Price elasticity measures how the quantity demanded of a product responds to changes in its price, revealing consumer sensitivity to cost fluctuations. Understanding this concept helps businesses optimize pricing strategies and maximize revenue based on consumer behavior. Explore the full article to learn how price elasticity can impact your market decisions and profitability.

Table of Comparison

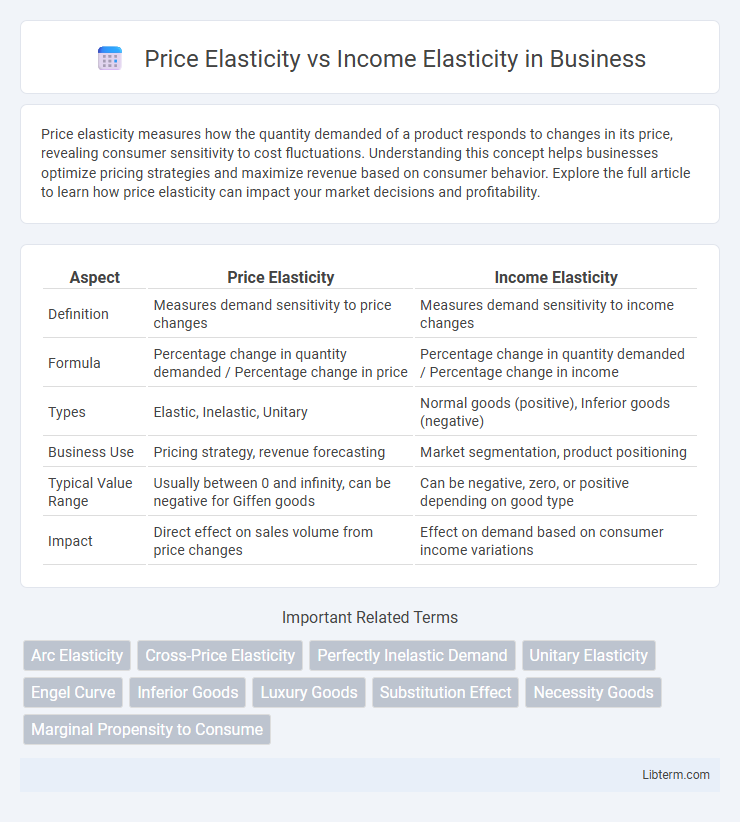

| Aspect | Price Elasticity | Income Elasticity |

|---|---|---|

| Definition | Measures demand sensitivity to price changes | Measures demand sensitivity to income changes |

| Formula | Percentage change in quantity demanded / Percentage change in price | Percentage change in quantity demanded / Percentage change in income |

| Types | Elastic, Inelastic, Unitary | Normal goods (positive), Inferior goods (negative) |

| Business Use | Pricing strategy, revenue forecasting | Market segmentation, product positioning |

| Typical Value Range | Usually between 0 and infinity, can be negative for Giffen goods | Can be negative, zero, or positive depending on good type |

| Impact | Direct effect on sales volume from price changes | Effect on demand based on consumer income variations |

Understanding Price Elasticity: Definition and Importance

Price elasticity measures the responsiveness of quantity demanded to changes in price, reflecting consumer sensitivity and market dynamics. Understanding price elasticity helps businesses optimize pricing strategies, maximize revenue, and forecast demand fluctuations. It plays a crucial role in determining the impact of price changes on sales volumes and overall profitability.

Defining Income Elasticity: What Sets It Apart

Income elasticity measures the responsiveness of demand for a good relative to changes in consumer income, distinguishing it from price elasticity, which focuses on price changes. While price elasticity evaluates how quantity demanded varies with price fluctuations, income elasticity captures how consumer purchasing patterns shift as their income rises or falls. This distinction is crucial for understanding goods as normal, inferior, or luxury based on their income sensitivity.

Key Differences Between Price and Income Elasticity

Price elasticity measures the responsiveness of quantity demanded to changes in the price of a good, typically expressed as a percentage change in quantity over percentage change in price. Income elasticity gauges how quantity demanded varies with consumer income changes, indicating whether a product is normal or inferior based on positive or negative elasticity values. Key differences include the factors influencing demand--price versus income--and the implications for pricing strategy and market analysis, where price elasticity helps optimize pricing and income elasticity aids in forecasting demand shifts due to economic growth or recession.

Factors Influencing Price Elasticity of Demand

Price elasticity of demand is influenced by factors such as the availability of substitutes, the proportion of income spent on the good, and the time period considered for adjustment. Goods with many close substitutes tend to have higher price elasticity, as consumers can easily switch when prices change. Products that constitute a large share of a consumer's budget generally exhibit greater sensitivity to price changes, increasing the elasticity measure.

Determinants Affecting Income Elasticity of Demand

Income elasticity of demand depends primarily on the type of good, consumer income levels, and the proportion of income spent on the good; luxury goods tend to have high positive income elasticity, while necessities exhibit low positive values and inferior goods have negative elasticity. Economic conditions and consumer preferences also influence income elasticity, as shifts in income distribution or cultural trends alter purchasing behavior. Price elasticity is influenced more by substitution effects and availability of alternatives, making income elasticity uniquely sensitive to systemic economic changes affecting consumer income.

Calculating Price Elasticity: Methods and Examples

Price elasticity of demand is calculated by dividing the percentage change in quantity demanded by the percentage change in price, often using the midpoint formula for accuracy. For example, if the price of a product increases from $10 to $12 and the quantity demanded decreases from 100 units to 80 units, the price elasticity of demand is calculated as [(80-100)/((80+100)/2)] / [(12-10)/((12+10)/2)] = -1.25, indicating elastic demand. This method helps businesses and economists understand consumer sensitivity to price changes, informing pricing strategies and market predictions.

Measuring Income Elasticity: Step-by-Step Guide

Measuring income elasticity involves calculating the percentage change in quantity demanded divided by the percentage change in consumer income, reflecting how demand varies with income fluctuations. Begin by identifying the initial and new quantities demanded along with the initial and new income levels, then apply the formula: Income Elasticity of Demand (YED) = (% Change in Quantity Demanded) / (% Change in Income). A YED greater than one indicates a luxury good, less than one signals a necessity, and negative values correspond to inferior goods, facilitating targeted economic and marketing strategies.

Real-World Applications of Price and Income Elasticities

Price elasticity of demand measures consumer sensitivity to price changes, crucial for businesses in setting optimal pricing strategies to maximize revenue or market share. Income elasticity evaluates how demand varies with consumer income fluctuations, helping firms forecast product demand during economic shifts and tailor marketing efforts accordingly. Real-world applications include airlines adjusting fares based on price elasticity and luxury brands targeting advertising based on income elasticity to capture affluent market segments.

Implications for Businesses and Policymakers

Price elasticity measures consumer responsiveness to changes in product price, guiding businesses in pricing strategies to maximize revenue and manage demand fluctuations. Income elasticity reflects how consumer demand varies with income changes, helping policymakers predict consumption patterns during economic growth or recession. Understanding both elasticities enables targeted interventions and strategic decisions, optimizing resource allocation and market outcomes.

Conclusion: Choosing the Right Elasticity Metric

Choosing the right elasticity metric depends on the specific economic analysis goals: price elasticity measures consumer responsiveness to price changes, crucial for pricing strategies and demand forecasting. Income elasticity captures how demand varies with consumer income shifts, essential for understanding market growth during economic fluctuations. Accurately identifying whether price sensitivity or income variation drives demand ensures effective business decisions and policy formulations.

Price Elasticity Infographic

libterm.com

libterm.com