Continuous Linked Settlement (CLS) revolutionizes foreign exchange by eliminating settlement risk through simultaneous payment-versus-payment processing in multiple currencies. This system enhances global financial stability and efficiency by ensuring transactions are settled in real-time, reducing potential losses from currency fluctuations. Discover how CLS can secure and streamline Your international transactions by exploring the full article.

Table of Comparison

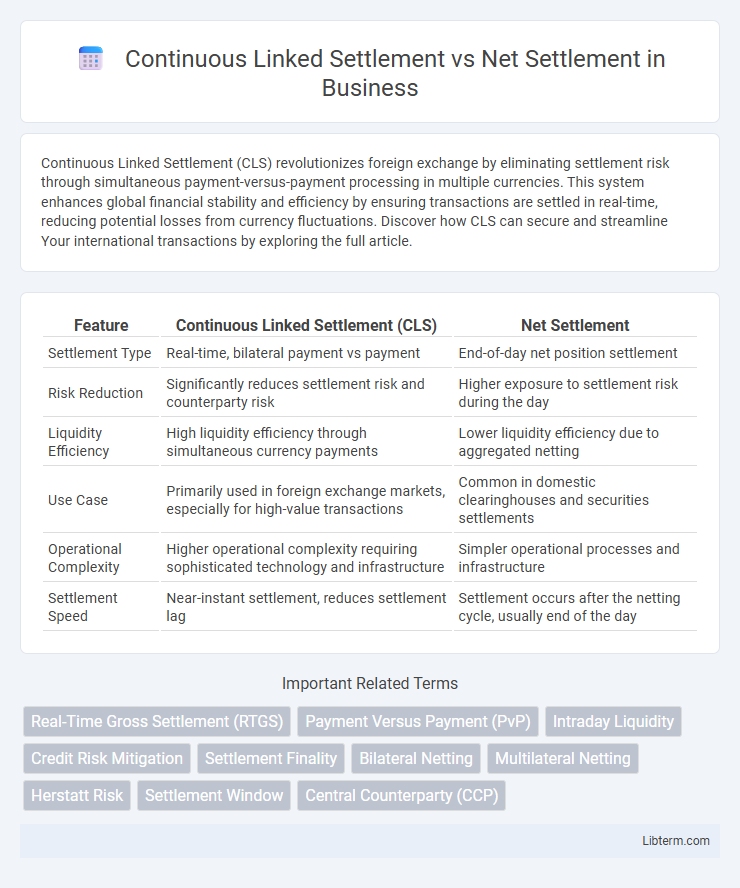

| Feature | Continuous Linked Settlement (CLS) | Net Settlement |

|---|---|---|

| Settlement Type | Real-time, bilateral payment vs payment | End-of-day net position settlement |

| Risk Reduction | Significantly reduces settlement risk and counterparty risk | Higher exposure to settlement risk during the day |

| Liquidity Efficiency | High liquidity efficiency through simultaneous currency payments | Lower liquidity efficiency due to aggregated netting |

| Use Case | Primarily used in foreign exchange markets, especially for high-value transactions | Common in domestic clearinghouses and securities settlements |

| Operational Complexity | Higher operational complexity requiring sophisticated technology and infrastructure | Simpler operational processes and infrastructure |

| Settlement Speed | Near-instant settlement, reduces settlement lag | Settlement occurs after the netting cycle, usually end of the day |

Overview of Continuous Linked Settlement (CLS)

Continuous Linked Settlement (CLS) is a global system that mitigates settlement risk in the foreign exchange market by settling payments simultaneously on a payment-versus-payment (PvP) basis across multiple currencies. It offers real-time settlement processing for over 18 million FX transactions annually, reducing the risk of one party defaulting after the other has paid. By operating through a centralized platform, CLS enhances liquidity management and operational efficiency compared to traditional net settlement methods.

Introduction to Net Settlement Systems

Net settlement systems aggregate multiple payment obligations between participants, settling the net amount owed at specified intervals to reduce liquidity needs and operational risk. Unlike Continuous Linked Settlement (CLS), which settles foreign exchange transactions simultaneously to eliminate settlement risk in real-time, net settlement processes delay final settlement, exposing parties to credit risk during the clearing period. These systems optimize transaction processing efficiency but require robust risk management to handle potential default exposures.

