Screening is a critical process used to identify potential issues, candidates, or risks early on, enhancing decision-making efficiency across various fields such as healthcare, security, and recruitment. Effective screening techniques leverage advanced tools and data analysis to ensure accurate and timely results, reducing the likelihood of overlooking important details. Discover how optimized screening methods can improve your outcomes by exploring the rest of this article.

Table of Comparison

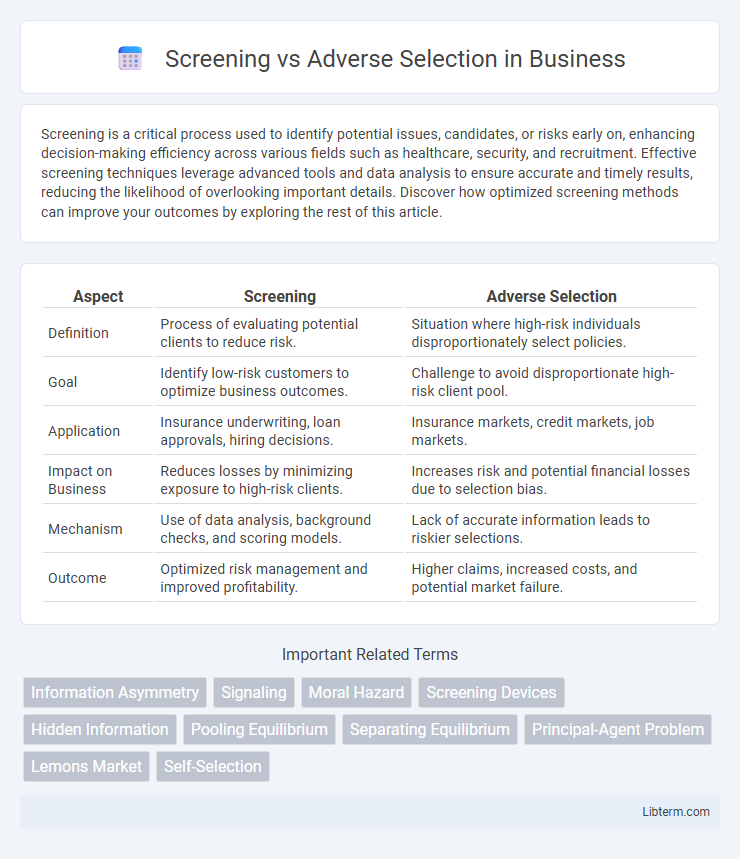

| Aspect | Screening | Adverse Selection |

|---|---|---|

| Definition | Process of evaluating potential clients to reduce risk. | Situation where high-risk individuals disproportionately select policies. |

| Goal | Identify low-risk customers to optimize business outcomes. | Challenge to avoid disproportionate high-risk client pool. |

| Application | Insurance underwriting, loan approvals, hiring decisions. | Insurance markets, credit markets, job markets. |

| Impact on Business | Reduces losses by minimizing exposure to high-risk clients. | Increases risk and potential financial losses due to selection bias. |

| Mechanism | Use of data analysis, background checks, and scoring models. | Lack of accurate information leads to riskier selections. |

| Outcome | Optimized risk management and improved profitability. | Higher claims, increased costs, and potential market failure. |

Understanding Screening and Adverse Selection

Screening is a risk management technique used by insurers to gather information about potential clients, reducing uncertainty by identifying high-risk individuals before issuing policies. Adverse selection occurs when individuals with higher risk are more likely to seek insurance coverage, leading to an imbalance that raises overall costs for insurers. Understanding the dynamics between screening and adverse selection is crucial for designing effective underwriting strategies that mitigate financial losses.

The Economic Foundations of Asymmetric Information

Screening and adverse selection arise from asymmetric information where one party holds more or better information than the other, impacting market efficiency. Screening involves the less informed party taking actions to reveal private information, such as insurers requiring medical exams to assess risk accurately. Adverse selection occurs when hidden information leads to high-risk individuals being more likely to participate, exemplified by individuals with poor health disproportionately seeking insurance coverage, causing market distortions.

