Special Purpose Acquisition Companies (SPACs) are investment vehicles designed to raise capital through an initial public offering with the intent to merge with or acquire an existing private company. These companies offer a streamlined path for businesses to go public without the traditional IPO complexities, providing investors with unique opportunities to participate in emerging markets. Discover how SPACs can impact your investment strategy and explore the key factors to consider in the full article.

Table of Comparison

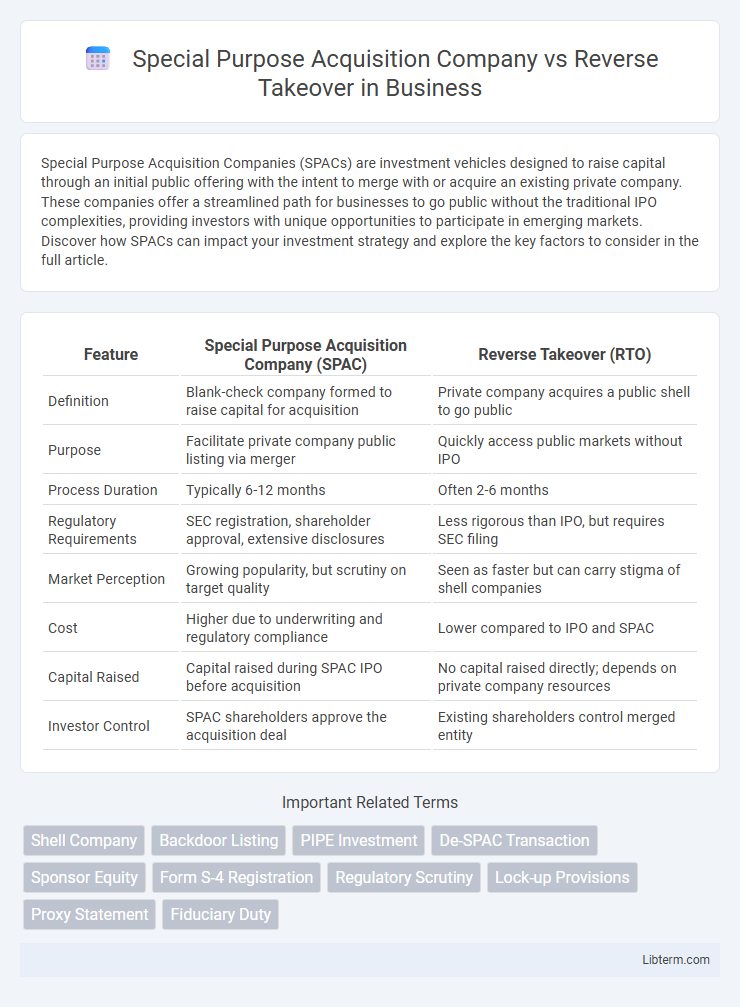

| Feature | Special Purpose Acquisition Company (SPAC) | Reverse Takeover (RTO) |

|---|---|---|

| Definition | Blank-check company formed to raise capital for acquisition | Private company acquires a public shell to go public |

| Purpose | Facilitate private company public listing via merger | Quickly access public markets without IPO |

| Process Duration | Typically 6-12 months | Often 2-6 months |

| Regulatory Requirements | SEC registration, shareholder approval, extensive disclosures | Less rigorous than IPO, but requires SEC filing |

| Market Perception | Growing popularity, but scrutiny on target quality | Seen as faster but can carry stigma of shell companies |

| Cost | Higher due to underwriting and regulatory compliance | Lower compared to IPO and SPAC |

| Capital Raised | Capital raised during SPAC IPO before acquisition | No capital raised directly; depends on private company resources |

| Investor Control | SPAC shareholders approve the acquisition deal | Existing shareholders control merged entity |

Introduction to Special Purpose Acquisition Companies (SPACs)

Special Purpose Acquisition Companies (SPACs) are investment vehicles created specifically to raise capital through an initial public offering (IPO) with the sole purpose of acquiring or merging with an existing private company. Unlike traditional IPOs, SPACs provide a faster and more cost-effective route for private companies to access public markets by bypassing the lengthy regulatory process. This structure contrasts with Reverse Takeovers, where a private company acquires a publicly listed shell company to become public, but SPACs involve a pre-established public entity actively seeking acquisition targets.

Understanding Reverse Takeovers (RTOs)

Reverse Takeovers (RTOs) enable private companies to become publicly traded by acquiring a publicly listed shell company, bypassing the lengthy initial public offering (IPO) process. This method allows faster access to capital markets with reduced regulatory scrutiny compared to traditional listings. RTOs are often favored for their cost efficiency and speed, but require careful due diligence to assess the shell company's liabilities and compliance status.

