Common stock represents ownership in a corporation and entitles shareholders to voting rights and dividends based on company performance. It carries higher risk compared to preferred stock but offers potential for significant capital gains. Discover how common stock can impact your investment strategy by reading the rest of this article.

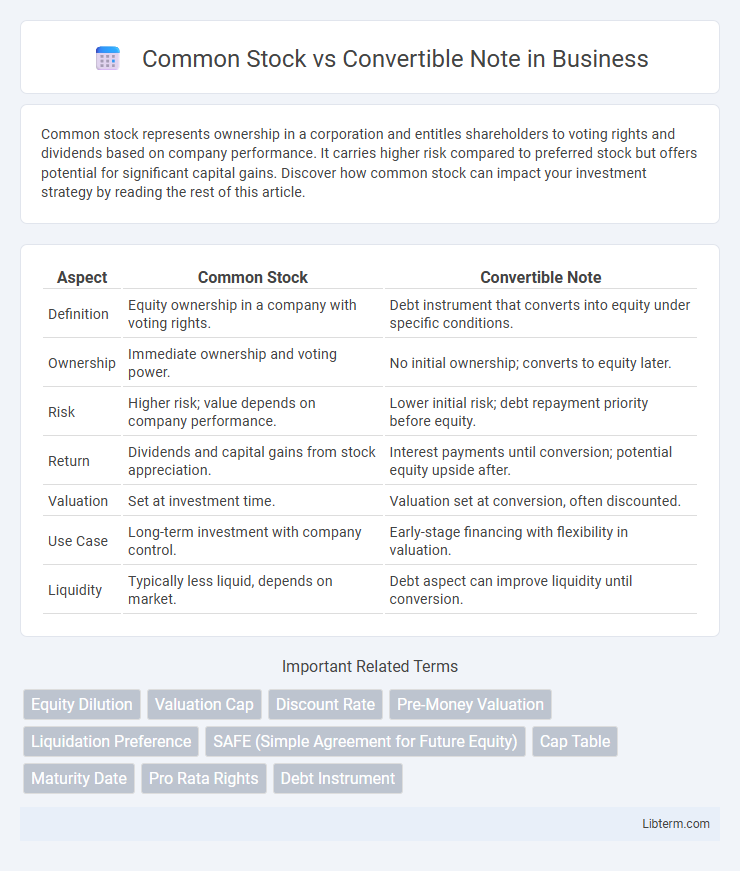

Table of Comparison

| Aspect | Common Stock | Convertible Note |

|---|---|---|

| Definition | Equity ownership in a company with voting rights. | Debt instrument that converts into equity under specific conditions. |

| Ownership | Immediate ownership and voting power. | No initial ownership; converts to equity later. |

| Risk | Higher risk; value depends on company performance. | Lower initial risk; debt repayment priority before equity. |

| Return | Dividends and capital gains from stock appreciation. | Interest payments until conversion; potential equity upside after. |

| Valuation | Set at investment time. | Valuation set at conversion, often discounted. |

| Use Case | Long-term investment with company control. | Early-stage financing with flexibility in valuation. |

| Liquidity | Typically less liquid, depends on market. | Debt aspect can improve liquidity until conversion. |

Introduction to Common Stock and Convertible Notes

Common stock represents equity ownership in a company, granting shareholders voting rights and potential dividends, often used by startups to attract investors. Convertible notes are short-term debt instruments that convert into equity, usually during a future financing round, combining features of debt and equity financing. Startups often use convertible notes to delay valuation negotiations while providing investors a path to ownership.

Key Definitions: Common Stock vs Convertible Note

Common stock represents equity ownership in a company, granting shareholders voting rights and potential dividends based on company performance. A convertible note is a debt instrument that converts into equity, typically common stock, upon a future financing event, offering investors initial protection as a loan with the opportunity to convert at a discounted valuation. Understanding these key definitions highlights the fundamental difference between direct equity participation and debt that transitions into equity under predefined conditions.

How Common Stock Works

Common stock represents ownership in a company, granting shareholders voting rights and potential dividends based on company performance. Shareholders benefit from capital appreciation as the company grows, with stock value fluctuating according to market conditions and business success. Unlike convertible notes, common stockholders assume higher risk but also stand to gain significantly if the company prospers.

Understanding Convertible Notes

Convertible notes are debt instruments that convert into equity, typically during a future financing round, offering investors a way to delay valuation until more information is available. They include key features such as a conversion discount, valuation cap, and maturity date, all designed to provide favorable terms for early investors while protecting startups from immediate dilution. Understanding these terms is crucial for founders and investors to balance risk, ensure alignment, and optimize fundraising strategy compared to issuing common stock outright.

Key Differences Between Common Stock and Convertible Notes

Common stock represents equity ownership in a company, granting shareholders voting rights and potential dividends, while convertible notes are debt instruments that can convert into equity under predefined conditions. Common stockholders bear higher risk but have unlimited upside potential, whereas convertible note holders enjoy debt priority and interest but face conversion terms that may dilute ownership. Convertible notes typically include maturity dates and interest rates, contrasting with common stock's indefinite term and direct equity stake.

Advantages of Issuing Common Stock

Issuing common stock allows companies to raise capital without incurring debt or obligating future repayment, enhancing financial flexibility. Common stockholders contribute to long-term growth by providing permanent equity, improving the company's balance sheet and creditworthiness. Unlike convertible notes, common stock issuance does not involve interest payments or dilution risks linked to conversion terms.

Benefits of Using Convertible Notes

Convertible notes offer startups a flexible financing option by delaying valuation discussions until a future funding round, reducing immediate negotiation complexities. They provide investors with the opportunity to convert debt into equity at a discounted price, aligning incentives and potentially increasing returns. This instrument also helps preserve ownership dilution for founders by postponing equity issuance until a more mature valuation is established.

Risks and Drawbacks for Investors and Founders

Common stock carries the risk of value dilution for existing shareholders as new shares are issued, potentially decreasing ownership control and voting power for founders and investors. Convertible notes pose uncertainty due to their debt-like nature, where valuation caps and interest rates may lead to unpredictable conversion terms, complicating exit strategies and future funding rounds. Both instruments expose founders to potential loss of control and investors to risks of illiquidity and valuation fluctuations during conversion.

When to Choose Common Stock or Convertible Notes

Choose common stock during early-stage funding when valuing the company is feasible, providing investors with immediate ownership and voting rights. Convertible notes suit seed rounds or uncertain valuations, offering a debt instrument that converts into equity at a later priced round, minimizing negotiation complexity. Opt for common stock if investor rights and control are priorities, while convertible notes are preferable for flexibility and speeding up funding without valuation disputes.

Conclusion: Choosing the Right Financing Option

Common stock offers ownership and voting rights, appealing to investors seeking long-term equity participation, while convertible notes provide debt with the potential to convert into equity, favoring startups needing immediate capital with deferred valuation. Selecting the right financing option depends on the company's current financial health, investor preferences, and growth projections. Balancing control dilution against funding flexibility is crucial to optimizing capital structure and aligning with strategic business goals.

Common Stock Infographic

libterm.com

libterm.com