A quotation captures the exact words of a speaker or writer, providing authenticity and emphasis to your message. Incorporating quotations can strengthen your arguments and connect your audience to authoritative voices. Explore this article to learn how to effectively use quotations in your writing.

Table of Comparison

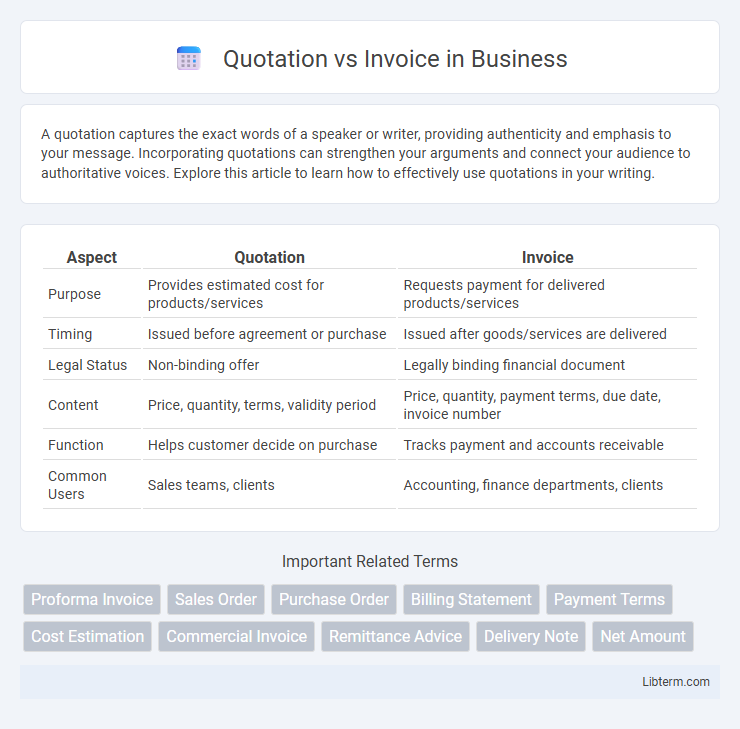

| Aspect | Quotation | Invoice |

|---|---|---|

| Purpose | Provides estimated cost for products/services | Requests payment for delivered products/services |

| Timing | Issued before agreement or purchase | Issued after goods/services are delivered |

| Legal Status | Non-binding offer | Legally binding financial document |

| Content | Price, quantity, terms, validity period | Price, quantity, payment terms, due date, invoice number |

| Function | Helps customer decide on purchase | Tracks payment and accounts receivable |

| Common Users | Sales teams, clients | Accounting, finance departments, clients |

Understanding Quotation and Invoice

A quotation is a formal document that outlines the estimated cost and details of goods or services a seller offers to a potential buyer before a transaction takes place. An invoice is a legal document issued after the sale, requesting payment for goods or services delivered, specifying the amounts due, payment terms, and dates. Understanding the distinction between a quotation and an invoice is essential for accurate financial management and transparent business communication.

Key Differences Between Quotation and Invoice

A quotation is a detailed estimate provided to a potential buyer outlining the price and terms before a sale, while an invoice is a formal request for payment issued after goods or services have been delivered. Quotations serve as proposals or offers that may be accepted or negotiated, whereas invoices represent confirmed transactions requiring payment within specified terms. The primary distinction lies in timing and purpose: quotations facilitate decision-making before purchase, invoices enforce payment obligations after the sale.

Purpose and Function of Quotations

Quotations serve as formal offers detailing the estimated costs and terms for products or services before a sale is confirmed, helping clients understand pricing and scope. Their primary function is to provide potential buyers with transparent information to make informed purchasing decisions. Unlike invoices, which request payment post-delivery, quotations are non-binding and aim to initiate negotiations and agreements.

Purpose and Function of Invoices

Invoices serve as formal requests for payment, detailing products or services provided, quantities, prices, and payment terms. Their primary function is to document a completed transaction, ensuring legal proof of sale and aiding in financial record-keeping for both buyer and seller. Invoices facilitate cash flow management by specifying due dates and payment methods, reinforcing accountability in business operations.

Essential Elements of a Quotation

A quotation must include detailed descriptions of goods or services, precise pricing, validity period, and terms of payment to provide clear expectations for both parties. It often contains company information, client details, and any applicable taxes or discounts to ensure transparency. Accurate quotation elements help prevent disputes and streamline the transition from offer to formal invoicing.

Essential Elements of an Invoice

An invoice must include essential elements such as the unique invoice number, date of issue, and detailed description of goods or services provided along with their quantities and unit prices. It should clearly state the total amount due, payment terms, and the seller's contact information including tax identification number when applicable. Unlike a quotation, which is an estimate of costs, an invoice serves as a formal request for payment after goods or services have been delivered.

When to Use a Quotation vs an Invoice

Use a quotation when providing a potential customer with a detailed estimate of costs before services or products are delivered, helping to set clear expectations and enable informed decision-making. An invoice is issued after goods or services have been provided, serving as an official request for payment and including details like quantities, prices, and payment terms. Businesses rely on quotations to negotiate terms and invoices to finalize transactions, ensuring accurate financial records and cash flow management.

Legal Implications: Quotation vs Invoice

A quotation serves as a preliminary offer outlining the estimated cost for goods or services and is generally non-binding unless explicitly stated, while an invoice is a legally binding document requesting payment for delivered goods or services. Failure to honor a valid invoice can lead to legal action for breach of contract or debt recovery, whereas disputes over quotations typically revolve around misunderstandings of terms rather than enforceable claims. Proper documentation and clarity in both quotations and invoices are essential to avoid legal complications and ensure compliance with commercial law and tax regulations.

Common Mistakes in Using Quotations and Invoices

Common mistakes in using quotations include failing to specify terms clearly, such as payment deadlines and item descriptions, which can lead to misunderstandings with clients. Invoices often contain errors like incorrect invoice numbers, mismatched pricing, or missing tax details, causing delays in payment processing. Ensuring accuracy and consistency in both documents is essential for smooth financial transactions and maintaining professional client relationships.

Best Practices for Managing Quotations and Invoices

Effective management of quotations and invoices requires clear documentation, timely communication, and accurate record-keeping to ensure transparency and streamline client transactions. Implementing standardized templates for both quotations and invoices enhances consistency and reduces errors, while integrating digital tools facilitates real-time tracking, approval workflows, and automated reminders. Prioritizing thorough verification processes before sending quotations and invoices minimizes disputes, accelerates payment cycles, and improves overall cash flow management.

Quotation Infographic

libterm.com

libterm.com