Articles of Organization establish the core framework for forming a limited liability company (LLC), outlining essential details like the company's name, address, and management structure. Filing these documents with the appropriate state agency legally registers the LLC and defines your business's operational foundation. Explore the rest of this article to understand the importance of Articles of Organization and how to properly prepare and file them.

Table of Comparison

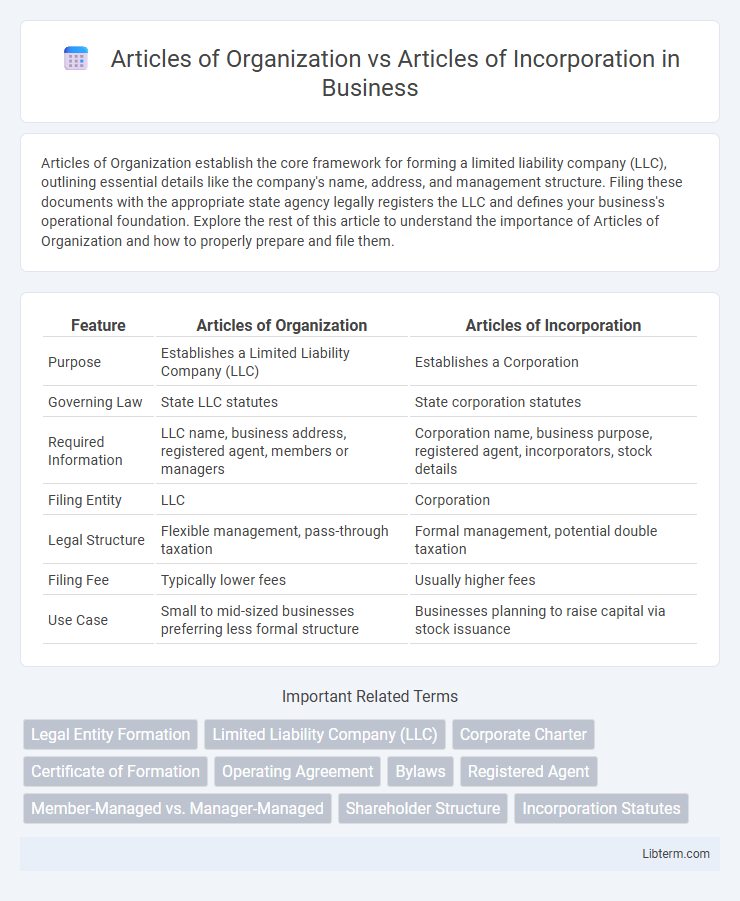

| Feature | Articles of Organization | Articles of Incorporation |

|---|---|---|

| Purpose | Establishes a Limited Liability Company (LLC) | Establishes a Corporation |

| Governing Law | State LLC statutes | State corporation statutes |

| Required Information | LLC name, business address, registered agent, members or managers | Corporation name, business purpose, registered agent, incorporators, stock details |

| Filing Entity | LLC | Corporation |

| Legal Structure | Flexible management, pass-through taxation | Formal management, potential double taxation |

| Filing Fee | Typically lower fees | Usually higher fees |

| Use Case | Small to mid-sized businesses preferring less formal structure | Businesses planning to raise capital via stock issuance |

Introduction to Articles of Organization and Articles of Incorporation

Articles of Organization establish a limited liability company (LLC) by outlining the management structure, member roles, and operating procedures essential for LLC formation. Articles of Incorporation serve as the foundational legal document for a corporation, defining its purpose, stock details, registered agent, and bylaws framework. Both documents are filed with the state government to officially create the business entity and ensure compliance with state regulations.

Defining Articles of Organization

Articles of Organization are a foundational document used to establish a Limited Liability Company (LLC), outlining key details like the company's name, address, registered agent, and management structure. This document is filed with the state's Secretary of State office to legally create the LLC and define its operational framework. Unlike Articles of Incorporation, which form corporations, Articles of Organization specifically cater to the flexible management and liability protections unique to LLCs.

Understanding Articles of Incorporation

Articles of Incorporation are legal documents filed with a state government to officially create a corporation, establishing its existence and outlining critical details such as the corporation's name, purpose, stock structure, and initial directors. These articles serve as a foundational framework that governs the corporation's operations and ensures compliance with state laws. Unlike Articles of Organization, which apply to LLCs, Articles of Incorporation are specific to corporations and are essential for obtaining corporate status and limited liability protections.

Key Differences Between Articles of Organization and Articles of Incorporation

Articles of Organization establish a limited liability company (LLC) and outline its management structure, ownership, and operating guidelines, while Articles of Incorporation form a corporation and define its purpose, stock structure, and board of directors. Key differences include the type of business entity created--LLCs offer flexible management and pass-through taxation, whereas corporations have a formal structure with shareholders and potential double taxation. Articles of Incorporation also typically require more regulatory compliance and ongoing formalities compared to the simpler filing and operational requirements of Articles of Organization.

Legal Structures: LLCs vs Corporations

Articles of Organization establish the legal foundation for Limited Liability Companies (LLCs), outlining management structures and member responsibilities. Articles of Incorporation create corporations by defining the corporate framework, including the issuance of stock and governance by a board of directors. Understanding these documents is essential for selecting between the flexible, member-managed LLC and the more formal, shareholder-driven corporation as legal business structures.

Filing Process and Requirements

Articles of Organization and Articles of Incorporation serve different entities, with the former filed to establish an LLC and the latter for a corporation. The filing process for Articles of Organization typically requires submitting basic information such as the LLC's name, address, registered agent, and management structure to the state's business filing agency. In contrast, Articles of Incorporation demand more detailed data, including the corporation's name, purpose, number of authorized shares, initial directors, and must often comply with stricter state regulations and fees.

Essential Information Included in Each Document

Articles of Organization primarily outline essential information such as the LLC's name, registered agent, management structure, and purpose, serving as the foundational document for forming a Limited Liability Company. Articles of Incorporation include critical details like the corporation's name, purpose, stock structure, registered agent, and the names of incorporators, establishing the corporation's legal existence. Both documents are filed with the state to legally register the business entity but differ based on the entity type and specific statutory requirements.

State-Specific Variations and Compliance

Articles of Organization and Articles of Incorporation serve distinct purposes in business formation, with the former for LLCs and the latter for corporations, and both documents vary significantly by state regarding required information and filing procedures. State-specific variations affect compliance, including differences in naming conventions, filing fees, and mandatory disclosures that businesses must adhere to in order to maintain good standing. Understanding state regulations is crucial to ensure accurate submission and avoid penalties, as each jurisdiction imposes unique rules governing amendments, annual reports, and registered agent requirements.

Choosing the Right Formation Document for Your Business

Choosing the right formation document for your business depends on whether you are establishing an LLC or a corporation. Articles of Organization serve as the foundational document to create a Limited Liability Company, outlining essential details like the company name, address, and registered agent. In contrast, Articles of Incorporation are used to form a corporation, specifying information such as the corporate name, purpose, stock structure, and incorporators, making it crucial to select the appropriate document to ensure legal compliance and operational clarity.

Conclusion: Making the Best Choice for Your Business Entity

Choosing between Articles of Organization and Articles of Incorporation depends on your business structure and goals; Articles of Organization establish an LLC with flexible management and pass-through taxation, while Articles of Incorporation create a corporation with formal governance and potential for stock issuance. Evaluate factors like liability protection, tax treatment, and complexity of compliance to determine the best entity for your needs. Properly filing the correct document aligns your business with legal requirements and operational advantages, ensuring a solid foundation for growth.

Articles of Organization Infographic

libterm.com

libterm.com