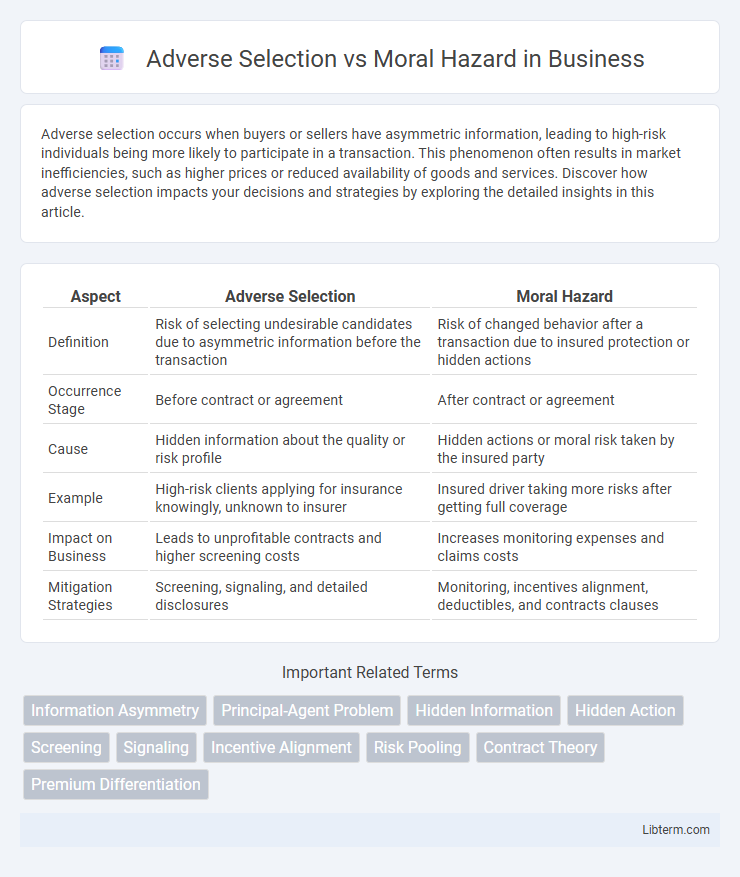

Adverse selection occurs when buyers or sellers have asymmetric information, leading to high-risk individuals being more likely to participate in a transaction. This phenomenon often results in market inefficiencies, such as higher prices or reduced availability of goods and services. Discover how adverse selection impacts your decisions and strategies by exploring the detailed insights in this article.

Table of Comparison

| Aspect | Adverse Selection | Moral Hazard |

|---|---|---|

| Definition | Risk of selecting undesirable candidates due to asymmetric information before the transaction | Risk of changed behavior after a transaction due to insured protection or hidden actions |

| Occurrence Stage | Before contract or agreement | After contract or agreement |

| Cause | Hidden information about the quality or risk profile | Hidden actions or moral risk taken by the insured party |

| Example | High-risk clients applying for insurance knowingly, unknown to insurer | Insured driver taking more risks after getting full coverage |

| Impact on Business | Leads to unprofitable contracts and higher screening costs | Increases monitoring expenses and claims costs |

| Mitigation Strategies | Screening, signaling, and detailed disclosures | Monitoring, incentives alignment, deductibles, and contracts clauses |

Introduction to Adverse Selection and Moral Hazard

Adverse selection occurs when asymmetric information leads one party to engage in transactions with high-risk counterparts, often before a contract is signed, causing market inefficiencies. Moral hazard arises after a contract is established, where one party may change their behavior to the detriment of the other due to hidden actions. Both concepts critically impact insurance, finance, and contract theory by influencing risk assessment and incentive structures.

Defining Adverse Selection

Adverse selection occurs when one party in a transaction possesses hidden information that leads to an imbalance, causing high-risk individuals to be more likely to engage, especially in insurance markets where those with greater risk are more inclined to purchase coverage. This phenomenon results in inefficient market outcomes due to asymmetric information before a contract is executed. Understanding adverse selection is crucial for designing mechanisms like screening and signaling to mitigate its effects.

