Private equity firms specialize in investing in private companies, often acquiring significant stakes to improve operations and increase value before eventually exiting through sales or public offerings. These firms provide strategic guidance, financial expertise, and capital growth opportunities to transform businesses and generate substantial returns. Explore the rest of the article to discover how private equity can impact Your investment portfolio and business growth.

Table of Comparison

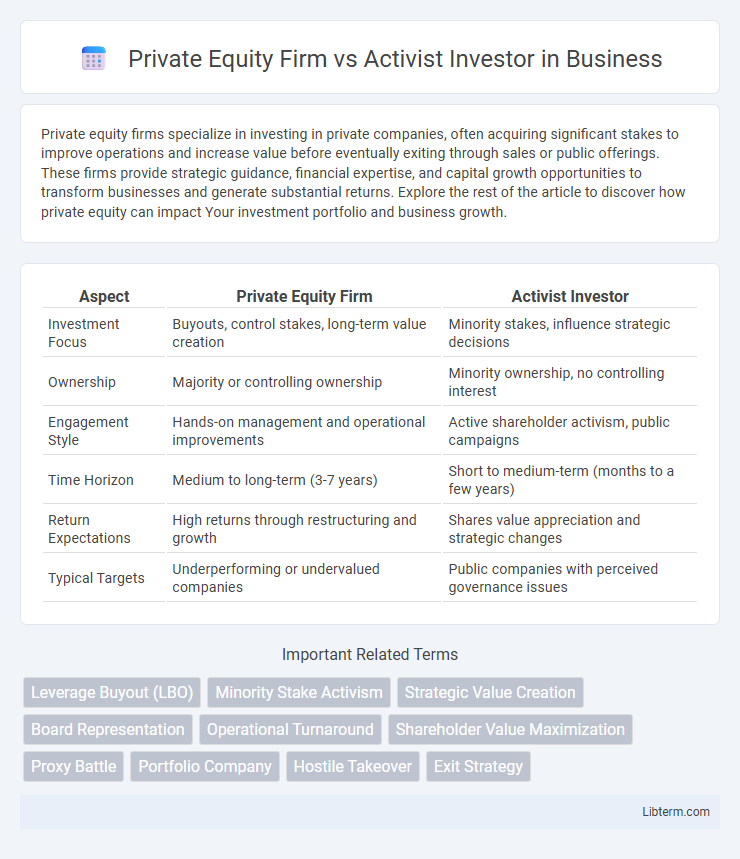

| Aspect | Private Equity Firm | Activist Investor |

|---|---|---|

| Investment Focus | Buyouts, control stakes, long-term value creation | Minority stakes, influence strategic decisions |

| Ownership | Majority or controlling ownership | Minority ownership, no controlling interest |

| Engagement Style | Hands-on management and operational improvements | Active shareholder activism, public campaigns |

| Time Horizon | Medium to long-term (3-7 years) | Short to medium-term (months to a few years) |

| Return Expectations | High returns through restructuring and growth | Shares value appreciation and strategic changes |

| Typical Targets | Underperforming or undervalued companies | Public companies with perceived governance issues |

Introduction to Private Equity Firms and Activist Investors

Private equity firms are investment management companies that acquire private ownership stakes in companies, aiming to enhance their value through strategic, operational, and financial improvements before eventually exiting the investment for profit. Activist investors, typically hedge funds or large shareholders, acquire significant equity positions in public companies to influence management decisions and drive changes that increase shareholder value. Both entities play critical roles in corporate governance and value creation, but private equity firms generally pursue full or majority control, while activist investors seek to impact policies without complete ownership.

Defining Private Equity Firms

Private equity firms are investment management companies that acquire equity ownership in private companies or public companies seeking to go private, aiming to improve operational performance and increase value before exiting through a sale or IPO. These firms typically raise capital from institutional investors and high-net-worth individuals to deploy in buyouts, growth equity, or venture capital investments. Unlike activist investors who focus on influencing corporate governance and strategic decisions in publicly traded companies, private equity firms engage directly in managing and restructuring portfolio companies to maximize returns.

