Earnings reflect the profitability and financial health of a business, directly influencing its stock value and investor confidence. Understanding your earnings statement helps identify key revenue streams and cost drivers that impact overall performance. Explore the rest of this article to learn how to analyze earnings effectively and make informed financial decisions.

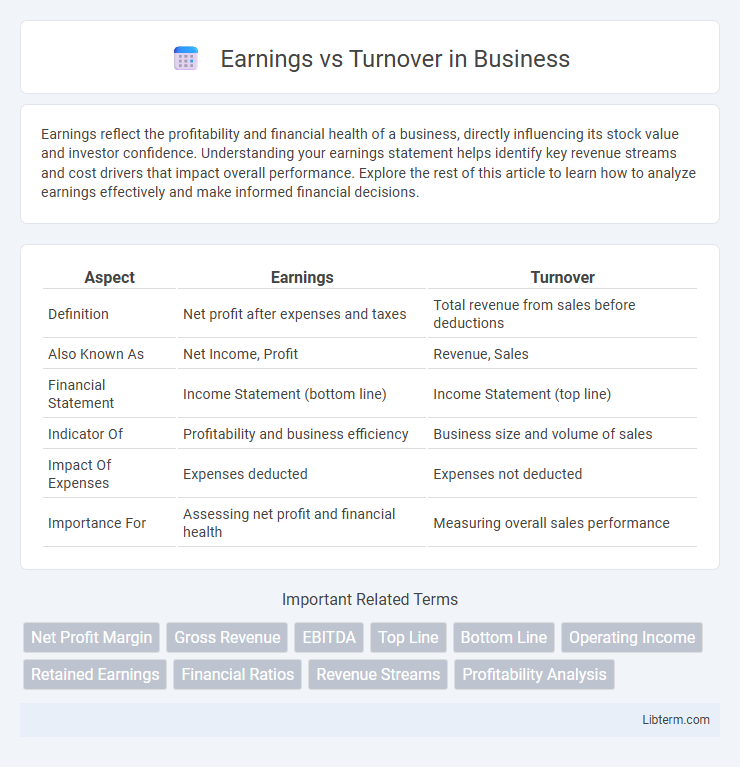

Table of Comparison

| Aspect | Earnings | Turnover |

|---|---|---|

| Definition | Net profit after expenses and taxes | Total revenue from sales before deductions |

| Also Known As | Net Income, Profit | Revenue, Sales |

| Financial Statement | Income Statement (bottom line) | Income Statement (top line) |

| Indicator Of | Profitability and business efficiency | Business size and volume of sales |

| Impact Of Expenses | Expenses deducted | Expenses not deducted |

| Importance For | Assessing net profit and financial health | Measuring overall sales performance |

Understanding Earnings vs Turnover: Key Differences

Earnings represent the net profit a company makes after deducting all expenses, taxes, and costs, reflecting its true profitability. Turnover, also known as revenue or sales, is the total income generated from the sale of goods or services before any expenses are subtracted. Understanding the distinction between earnings and turnover is crucial for assessing a business's financial performance, as turnover shows market demand while earnings indicate operational efficiency and profitability.

What Is Turnover? Definition and Examples

Turnover, also known as revenue, represents the total income generated by a company from its core business activities before any expenses are deducted. For example, a retail store's turnover includes the total sales value of all products sold within a given period. This metric is crucial for assessing business scale and market demand but differs from earnings, which reflect net profit after costs and taxes.

What Counts as Earnings in Business?

Earnings in business typically refer to the net profit, which is the total revenue minus all operating expenses, taxes, and costs. This figure includes income from sales, services, and other sources after deducting expenses such as salaries, rent, utilities, and depreciation. Unlike turnover, which represents the gross sales or revenue generated before expenses, earnings provide a clearer picture of a company's profitability and financial health.

Earnings vs Turnover: Why the Distinction Matters

Earnings represent the net profit a company retains after all expenses, taxes, and costs are deducted from total revenue, while turnover refers to the total sales or revenue generated during a specific period. Understanding the distinction between earnings and turnover is crucial for accurate financial analysis, as high turnover does not necessarily indicate profitability without substantial earnings. Investors and stakeholders rely on earnings to assess a company's true financial health and operational efficiency beyond just sales volume.

Calculating Turnover: Methods and Metrics

Calculating turnover involves measuring total sales or revenue generated by a business within a specific period, typically using gross turnover or net turnover metrics. Gross turnover accounts for the full value of goods and services sold before deductions, while net turnover subtracts returns, discounts, and allowances, providing a more accurate reflection of revenue. Common methods include tallying invoice values, analyzing point-of-sale data, and aggregating recurring revenue streams to capture comprehensive turnover figures essential for financial analysis.

Determining Earnings: Net vs Gross Explained

Earnings represent the net income a company retains after subtracting all expenses, taxes, and costs from total revenue, while turnover refers to the gross revenue generated from sales before any deductions. Determining earnings involves calculating gross earnings first--total sales minus the cost of goods sold (COGS)--and then deriving net earnings by further deducting operating expenses, interest, and taxes. Understanding the distinction between net and gross earnings is crucial for accurate financial analysis and assessing the company's true profitability.

Impact of Earnings and Turnover on Taxation

Earnings and turnover significantly impact taxation, with earnings representing net profit subject to income tax, while turnover reflects total revenue influencing indirect tax liabilities like VAT or sales tax. Accurate differentiation between earnings and turnover ensures compliance with tax regulations and optimized tax planning. Understanding their roles helps businesses manage taxable income effectively and anticipate tax obligations from varying revenue scales.

Common Misconceptions about Turnover and Earnings

Turnover is often mistaken for profit, but it actually represents the total revenue generated by a company before expenses. Earnings, also known as net income, reflect the company's actual profitability after deducting all costs, including taxes and operating expenses. Confusing turnover with earnings can lead to an inaccurate assessment of a company's financial health and performance.

Earnings and Turnover in Financial Reporting

Earnings represent the net profit a company generates after deducting all expenses, taxes, and costs from total revenue, serving as a key indicator of financial performance and profitability. Turnover, often referred to as revenue or sales, measures the total income from goods sold or services provided before any expenses are subtracted, reflecting the company's operational scale. In financial reporting, distinguishing between earnings and turnover is essential for stakeholders to assess both the company's efficiency in generating sales and its ability to convert revenue into actual profit.

Maximizing Earnings and Boosting Turnover: Practical Strategies

Maximizing earnings involves optimizing profit margins through cost control, pricing strategies, and enhancing operational efficiency. Boosting turnover requires increasing sales volume by expanding customer base, diversifying product offerings, and improving marketing reach. Combining these approaches ensures sustainable business growth by balancing revenue generation with cost management.

Earnings Infographic

libterm.com

libterm.com