Understanding Moral Hazard

Moral hazard occurs when one party takes on more risks because they do not bear the full consequences of their actions, often seen in insurance and financial markets. It creates inefficiencies by incentivizing behavior that increases the likelihood or severity of loss, such as excessive risk-taking after obtaining coverage. Understanding moral hazard is crucial for designing contracts, regulatory policies, and insurance premiums that align incentives and minimize reckless behavior.

Key Differences Between Adverse Selection and Moral Hazard

Adverse selection occurs when asymmetric information causes high-risk individuals to self-select into insurance or transactions, leading to an unbalanced risk pool. Moral hazard arises post-contract when insured parties change their behavior, increasing the likelihood or severity of a loss due to the presence of insurance. The key difference lies in timing and information asymmetry: adverse selection happens before contract agreement due to hidden characteristics, while moral hazard occurs after contract formation due to hidden actions.

Real-World Examples of Adverse Selection

Adverse selection occurs when buyers or sellers have asymmetric information before a transaction, leading to high-risk parties being more likely to participate, such as in the health insurance market where individuals with pre-existing conditions are more inclined to purchase coverage. In used car markets, sellers often have better knowledge about vehicle defects, resulting in a higher proportion of low-quality cars being sold, a phenomenon known as the "lemons problem." These scenarios highlight how adverse selection distorts market outcomes by attracting higher-risk participants and driving prices or quality downward.

Real-World Examples of Moral Hazard

Moral hazard occurs when individuals or entities take on greater risks because they do not bear the full consequences of their actions, as seen in the 2008 financial crisis where banks engaged in risky lending practices knowing they were likely to be bailed out. Another example is in the insurance industry, where policyholders might drive recklessly or neglect property maintenance after securing coverage, increasing the likelihood of claims. These behaviors highlight the importance of incentive alignment and monitoring mechanisms to mitigate moral hazard in various sectors.

Economic Impact of Adverse Selection

Adverse selection leads to market inefficiencies by causing high-risk individuals to disproportionately participate in insurance markets, resulting in increased premiums and reduced coverage availability. This economic impact decreases overall market welfare as insurers exit or restrict offerings to avoid losses, ultimately shrinking market size. The distortion in risk pooling undermines the effectiveness of insurance and can trigger market failure, emphasizing the need for mechanisms like screening and signaling to mitigate adverse selection.

Economic Consequences of Moral Hazard

Moral hazard leads to inefficient resource allocation as individuals or firms engage in riskier behavior when protected from the consequences, resulting in higher costs for insurers and increased premiums for all participants in the market. This distortion often causes market failure due to asymmetric information, where the insured party's actions cannot be fully monitored or controlled by the insurer. The economic consequences include reduced overall welfare, greater incidence of fraud or negligent behavior, and the need for complex contract designs or regulatory interventions to mitigate these inefficiencies.

Strategies to Mitigate Adverse Selection and Moral Hazard

Employing thorough screening processes and leveraging detailed applicant data mitigates adverse selection by accurately assessing risk profiles before contract initiation. To counter moral hazard, implementing monitoring systems, performance-based incentives, and contract clauses that align interests reduces the likelihood of opportunistic behavior post-agreement. Combining risk-sharing mechanisms with transparency-enhancing technologies optimizes the mitigation of both adverse selection and moral hazard in insurance and financial markets.

Conclusion: Managing Risks in Financial Contracts

Effective management of risks in financial contracts requires distinguishing between adverse selection, where asymmetric information occurs before contract signing, and moral hazard, which arises from changes in behavior after agreement. Implementing screening mechanisms, such as credit scoring and mandatory disclosures, helps mitigate adverse selection, while ongoing monitoring and incentive alignment through performance-based clauses reduce moral hazard. Combining these strategies enhances contract efficiency and minimizes financial losses for lenders and insurers.

Adverse Selection Infographic

libterm.com

libterm.com