How Screening Works in Practice

Screening works in practice by gathering relevant information to differentiate between high-risk and low-risk individuals, allowing firms to tailor contracts or prices accordingly. Common methods include questionnaires, medical exams, and credit checks which help reduce information asymmetry between parties. Effective screening minimizes adverse selection by ensuring that only suitable candidates are accepted, improving market efficiency.

Key Characteristics of Adverse Selection

Adverse selection occurs when individuals with higher risk are more likely to seek insurance, leading to an imbalanced pool and increased costs for insurers. Key characteristics include asymmetric information where the insured knows more about their risk level than the insurer, the inability of insurers to fully differentiate between high-risk and low-risk applicants, and the tendency for insurers to raise premiums or limit coverage, which may further exclude low-risk individuals. This phenomenon creates market inefficiencies and challenges in designing effective screening mechanisms to mitigate adverse outcomes.

Screening Strategies in Various Industries

Screening strategies are essential tools used across industries such as finance, healthcare, and insurance to mitigate adverse selection risks by identifying high-risk or low-quality participants before engagement. In the insurance industry, underwriting processes and medical examinations serve as primary screening methods to assess applicant risk profiles accurately. Similarly, credit scoring and background checks in banking effectively filter out potential defaulters, while employment screening in human resources ensures candidate suitability and reduces information asymmetry.

Case Studies: Screening vs. Adverse Selection

Case studies in economics and insurance highlight screening as a proactive mechanism to mitigate adverse selection by distinguishing high-risk from low-risk individuals before contract finalization. For example, health insurers implement detailed medical questionnaires and physical exams to screen applicants, thereby reducing the likelihood of adverse selection where only high-risk individuals seek coverage. Empirical research demonstrates that effective screening strategies improve market efficiency by aligning premiums more closely with actual risk profiles.

The Role of Incentives and Signals

Screening and adverse selection involve asymmetric information where insurers use incentives and signals to differentiate between high-risk and low-risk individuals. Incentives such as premium discounts encourage insureds to reveal true risk levels, while signals like health disclosures and past claims history help insurers identify adverse selection patterns. Effective screening mechanisms reduce information asymmetry, aligning incentives to promote fair pricing and risk pooling.

Policy Solutions to Combat Adverse Selection

Screening techniques, such as risk assessment questionnaires and medical exams, help insurers identify high-risk individuals to mitigate adverse selection, which occurs when those with higher risks disproportionately purchase insurance. Policy solutions to combat adverse selection include mandatory insurance enrollment, which expands the risk pool and prevents market imbalances, and community rating regulations that limit premium differentiation based on individual risk. Implementing penalty fees for non-enrollment and offering subsidies can further encourage participation from low-risk individuals, stabilizing the insurance market.

Measuring the Effectiveness of Screening

Measuring the effectiveness of screening involves evaluating its ability to accurately differentiate high-risk from low-risk individuals before entering into contracts or agreements. Key metrics include the reduction in adverse selection costs, improvements in risk classification accuracy, and the impact on overall pool quality and profitability. Data analysis techniques such as predictive modeling and outcome tracking can quantify screening performance and guide adjustments to enhance risk assessment precision.

Future Trends in Screening and Adverse Selection

Future trends in screening and adverse selection emphasize advancements in artificial intelligence and big data analytics, enabling more precise risk assessments and personalized underwriting processes. Enhanced predictive models will reduce information asymmetry by integrating real-time health, behavioral, and lifestyle data, mitigating adverse selection in insurance markets. Insurance companies increasingly leverage biometrics and digital health platforms to improve screening accuracy and identify high-risk individuals early, fostering more equitable pricing and coverage offerings.

Screening Infographic

libterm.com

libterm.com