Key Differences Between CLS and Net Settlement

Continuous Linked Settlement (CLS) eliminates settlement risk in foreign exchange transactions by settling payments simultaneously across multiple currencies in real-time, whereas Net Settlement consolidates transactions and settles the net amount at specific intervals, increasing exposure to settlement risk. CLS operates on a payment-versus-payment (PvP) basis, ensuring that both sides of a foreign exchange trade are settled concurrently, while Net Settlement depends on bilateral agreements and may involve delays between payment obligations. The key difference lies in CLS's ability to reduce counterparty risk and liquidity requirements by settling gross amounts in real-time, compared to Net Settlement's netting process that optimizes liquidity but exposes participants to higher credit and timing risks.

Advantages of Continuous Linked Settlement

Continuous Linked Settlement (CLS) significantly reduces settlement risk by synchronizing the exchange of payments in multiple currencies, ensuring simultaneous settlement and eliminating the risk of one party defaulting. Unlike Net Settlement systems, where settlements occur periodically and involve netting multiple transactions, CLS provides real-time, payment-versus-payment (PvP) processing that enhances liquidity and operational efficiency. This real-time settlement mechanism improves transparency, reduces credit exposure, and supports global financial stability in foreign exchange markets.

Benefits of Net Settlement Systems

Net settlement systems reduce liquidity requirements by aggregating multiple transactions into a single net payment, enhancing capital efficiency for financial institutions. They minimize settlement risk by lowering the number and value of individual settlements, which decreases exposure to default or processing errors. This streamlined process supports faster reconciliation and improved operational efficiency within payment and securities markets.

Risk Mitigation in CLS vs Net Settlement

Continuous Linked Settlement (CLS) significantly reduces settlement risk by ensuring simultaneous payment and receipt of multiple currencies in foreign exchange transactions, effectively eliminating principal risk. In contrast, Net Settlement aggregates payments over a period and settles them at once, exposing participants to credit risk if one party defaults before final settlement. CLS's real-time, payment-versus-payment system minimizes the chance of failed trades and systemic risk, making it a more robust risk mitigation tool compared to traditional net settlement methods.

Settlement Finality and Timing Considerations

Continuous Linked Settlement (CLS) provides real-time foreign exchange settlement with payment-versus-payment (PvP) mechanisms, ensuring immediate settlement finality and significantly reducing settlement risk. Net Settlement aggregates multiple transactions for end-of-day processing, which can delay settlement finality and increase exposure to counterparty risk until settlement completion. The timing advantage of CLS enhances liquidity management and operational efficiency, while Net Settlement's batch process is more cost-effective but slower in confirming transaction finality.

Impact on Liquidity Management

Continuous Linked Settlement (CLS) significantly enhances liquidity management by settling foreign exchange transactions in real-time on a payment-versus-payment basis, reducing settlement risk and the need for excess liquidity buffers. In contrast, Net Settlement aggregates transactions, leading to delayed payments that can cause liquidity bottlenecks and increase intraday liquidity requirements for participants. CLS's real-time settlement mechanism optimizes cash flow, minimizes liquidity shortfalls, and lowers systemic risk compared to the deferred liquidity demands inherent in Net Settlement systems.

Regulatory Perspectives on CLS and Net Settlement

Regulatory perspectives on Continuous Linked Settlement (CLS) emphasize its risk-reduction benefits in foreign exchange markets by eliminating principal risk and enhancing settlement finality, aligning with global financial stability standards such as those from the Bank for International Settlements (BIS). Net Settlement systems face increased scrutiny due to inherent credit and liquidity risks arising from deferred payment obligations, prompting regulators to enforce stricter capital and collateral requirements under frameworks like Basel III. CLS's real-time gross settlement mechanism meets regulatory demands for transparency and systemic risk mitigation, encouraging broader adoption in cross-border forex transactions compared to traditional netting arrangements.

Choosing the Right Settlement Mechanism: Factors to Consider

Choosing the right settlement mechanism depends on factors such as transaction speed, risk exposure, and operational complexity. Continuous Linked Settlement (CLS) minimizes settlement risk by synchronizing foreign exchange payments in real-time, making it ideal for high-value, time-sensitive trades. Net Settlement aggregates multiple transactions into a single netted amount, reducing liquidity requirements but potentially increasing credit risk and settlement delays.

Continuous Linked Settlement Infographic

libterm.com

libterm.com