A merger combines two companies into a single entity, enhancing market reach and operational efficiency while reducing competition. It often leads to increased resources, expanded customer bases, and improved financial performance. Discover how mergers can transform your business strategy and what to consider before making this critical decision by reading the rest of the article.

Table of Comparison

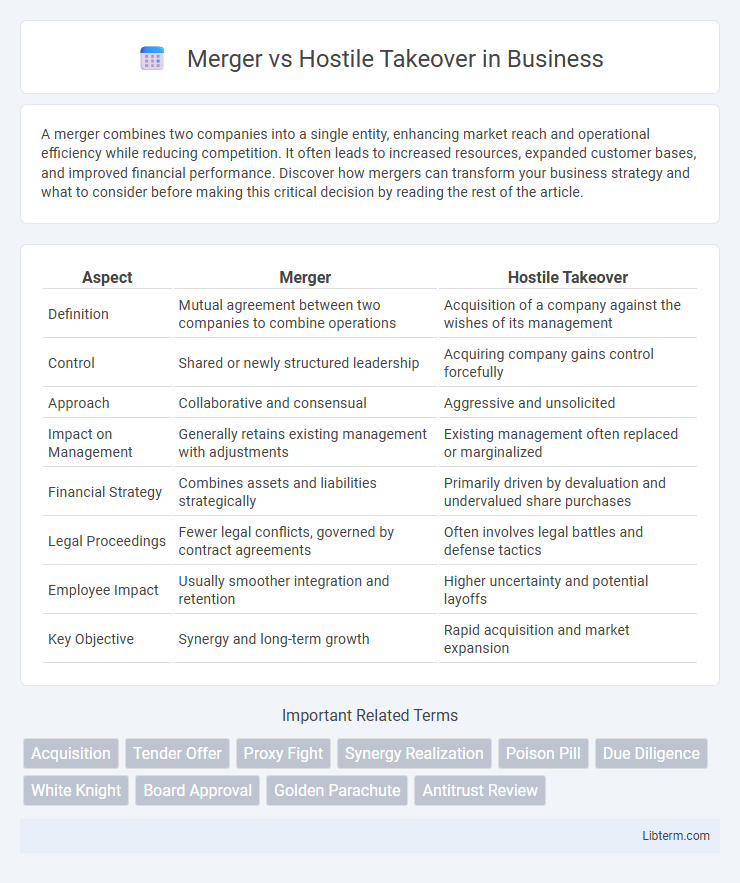

| Aspect | Merger | Hostile Takeover |

|---|---|---|

| Definition | Mutual agreement between two companies to combine operations | Acquisition of a company against the wishes of its management |

| Control | Shared or newly structured leadership | Acquiring company gains control forcefully |

| Approach | Collaborative and consensual | Aggressive and unsolicited |

| Impact on Management | Generally retains existing management with adjustments | Existing management often replaced or marginalized |

| Financial Strategy | Combines assets and liabilities strategically | Primarily driven by devaluation and undervalued share purchases |

| Legal Proceedings | Fewer legal conflicts, governed by contract agreements | Often involves legal battles and defense tactics |

| Employee Impact | Usually smoother integration and retention | Higher uncertainty and potential layoffs |

| Key Objective | Synergy and long-term growth | Rapid acquisition and market expansion |

Understanding Mergers: Definition and Key Features

Mergers involve the voluntary combination of two companies to form a single, unified entity with shared ownership and management, aiming for synergistic growth and increased market share. Key features include mutual agreement, integration of resources, and alignment of strategic goals, often resulting in enhanced operational efficiencies and competitive advantage. Understanding the distinction between mergers and hostile takeovers is crucial, as mergers emphasize cooperation and consent, whereas hostile takeovers involve acquiring a company against its management's wishes.

What is a Hostile Takeover? An Overview

A hostile takeover occurs when one company attempts to acquire another without the consent or approval of the target company's management, often by directly appealing to shareholders or buying a controlling stake on the open market. Unlike mergers, which are typically cooperative agreements between two firms, hostile takeovers involve aggressive tactics such as tender offers or proxy fights to gain control. This approach can lead to significant conflicts, impacting stock prices, corporate strategy, and employee morale within the targeted organization.

