Mutual funds offer a diversified investment option by pooling money from multiple investors to purchase a variety of securities, reducing risk compared to individual stock investments. They are managed by professional fund managers who select assets based on your financial goals and risk tolerance. Discover how mutual funds can enhance your investment portfolio by reading the rest of the article.

Table of Comparison

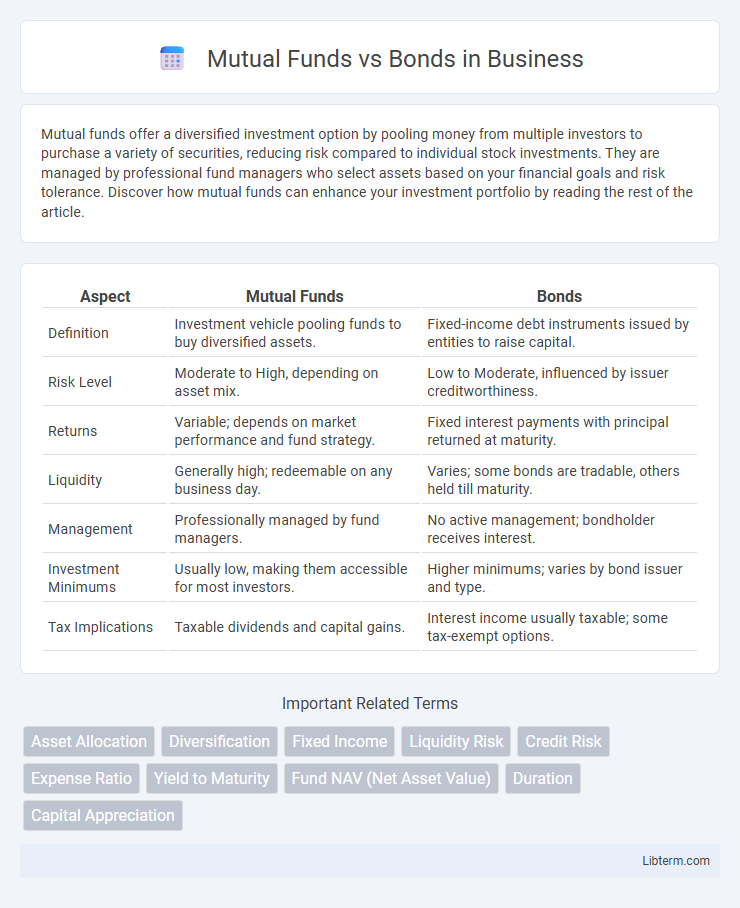

| Aspect | Mutual Funds | Bonds |

|---|---|---|

| Definition | Investment vehicle pooling funds to buy diversified assets. | Fixed-income debt instruments issued by entities to raise capital. |

| Risk Level | Moderate to High, depending on asset mix. | Low to Moderate, influenced by issuer creditworthiness. |

| Returns | Variable; depends on market performance and fund strategy. | Fixed interest payments with principal returned at maturity. |

| Liquidity | Generally high; redeemable on any business day. | Varies; some bonds are tradable, others held till maturity. |

| Management | Professionally managed by fund managers. | No active management; bondholder receives interest. |

| Investment Minimums | Usually low, making them accessible for most investors. | Higher minimums; varies by bond issuer and type. |

| Tax Implications | Taxable dividends and capital gains. | Interest income usually taxable; some tax-exempt options. |

Introduction to Mutual Funds and Bonds

Mutual funds pool capital from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering professional management and liquidity. Bonds represent fixed-income debt instruments issued by governments or corporations, providing regular interest payments and principal repayment at maturity. Both investment types cater to varying risk tolerances and financial goals, with mutual funds typically emphasizing diversification and bonds focusing on income stability.

Key Differences Between Mutual Funds and Bonds

Mutual funds pool investors' money to invest in a diversified portfolio of assets, including stocks, bonds, and other securities, offering professional management and liquidity. Bonds are fixed-income securities where investors lend money to an issuer, receiving regular interest payments and return of principal at maturity, typically with lower risk and predictability compared to mutual funds. Key differences include risk levels, investment goals, liquidity, and the potential for returns, with mutual funds providing diversification and growth potential, while bonds emphasize income stability and capital preservation.

How Mutual Funds Work

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers. Unlike bonds, which provide fixed interest payments over a set period, mutual funds offer potential growth through capital gains and dividends, with the value fluctuating based on market conditions. Investors can buy or sell mutual fund shares at the fund's net asset value (NAV) at the end of each trading day.

Understanding Bonds: Basics and Types

Bonds are fixed-income securities issued by corporations, municipalities, or governments to raise capital, providing regular interest payments until maturity. Common types include Treasury bonds, corporate bonds, and municipal bonds, each varying in risk, yield, and tax treatment. Understanding bond ratings, maturity dates, and coupon rates is essential for assessing investment risk and return potential compared to mutual funds.

Risk and Return Comparison

Mutual funds typically offer diversified portfolios that balance risk and return by investing in a mix of equities, bonds, and other assets, potentially yielding higher returns with moderate risk compared to bonds. Bonds generally provide fixed income with lower risk and more predictable returns, making them suitable for conservative investors seeking capital preservation. The risk associated with bonds depends on credit quality and interest rate fluctuations, whereas mutual funds' risk varies widely based on asset allocation and market exposure.

Liquidity and Accessibility

Mutual funds offer higher liquidity with the ability to buy or sell shares daily at net asset value, making them accessible to individual investors with low minimum investments. Bonds typically have lower liquidity, especially corporate or municipal bonds, which may require holding until maturity or selling in less-active secondary markets. Accessibility favors mutual funds due to easier entry points and professional management, while bonds often demand higher capital and understanding of market conditions.

Costs and Fees Involved

Mutual funds typically charge expense ratios ranging from 0.5% to 2%, covering management fees, administrative costs, and sometimes sales loads, which can reduce overall returns. Bonds usually involve lower fees, often limited to brokerage commissions or bid-ask spreads, making them cost-effective for long-term holding. Understanding these cost structures is essential for investors aiming to optimize net returns and manage investment expenses efficiently.

Income Generation Potential

Mutual funds often provide higher income generation potential compared to individual bonds due to diversified portfolios that include dividend-paying stocks, bonds, and other income-producing assets. Bonds offer fixed interest payments, providing stable and predictable income but usually at lower yields than some mutual funds focused on high-yield or inflation-protected securities. Investors seeking consistent income with moderate risk often use bond mutual funds to balance income potential with portfolio diversification.

Suitability for Different Investors

Mutual funds offer diversified portfolios suitable for investors seeking growth with moderate risk tolerance, benefiting those who prefer professional management and liquidity. Bonds provide fixed income and lower risk, appealing to conservative investors focused on preserving capital and generating steady cash flow. The choice depends on an investor's risk appetite, income needs, and investment horizon.

Choosing Between Mutual Funds and Bonds

Choosing between mutual funds and bonds depends on risk tolerance, investment goals, and time horizon. Mutual funds offer diversified portfolios managed by professionals, suitable for investors seeking growth and moderate risk, while bonds provide fixed income with lower risk but limited returns. Evaluating factors such as liquidity, interest rate sensitivity, and income needs helps determine which investment aligns best with individual financial objectives.

Mutual Funds Infographic

libterm.com

libterm.com