The rental model offers a flexible and cost-effective way to access products or services without long-term commitments, making it ideal for individuals or businesses seeking affordability and convenience. Understanding how the rental model works can help you maximize value and avoid common pitfalls. Discover more insights into the advantages and practical applications of rental models in the rest of this article.

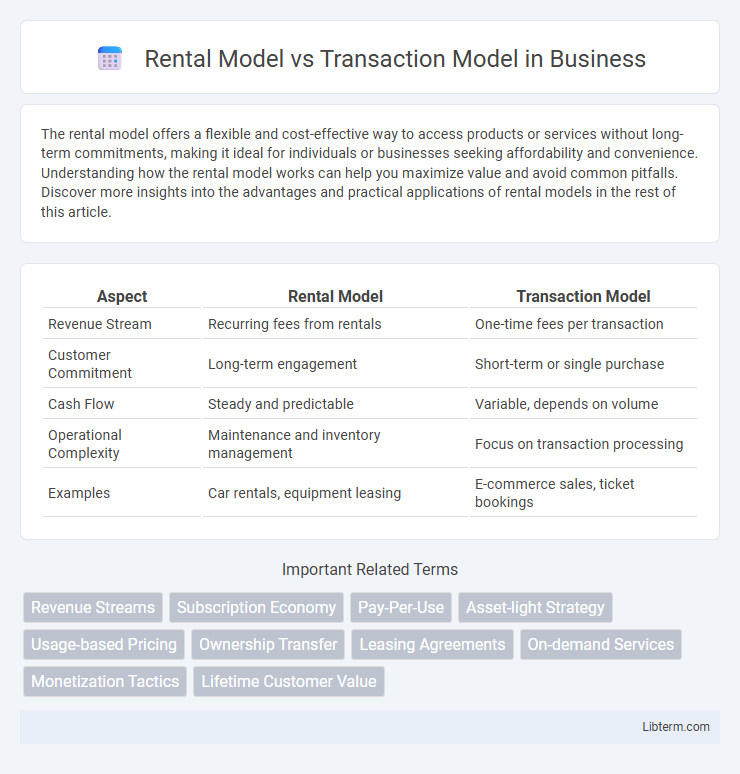

Table of Comparison

| Aspect | Rental Model | Transaction Model |

|---|---|---|

| Revenue Stream | Recurring fees from rentals | One-time fees per transaction |

| Customer Commitment | Long-term engagement | Short-term or single purchase |

| Cash Flow | Steady and predictable | Variable, depends on volume |

| Operational Complexity | Maintenance and inventory management | Focus on transaction processing |

| Examples | Car rentals, equipment leasing | E-commerce sales, ticket bookings |

Introduction to Rental and Transaction Models

The Rental Model generates revenue through continuous access fees for products or services, emphasizing long-term customer relationships and predictable income streams. The Transaction Model relies on one-time payments tied to individual sales, focusing on volume and frequency to drive profitability. Understanding these models helps businesses optimize cash flow, customer engagement, and growth strategies effectively.

Definition of Rental Model

The Rental Model refers to a business approach where customers pay for temporary access or use of an asset, such as property, vehicles, or equipment, without owning it. This model emphasizes recurring revenue through periodic rental fees, promoting flexibility and cost-efficiency for users who need the asset for limited durations. It contrasts with the Transaction Model, which centers on one-time sales or exchanges, transferring ownership instantly upon payment.

Definition of Transaction Model

The transaction model refers to a business framework where value is exchanged through individual, discrete sales or purchases, with revenue generated per transaction rather than ongoing usage. This model emphasizes single-point exchanges, often involving clear, one-time payments tied directly to specific goods or services. It contrasts with rental models, where customers pay periodically to access or use an asset over time rather than owning it outright.

Key Differences Between Rental and Transaction Models

The rental model generates revenue through recurring payments based on time intervals, providing continuous access to products or services, while the transaction model earns revenue from one-time sales completed upon each purchase. Rental models emphasize customer retention and long-term engagement, whereas transaction models focus on maximizing individual sale volume and frequency. Businesses choosing between these models consider factors like cash flow stability, customer lifetime value, and operational complexity.

Advantages of the Rental Model

The rental model offers consistent revenue streams by promoting customer retention and predictable cash flow, which enhances financial stability. It reduces upfront costs for users, making products and services more accessible while enabling businesses to maintain control over asset quality and lifecycle management. This model supports scalability and adaptability by allowing companies to update offerings regularly without requiring full customer reinvestment.

Benefits of the Transaction Model

The Transaction Model enables businesses to generate immediate revenue by charging customers per purchase or interaction, improving cash flow and financial predictability. This model fosters customer flexibility, as users only pay for what they consume, enhancing satisfaction and loyalty. Scalability is enhanced through diversified revenue streams, allowing companies to adapt quickly to market demand without the long-term commitment of rentals.

Industries Using Rental and Transaction Models

The rental model thrives in industries like automotive, real estate, and equipment leasing, providing flexible access to assets without ownership commitments. The transaction model dominates e-commerce, retail, and service sectors, emphasizing one-time purchases or individual service engagements. Companies in media streaming, tools rental, and hospitality often blend both models to maximize revenue and customer satisfaction.

Consumer Preferences and Behavior

Consumers gravitate towards the rental model when seeking cost-effective access to products without long-term commitments, valuing flexibility and reduced upfront expenses. The transaction model appeals to buyers preferring full ownership, emphasizing product permanence and potential future resale value. Behavioral trends indicate younger demographics favor rentals for experiential consumption, while older consumers prioritize the security and control associated with outright purchases.

Revenue Implications for Businesses

The rental model generates consistent, recurring revenue streams by charging customers for the use of products or services over a defined period, enhancing cash flow predictability and long-term customer retention. In contrast, the transaction model relies on one-time sales or interactions, resulting in more variable revenue that depends heavily on continuous customer acquisition and volume. Businesses leveraging the rental model benefit from stable income and increased lifetime value per customer, while transaction-based models face greater revenue volatility but can achieve rapid cash influx during peak sales periods.

Choosing the Right Model for Your Business

Choosing the right business model between Rental and Transaction depends on your industry, customer behavior, and revenue goals. Rental models generate consistent recurring income by leasing products or services over time, ideal for equipment, software, or property businesses. Transaction models focus on individual sales, maximizing revenue per interaction, making them best suited for retail and service-oriented enterprises aiming for high-volume sales.

Rental Model Infographic

libterm.com

libterm.com