Understanding Activist Investors

Activist investors strategically acquire significant stakes in public companies to influence management decisions and drive changes that enhance shareholder value. Unlike private equity firms, which typically engage in buyouts and long-term ownership, activist investors aim for targeted interventions such as board representation, restructuring, or policy shifts. Understanding activist investors involves recognizing their focus on short- to medium-term value creation through active engagement and public campaigns.

Key Investment Strategies Compared

Private equity firms primarily focus on acquiring majority stakes in companies to drive operational improvements, growth initiatives, and eventual profitable exits, often through buyouts or restructurings. Activist investors typically take minority positions to influence corporate governance, strategic shifts, or management changes, using shareholder proposals and public campaigns to unlock value. Both strategies aim to enhance shareholder returns, but private equity emphasizes control and long-term transformation, while activism centers on targeted influence and short-to-medium-term gains.

Influence on Corporate Governance

Private equity firms often gain significant control by acquiring majority stakes, enabling them to implement strategic changes and overhaul management to enhance operational efficiency and long-term value. Activist investors typically acquire minority positions but exert influence through aggressive shareholder engagement, proxy battles, and public campaigns aiming to prompt governance reforms, board changes, or strategic shifts. Both entities impact corporate governance but differ in approach: private equity drives change via direct control, whereas activists leverage shareholder rights to influence management decisions.

Impact on Company Performance

Private equity firms typically drive company performance by implementing operational improvements, restructuring, and strategic growth initiatives, often leading to enhanced efficiency and profitability. Activist investors influence performance by pushing for governance changes, management shake-ups, or asset divestitures, which can create short-term market value but may introduce volatility. Both approaches impact company performance differently, with private equity emphasizing long-term value creation and activists focusing on immediate shareholder returns.

Risk and Return Profiles

Private equity firms typically pursue control investments in portfolio companies, seeking to improve operational efficiency and achieve high returns over a multi-year horizon, often assuming substantial business risk due to leveraged buyouts. Activist investors focus on minority stakes, aiming to influence management and strategic decisions to unlock shareholder value, which carries market and reputational risks but generally involves lower capital commitment and shorter investment periods. The risk-return profile of private equity is characterized by higher illiquidity and potential for outsized gains, while activist investing offers more flexibility with moderate risk and the possibility of quicker returns through corporate governance changes.

Exit Strategies and Time Horizons

Private equity firms typically pursue exit strategies such as initial public offerings (IPOs), strategic sales, or secondary buyouts within a medium to long-term horizon, generally spanning three to seven years to maximize returns. Activist investors often have shorter time horizons, focusing on influencing company management to implement changes that boost shareholder value quickly, usually within one to three years, followed by exits through selling shares in the open market. The contrasting time frames and exit mechanisms reflect private equity's comprehensive operational involvement versus activists' strategic stakeholding and influence-driven approaches.

Case Studies: Successes and Failures

Private equity firms often achieve success by restructuring companies to improve operational efficiency, as seen in the turnaround of Hilton Worldwide by The Blackstone Group, which resulted in a significant market valuation increase after strategic asset management. Activist investors like Elliott Management have demonstrated both success and failure; their campaign against AT&T led to board changes and strategic shifts, enhancing shareholder value, while their effort with Arconic faced setbacks due to management resistance and prolonged battles. These case studies highlight the differing approaches and risk profiles of private equity firms focused on long-term value creation versus activist investors pushing for strategic changes through shareholder activism.

Choosing Between Private Equity and Activist Investors

Choosing between a private equity firm and an activist investor depends on the company's strategic goals and desired level of control. Private equity firms typically pursue full or majority ownership, driving operational improvements and long-term value creation through hands-on management and capital infusion. Activist investors usually acquire minority stakes to influence corporate governance and strategic decisions without full control, aiming for relatively quicker returns through shareholder activism.

Private Equity Firm Infographic

libterm.com

libterm.com