Fixed Asset Turnover measures how efficiently a company uses its fixed assets to generate sales, highlighting the relationship between net sales and net fixed assets. A higher ratio indicates better utilization of assets to produce revenue, essential for assessing operational performance and capital investment effectiveness. Discover more insights and strategies to enhance your business's fixed asset management in the rest of this article.

Table of Comparison

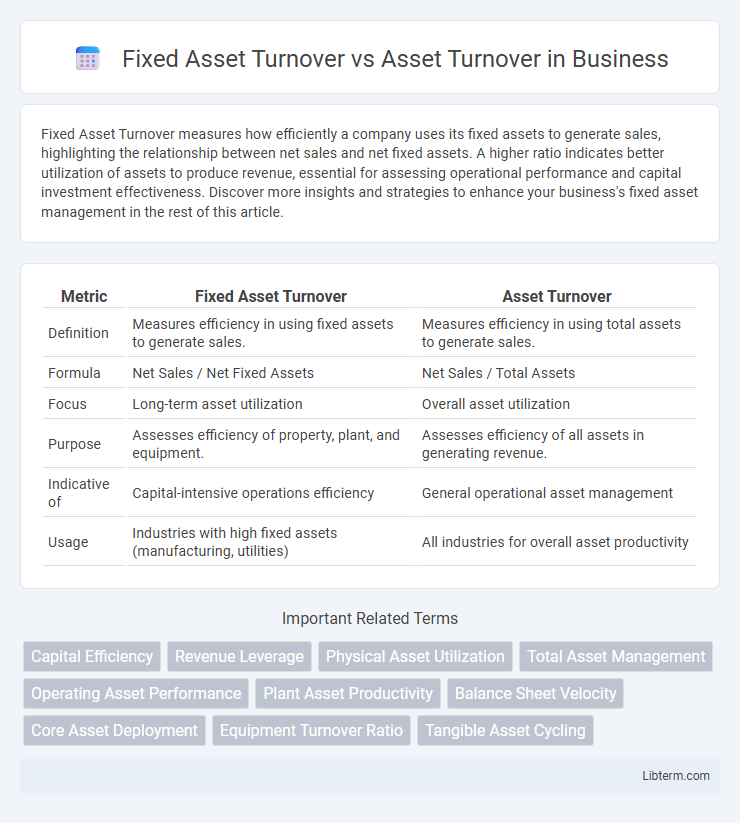

| Metric | Fixed Asset Turnover | Asset Turnover |

|---|---|---|

| Definition | Measures efficiency in using fixed assets to generate sales. | Measures efficiency in using total assets to generate sales. |

| Formula | Net Sales / Net Fixed Assets | Net Sales / Total Assets |

| Focus | Long-term asset utilization | Overall asset utilization |

| Purpose | Assesses efficiency of property, plant, and equipment. | Assesses efficiency of all assets in generating revenue. |

| Indicative of | Capital-intensive operations efficiency | General operational asset management |

| Usage | Industries with high fixed assets (manufacturing, utilities) | All industries for overall asset productivity |

Introduction to Asset Turnover Metrics

Fixed Asset Turnover measures the efficiency of a company in generating sales from its fixed assets, such as property, plant, and equipment, by dividing net sales by average net fixed assets. Asset Turnover, on the other hand, evaluates overall asset utilization by comparing net sales to average total assets, including both fixed and current assets. Understanding these metrics provides insights into how effectively a company employs its asset base to drive revenue, aiding investors and managers in performance assessment and strategic decision-making.

Defining Fixed Asset Turnover

Fixed Asset Turnover measures a company's efficiency in using its fixed assets, such as property, plant, and equipment, to generate sales revenue, calculated by dividing net sales by net fixed assets. Asset Turnover assesses overall asset utilization by comparing net sales to total assets, encompassing both fixed and current assets. Understanding Fixed Asset Turnover is crucial for industries reliant on substantial investment in long-term assets, as it highlights the effectiveness of these assets in driving revenue growth.

Understanding Total Asset Turnover

Total Asset Turnover measures a company's efficiency in generating sales from all its assets, reflecting overall operational performance. Fixed Asset Turnover specifically assesses how well a company utilizes its fixed assets, such as property and equipment, to produce revenue. Understanding Total Asset Turnover provides a comprehensive view of asset utilization, encompassing both fixed and current assets to evaluate overall asset productivity.

Key Formula Differences

Fixed Asset Turnover measures a company's efficiency in generating sales from its net fixed assets, calculated as Net Sales divided by Net Fixed Assets. Asset Turnover evaluates overall asset utilization by dividing Net Sales by Total Assets, encompassing both fixed and current assets. The key formula difference lies in the denominator, where Fixed Asset Turnover focuses exclusively on net fixed assets, while Asset Turnover considers the total asset base.

Industries Suited for Each Metric

Fixed Asset Turnover is ideal for capital-intensive industries like manufacturing and utilities where physical assets drive revenue, emphasizing efficient use of property, plant, and equipment. Asset Turnover suits service-based and retail industries with fewer fixed assets, measuring overall asset efficiency by including current assets like inventory and receivables. Choosing the right metric depends on the asset structure of the industry, optimizing performance evaluation accordingly.

Interpreting Fixed Asset Turnover Ratios

Fixed Asset Turnover measures how efficiently a company generates sales from its fixed assets, offering insights into asset utilization specific to property, plant, and equipment. Compared to Asset Turnover, which assesses total asset productivity including current assets, Fixed Asset Turnover provides a more targeted evaluation of long-term asset efficiency. High Fixed Asset Turnover ratios indicate effective use of capital-intensive assets, crucial for industries with significant investment in physical infrastructure.

Analyzing Total Asset Turnover Ratios

Total Asset Turnover measures a company's efficiency in generating sales from all assets, including fixed and current assets. Fixed Asset Turnover focuses specifically on how well a business utilizes its property, plant, and equipment to drive revenue. Analyzing both ratios together provides deeper insights into asset utilization, highlighting operational performance and investment effectiveness in asset management.

Strategic Implications for Businesses

Fixed Asset Turnover measures how efficiently a company uses its tangible fixed assets to generate sales, directly impacting capital-intensive industries' investment strategies and operational focus. Asset Turnover evaluates overall asset utilization, encompassing both fixed and current assets, influencing broader efficiency assessments and resource allocation decisions. Understanding the strategic implications of both ratios guides businesses in optimizing asset management, improving profitability, and aligning operational priorities with market demands.

Common Pitfalls in Ratio Analysis

Fixed Asset Turnover measures a company's efficiency in using fixed assets like property and equipment to generate sales, while Asset Turnover considers all assets, including current assets. Common pitfalls in ratio analysis include neglecting asset age and depreciation, which can distort fixed asset turnover results, and overlooking industry differences that impact asset composition and turnover rates. Analysts should ensure consistent asset valuation methods and adjust for non-operating assets to avoid misleading comparisons.

Conclusion: Choosing the Right Asset Turnover Metric

Fixed Asset Turnover measures efficiency in using tangible fixed assets to generate sales, ideal for capital-intensive industries, while Asset Turnover provides a broader view by including all assets. Selecting the appropriate metric depends on the company's asset structure and industry characteristics, ensuring a more accurate assessment of operational efficiency. Accurate metric choice enhances performance analysis and informs better investment and management decisions.

Fixed Asset Turnover Infographic

libterm.com

libterm.com