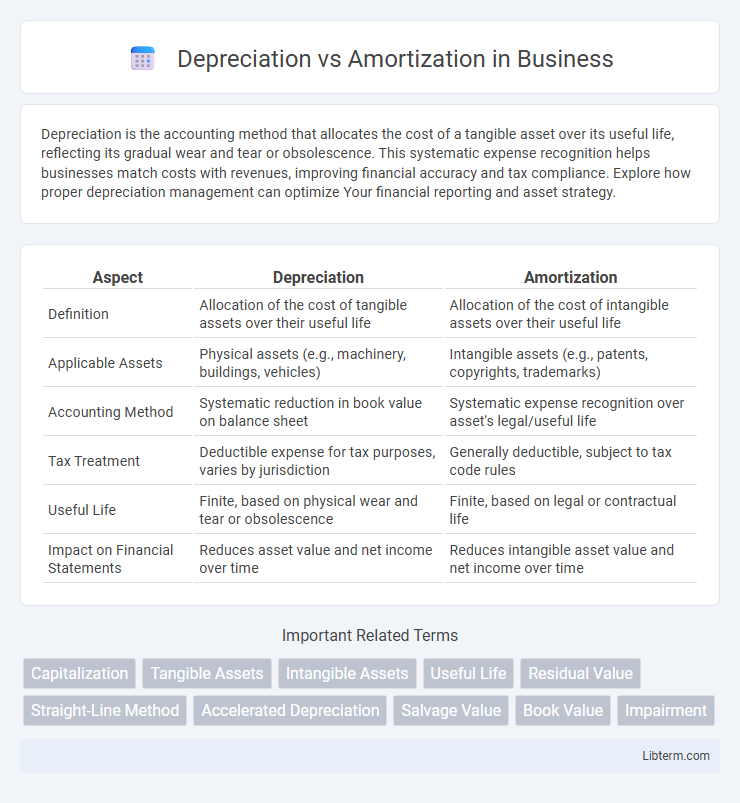

Depreciation is the accounting method that allocates the cost of a tangible asset over its useful life, reflecting its gradual wear and tear or obsolescence. This systematic expense recognition helps businesses match costs with revenues, improving financial accuracy and tax compliance. Explore how proper depreciation management can optimize Your financial reporting and asset strategy.

Table of Comparison

| Aspect | Depreciation | Amortization |

|---|---|---|

| Definition | Allocation of the cost of tangible assets over their useful life | Allocation of the cost of intangible assets over their useful life |

| Applicable Assets | Physical assets (e.g., machinery, buildings, vehicles) | Intangible assets (e.g., patents, copyrights, trademarks) |

| Accounting Method | Systematic reduction in book value on balance sheet | Systematic expense recognition over asset's legal/useful life |

| Tax Treatment | Deductible expense for tax purposes, varies by jurisdiction | Generally deductible, subject to tax code rules |

| Useful Life | Finite, based on physical wear and tear or obsolescence | Finite, based on legal or contractual life |

| Impact on Financial Statements | Reduces asset value and net income over time | Reduces intangible asset value and net income over time |

Understanding Depreciation and Amortization

Depreciation and amortization are accounting methods used to allocate the cost of tangible and intangible assets over their useful lives, respectively. Depreciation applies to physical assets like machinery, buildings, and vehicles, spreading their cost based on factors such as usage or time. Amortization, on the other hand, deals with intangible assets including patents, trademarks, and goodwill, systematically reducing their book value as they provide economic benefits.

Key Differences Between Depreciation and Amortization

Depreciation refers to the systematic allocation of the cost of tangible fixed assets, such as machinery and buildings, over their useful lives, whereas amortization applies to intangible assets like patents, copyrights, and trademarks. Depreciation methods often include straight-line and declining balance techniques, while amortization usually follows a straight-line approach over the asset's estimated useful period. Key differences also include the nature of assets involved and the fact that depreciation accounts for physical wear and tear, whereas amortization deals with the gradual expiration of intangible asset value.

Types of Assets: Tangible vs Intangible

Depreciation applies to tangible assets such as machinery, buildings, and vehicles, allocating the cost of these physical assets over their useful lives. Amortization pertains to intangible assets like patents, trademarks, and copyrights, systematically expensing their cost over the estimated period of benefit. Understanding the distinction between tangible and intangible assets is essential for accurate financial reporting and tax compliance.

Methods for Calculating Depreciation

Depreciation is calculated using several methods, including straight-line, declining balance, and units of production, each reflecting asset usage or time differently. The straight-line method spreads the asset's cost evenly over its useful life, while the declining balance method accelerates expense recognition by applying a fixed rate to the diminishing book value. Units of production method ties depreciation expense directly to the asset's operational output, offering precise matching of cost to asset use.

Common Amortization Techniques

Common amortization techniques include the straight-line method, where the asset's cost is evenly spread over its useful life, and the declining balance method, which accelerates expense recognition in earlier periods. Amortization applies primarily to intangible assets like patents, copyrights, and trademarks, systematically allocating their cost over time. Unlike depreciation, which addresses tangible asset wear and tear, amortization emphasizes the gradual consumption of intangible resources.

Impact on Financial Statements

Depreciation reduces the book value of tangible assets over time, directly impacting the balance sheet by lowering asset values and the income statement through expense recognition, which decreases net income. Amortization similarly affects intangible assets, systematically allocating their cost across periods, resulting in expense recognition on the income statement and amortized values on the balance sheet. Both processes reduce taxable income, influencing cash flow and providing a more accurate reflection of asset consumption in financial reporting.

Tax Implications of Depreciation and Amortization

Depreciation allocates the cost of tangible assets over their useful life, reducing taxable income by allowing businesses to deduct a portion of the asset's value annually, while amortization applies the same principle to intangible assets. Both methods impact tax liabilities by lowering taxable profit, but IRS rules dictate specific schedules and limits for each, affecting cash flow and tax planning strategies. Understanding these distinctions helps optimize tax benefits and compliance within corporate finance.

Real-World Examples: Depreciation vs Amortization

Depreciation applies to tangible assets like machinery, vehicles, and buildings, gradually reducing their book value as they wear out or become obsolete, such as a factory machine depreciating over ten years. Amortization, on the other hand, deals with intangible assets such as patents, copyrights, or goodwill, systematically expensing the asset's cost over its useful life--for example, amortizing a patent over its 20-year legal life. Both methods allocate the cost of assets to accounting periods, improving financial accuracy and tax compliance.

Choosing the Right Approach for Your Business

Choosing the right approach between depreciation and amortization depends on the nature of your business assets and their useful life. Depreciation applies to tangible fixed assets such as machinery, vehicles, and buildings, allowing businesses to allocate the asset's cost over its physical lifespan. Amortization focuses on intangible assets like patents, trademarks, and software, spreading their cost over the estimated period of benefit, enabling accurate financial reporting and tax optimization.

Frequently Asked Questions on Depreciation and Amortization

Depreciation applies to tangible assets like machinery or vehicles, while amortization relates to intangible assets such as patents or copyrights. Common FAQs include how to calculate these expenses, the difference between straight-line and accelerated methods, and their tax implications. Both processes systematically allocate the cost of an asset over its useful life, impacting financial statements and tax returns.

Depreciation Infographic

libterm.com

libterm.com