Strategic Objectives: Merger vs Hostile Takeover

Mergers aim to achieve strategic objectives such as synergy creation, market expansion, and enhanced competitive positioning through mutual agreement and collaboration between companies. Hostile takeovers target rapid control acquisition, often prioritizing asset stripping, cost reduction, or market share increase without requiring the target company's consent. The strategic intent behind mergers typically emphasizes long-term growth and value creation, while hostile takeovers focus on immediate financial gain and control consolidation.

Legal Frameworks Governing Mergers and Hostile Takeovers

Legal frameworks governing mergers and hostile takeovers vary significantly, with mergers typically regulated by comprehensive securities laws and antitrust regulations designed to ensure fair competition and protect shareholder interests. Hostile takeovers face stricter scrutiny under these laws, often triggering defensive measures such as poison pills and golden parachutes, which are legally vetted to prevent unfair acquisition practices. Regulatory bodies like the Securities and Exchange Commission (SEC) and antitrust authorities enforce compliance through mandatory disclosures, tender offer rules, and review processes to maintain market integrity and protect investors.

Shareholder Impact: Profits and Risks

Shareholders in a merger typically benefit from increased profits due to synergies, enhanced market share, and combined resources that drive growth and stability. In a hostile takeover, shareholders may experience short-term stock price gains but face significant risks, including management disruption, operational instability, and potential asset sell-offs. The uncertainty and aggressive nature of hostile takeovers often increase volatility and long-term risk for shareholder value.

Management’s Role and Reactions

In a merger, management typically collaborates closely with the acquiring company to negotiate terms and integrate operations, often maintaining key leadership roles. During a hostile takeover, management frequently resists the acquisition through defensive tactics such as poison pills, employee consultations, and seeking alternative buyers to protect shareholder interests. The contrasting reactions highlight management's critical influence in shaping outcomes based on their alignment with or opposition to the proposed transaction.

Financial Implications and Valuation

Mergers typically involve mutual agreement between companies, resulting in combined financial statements that reflect consolidated assets, liabilities, and earnings, often enhancing overall market valuation through synergies and cost efficiencies. Hostile takeovers, by contrast, may prompt premium bids above market price to acquire a target company, increasing acquisition costs and potentially leading to defensive financial measures like buybacks or debt restructuring, which can impact the acquirer's valuation negatively. Investors closely monitor post-transaction valuation adjustments in both scenarios to assess the financial health and long-term profitability of the resulting entity.

Cultural Integration Challenges

Cultural integration challenges during mergers often revolve around aligning organizational values, communication styles, and management practices to foster collaboration and employee engagement. In hostile takeovers, these challenges intensify due to employee resistance, lack of trust, and conflicting corporate identities, which can jeopardize operational synergy and retention. Successfully managing cultural integration requires deliberate strategies such as transparent communication, empathetic leadership, and inclusive change management to mitigate conflicts and unify disparate workforces.

Case Studies: Successful Mergers and Notorious Hostile Takeovers

The merger of Disney and Pixar in 2006 stands as a landmark case study exemplifying successful synergy, where complementary creative strengths and intellectual property united to dominate animated entertainment. Contrastingly, the hostile takeover of RJR Nabisco by Kohlberg Kravis Roberts in 1988 is notorious for its aggressive tactics and record-breaking leveraged buyout, highlighting the intense financial battles and shareholder conflicts typical of such acquisitions. These examples underscore the strategic, cultural, and financial complexities distinguishing amicable mergers from contentious hostile takeovers in corporate history.

Deciding Between a Merger or Hostile Takeover

Deciding between a merger or hostile takeover depends on strategic goals, company culture, and shareholder support. Mergers typically involve mutual agreement, fostering cooperative integration and shared benefits, while hostile takeovers involve acquiring control without management consent, often leading to resistance and higher costs. Evaluating financial leverage, potential synergies, and regulatory hurdles helps determine the most viable approach for corporate expansion or market entry.

Merger Infographic

libterm.com

libterm.com