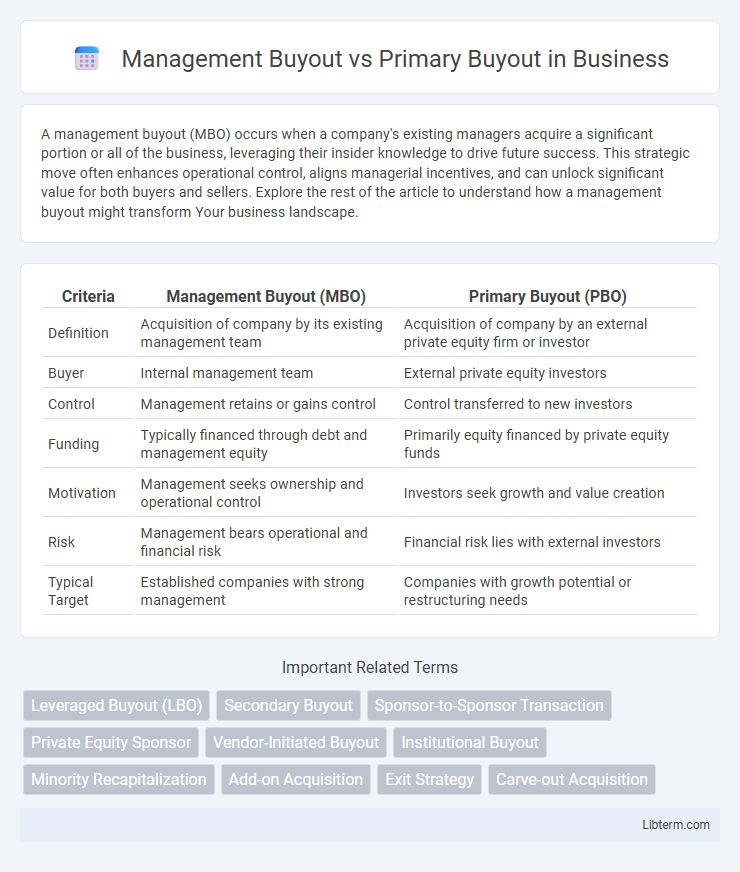

Table of Comparison

| Criteria | Management Buyout (MBO) | Primary Buyout (PBO) |

|---|---|---|

| Definition | Acquisition of company by its existing management team | Acquisition of company by an external private equity firm or investor |

| Buyer | Internal management team | External private equity investors |

| Control | Management retains or gains control | Control transferred to new investors |

| Funding | Typically financed through debt and management equity | Primarily equity financed by private equity funds |

| Motivation | Management seeks ownership and operational control | Investors seek growth and value creation |

| Risk | Management bears operational and financial risk | Financial risk lies with external investors |

| Typical Target | Established companies with strong management | Companies with growth potential or restructuring needs |

Introduction to Buyouts: MBO vs. Primary Buyout

Management buyouts (MBOs) occur when a company's existing management team acquires a significant portion or all of the business, leveraging their operational expertise and insider knowledge to drive growth. Primary buyouts involve private equity firms purchasing a controlling interest in a company directly from its founders or shareholders, targeting strategic value creation through capital injection and restructuring. Both buyout types serve as critical mechanisms for ownership transition, yet differ fundamentally in buyer composition and control objectives.

Definition of Management Buyout (MBO)

A Management Buyout (MBO) occurs when a company's existing management team acquires a significant portion or all of the business, typically using a combination of personal capital and external financing. This buyout aligns the interests of management with company performance, often leading to more focused strategic direction and operational efficiency. In contrast, a Primary Buyout involves an external private equity firm purchasing a company without direct involvement from the current management team.

Definition of Primary Buyout

A Primary Buyout occurs when a private equity firm acquires a controlling stake in a company directly from its founders, family owners, or early-stage investors, injecting capital to support growth or strategic changes. This contrasts with a Management Buyout (MBO), where the existing management team purchases the company, often partnering with external financiers. Primary Buyouts typically involve fresh capital infusion and a new ownership structure, enabling expansion and operational improvements.

Key Differences Between MBO and Primary Buyout

Management Buyout (MBO) involves the existing management team acquiring a significant portion or all of the company, whereas a Primary Buyout is typically led by private equity firms or external investors purchasing shares directly from the company or its shareholders. MBOs prioritize continuity and leverage management's intimate knowledge of the business, while Primary Buyouts emphasize injecting external capital to drive strategic growth or restructuring. Key differences include the source of buyout financing, the buyer's relationship to the company, and the strategic objectives guiding the acquisition.

Advantages of Management Buyouts

Management buyouts (MBOs) allow existing management teams to acquire ownership, aligning their interests directly with the company's success and driving stronger motivation and performance. This alignment often leads to enhanced operational efficiency and quicker decision-making due to the management's intimate knowledge of the business. MBOs also minimize disruption and preserve company culture, benefiting employee morale and customer relationships.

Advantages of Primary Buyouts

Primary buyouts offer significant advantages including access to substantial capital from private equity firms, enabling accelerated growth and operational improvements. They provide management teams with strategic support and industry expertise, leading to enhanced value creation and competitive positioning. The influx of resources and professional guidance in primary buyouts often results in improved financial performance and long-term business sustainability.

Challenges in Management Buyouts

Management buyouts (MBOs) face unique challenges such as securing sufficient financing, managing conflicts of interest between management and investors, and navigating complex valuation negotiations. Unlike primary buyouts where external investors acquire majority control, MBOs require management teams to balance operational duties with new ownership responsibilities, often leading to strained internal dynamics and risk management issues. Successfully addressing these challenges demands strong leadership capabilities and clear governance frameworks within the management team.

Risks Associated with Primary Buyouts

Primary buyouts involve private equity firms acquiring a company directly from its owners, carrying risks such as high leverage levels that can strain the company's cash flow and operational performance. Unlike management buyouts where existing management is involved and aligned with business continuity, primary buyouts face integration challenges and potential conflicts with new management teams unfamiliar with the company culture. Market risks also intensify as primary buyouts depend heavily on external financing conditions, increasing vulnerability during economic downturns or credit tightening.

Factors to Consider When Choosing Between MBO and Primary Buyout

When choosing between a Management Buyout (MBO) and a Primary Buyout, key factors include the level of internal expertise and alignment of interests within the existing management team, which is critical for MBOs as they rely on current leadership to drive future growth. Primary Buyouts often involve external private equity firms seeking to acquire a majority stake, prioritizing access to capital and operational restructuring capabilities. Financial resources, risk tolerance, and long-term strategic goals heavily influence the decision, with MBOs favoring continuity and insider knowledge, while Primary Buyouts focus on fresh management and scalability.

Conclusion: Choosing the Right Buyout Strategy

Selecting the right buyout strategy depends on company goals, financial stability, and stakeholder interests; management buyouts foster continuity by empowering existing leadership, while primary buyouts bring in fresh resources and expertise through external investors. Evaluating long-term value creation, risk tolerance, and operational control is essential to determine whether management's insight or external capital aligns best with growth objectives. Careful assessment of market conditions and strategic priorities ensures optimal alignment between buyout type and business transformation outcomes.

Management Buyout Infographic

libterm.com

libterm.com