Key Differences Between SPACs and RTOs

Special Purpose Acquisition Companies (SPACs) are shell companies that raise capital through an initial public offering (IPO) to acquire a private company and bring it public without a traditional IPO process. Reverse Takeovers (RTOs) involve a private company merging with a publicly listed company to bypass the lengthy IPO procedures and quickly achieve public status. Key differences include SPACs raising funds upfront with blank-check structures, whereas RTOs rely on an existing public shell company, often leading to varied regulatory scrutiny and timeframes for public market entry.

Process Overview: SPAC Merger vs RTO

A Special Purpose Acquisition Company (SPAC) merger involves a publicly traded shell company raising capital through an IPO to acquire a private firm, allowing the target to go public without a traditional IPO process. The SPAC process includes fundraising, target identification, due diligence, shareholder approval, and final merger, typically completing within 12-24 months. A Reverse Takeover (RTO) requires a private company acquiring a publicly listed shell company to bypass the lengthy IPO, involving asset transfers, regulatory filings, and shareholder consent, generally resulting in quicker public listing but with more regulatory scrutiny.

Regulatory Requirements and Compliance

Special Purpose Acquisition Companies (SPACs) must comply with strict regulatory requirements set by the SEC, including detailed disclosures, financial audits, and adherence to IPO registration rules, ensuring transparency and investor protection. Reverse Takeovers (RTOs) require regulatory approval tailored to the jurisdiction, often involving extensive due diligence, shareholder consent, and compliance with stock exchange listing standards to maintain market integrity. Both SPACs and RTOs face rigorous compliance frameworks that mandate continuous reporting and governance protocols to uphold regulatory scrutiny and safeguard stakeholders.

Advantages of SPAC Transactions

Special Purpose Acquisition Company (SPAC) transactions offer faster access to public capital markets compared to traditional IPOs, reducing time-to-market for target companies. SPACs provide enhanced deal certainty with negotiated valuations and minimized market risks versus Reverse Takeovers (RTOs), which often face regulatory scrutiny and integration challenges. The structure of SPACs allows target firms to leverage the sponsor's expertise and capital, facilitating streamlined growth opportunities post-merger.

Benefits of Choosing a Reverse Takeover

Choosing a Reverse Takeover (RTO) offers faster market access compared to a Special Purpose Acquisition Company (SPAC), eliminating the need for traditional initial public offering (IPO) procedures and extensive regulatory approvals. RTOs provide greater control over the transaction process, allowing private companies to negotiate terms directly with the public entity, thus potentially reducing dilutive effects on shareholders. This strategic approach can also lower costs significantly by bypassing multiple fundraising rounds and expensive underwriting fees associated with SPACs.

Risks and Challenges: SPACs vs RTOs

Special Purpose Acquisition Companies (SPACs) face risks including regulatory scrutiny, potential overvaluation, and investor dilution post-merger, while Reverse Takeovers (RTOs) carry challenges such as lack of transparency, potential undisclosed liabilities, and difficulties in securing financing. SPACs often encounter market volatility impacting their share prices before acquisition, whereas RTOs risk damaging reputation due to limited due diligence and less rigorous disclosure requirements. Both methods pose integration risks but SPACs generally offer more structured regulatory oversight compared to the relatively opaque process of RTOs.

Market Trends and Recent Examples

Special Purpose Acquisition Companies (SPACs) have surged in popularity as an alternative to traditional Initial Public Offerings (IPOs), offering faster market entry and reduced regulatory scrutiny, with 2023 witnessing notable transactions like the merger of Social Capital Hedosophia with SoFi. Reverse Takeovers (RTOs) remain prevalent in emerging markets, providing private companies a cost-effective path to public status, exemplified by recent RTOs in the Southeast Asian tech sector. Market trends indicate an increased preference for SPACs in North America due to investor appetite for innovation-driven companies, while RTOs sustain relevance in areas with less mature capital markets and tighter regulatory environments.

Choosing the Right Path: SPAC or RTO

Selecting between a Special Purpose Acquisition Company (SPAC) and a Reverse Takeover (RTO) hinges on factors such as speed to public listing, regulatory requirements, and market conditions. SPACs offer a faster route with pre-raised capital and streamlined SEC approval, ideal for companies seeking efficiency and investor confidence. RTOs often suit firms needing flexibility and lower upfront costs, though they may face longer integration periods and enhanced due diligence challenges.

Special Purpose Acquisition Company Infographic

libterm.com

libterm.com