Collateral plays a crucial role in securing loans by providing lenders with a tangible asset to recover funds in case of default. Understanding how collateral impacts loan terms and your financial risk can help you make informed borrowing decisions. Explore the rest of this article to learn more about different types of collateral and their implications for your credit options.

Table of Comparison

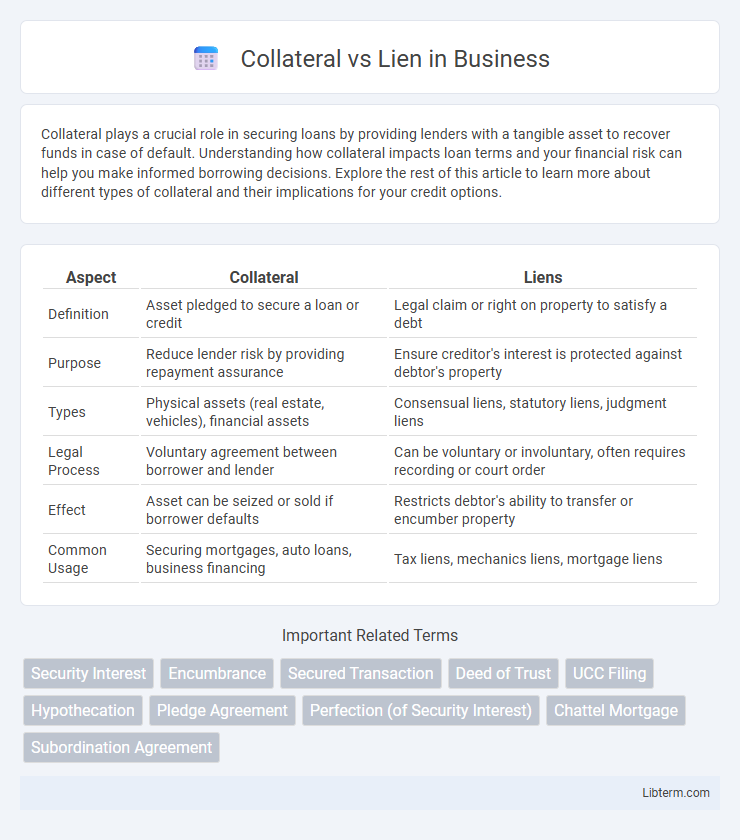

| Aspect | Collateral | Liens |

|---|---|---|

| Definition | Asset pledged to secure a loan or credit | Legal claim or right on property to satisfy a debt |

| Purpose | Reduce lender risk by providing repayment assurance | Ensure creditor's interest is protected against debtor's property |

| Types | Physical assets (real estate, vehicles), financial assets | Consensual liens, statutory liens, judgment liens |

| Legal Process | Voluntary agreement between borrower and lender | Can be voluntary or involuntary, often requires recording or court order |

| Effect | Asset can be seized or sold if borrower defaults | Restricts debtor's ability to transfer or encumber property |

| Common Usage | Securing mortgages, auto loans, business financing | Tax liens, mechanics liens, mortgage liens |

Understanding Collateral: Definition and Types

Collateral refers to assets pledged by a borrower to secure a loan, reducing the lender's risk in case of default. Common types of collateral include real estate, vehicles, inventory, and accounts receivable, each varying in liquidity and valuation. Understanding the nature and classification of collateral is essential for both lenders and borrowers to negotiate loan terms effectively.

What is a Lien? Core Concepts Explained

A lien is a legal right or interest that a creditor has in another's property, typically used as security for a debt or obligation. It allows the lienholder to retain possession or claim the property until the debt is satisfied, ensuring repayment or performance. Unlike collateral, which is voluntarily pledged, liens can arise by operation of law, such as tax liens or mechanic's liens, providing a legal claim without immediate transfer of ownership.

Key Differences Between Collateral and Lien

Collateral is an asset pledged by a borrower to secure a loan, which the lender can claim if the borrower defaults, whereas a lien is a legal claim or right against property to satisfy a debt or obligation. Collateral involves tangible or intangible property directly tied to loan security, while a lien represents a broader legal encumbrance that can arise from various debts or judgments. The key difference lies in collateral being an agreed-upon security mechanism, whereas a lien is a legal right that may exist independently of loan agreements.

How Collateral Works in Secured Transactions

In secured transactions, collateral serves as an asset pledged by the borrower to secure a loan, providing the lender a legal right to seize or sell the asset if the borrower defaults. This asset can include real estate, vehicles, inventory, or accounts receivable, enhancing the lender's confidence by reducing credit risk. The effectiveness of collateral depends on proper documentation and perfecting the security interest, typically through public filing, to establish priority over other creditors.

The Role of Liens in Debt Recovery

Liens serve as a legal claim or hold on a debtor's property, ensuring creditors have a prioritized right to recover debts in cases of default. Unlike general collateral, liens specifically grant lenders the ability to seize or sell the secured asset to satisfy outstanding obligations. This mechanism strengthens debt recovery by providing creditors with a structured process to enforce their rights and minimize financial losses.

Common Examples: Collateral vs. Lien in Practice

Common examples of collateral include real estate, vehicles, and inventory used to secure loans, allowing lenders to recover value if borrowers default. Liens often arise from unpaid taxes, mechanic services, or judgments, granting legal claims against property without necessarily transferring ownership. While collateral serves as pledged security for debt repayment, liens represent legal encumbrances that must be settled before transferring or selling the asset.

Legal Implications: Collateral and Lien Agreements

Collateral agreements create a security interest in specific assets pledged by a borrower to secure a loan, granting the lender priority rights to those assets upon default, which must comply with the Uniform Commercial Code (UCC) for perfection and enforceability. Lien agreements establish a legal claim or encumbrance on property, often without transferring possession, allowing creditors to enforce their rights through foreclosure or court actions based on statutory or common law provisions. Both collateral and lien agreements require precise documentation and registration to protect creditor rights and avoid disputes regarding priority and enforceability in bankruptcy or liquidation scenarios.

Risk Factors for Borrowers and Lenders

Collateral secures a loan by pledging specific assets, reducing risk for lenders but increasing potential loss for borrowers if repayment fails; improper valuation or asset depreciation amplifies this risk. Liens place a legal claim on property without transferring possession, allowing lenders to recover debts through forced sale but exposing borrowers to foreclosure and credit damage. Both mechanisms require careful assessment of asset liquidity, market volatility, and legal enforcement complexities to mitigate financial exposure for all parties involved.

Removing a Lien: Steps and Considerations

Removing a lien involves obtaining a lien release from the lienholder after the underlying debt is fully paid or resolved, ensuring the release document is properly recorded with the relevant government authority, such as the county recorder or land registry. It is essential to verify the lien release matches the lien description exactly to prevent future title issues. Failure to remove the lien can result in complications during property sales or refinancing, making timely lien clearance critical for maintaining clear ownership records.

Choosing the Right Security: Collateral vs. Lien

Choosing the right security involves understanding that collateral is an asset pledged to secure a loan, while a lien is a legal claim or right against property to satisfy a debt. Collateral offers tangible assurance to lenders by providing specific assets that can be seized upon default, whereas a lien establishes a priority interest that may restrict ownership rights until the obligation is fulfilled. Evaluating the nature of the loan, asset type, and legal implications is crucial for deciding between using collateral or a lien to protect both borrower and lender interests.

Collateral Infographic

libterm.com

libterm.com