Liabilities represent obligations your business must settle, often involving debts or financial responsibilities owed to others. Proper management of liabilities is crucial to maintain financial stability and ensure long-term growth. Explore the rest of the article to understand how effectively handling liabilities can impact your overall financial health.

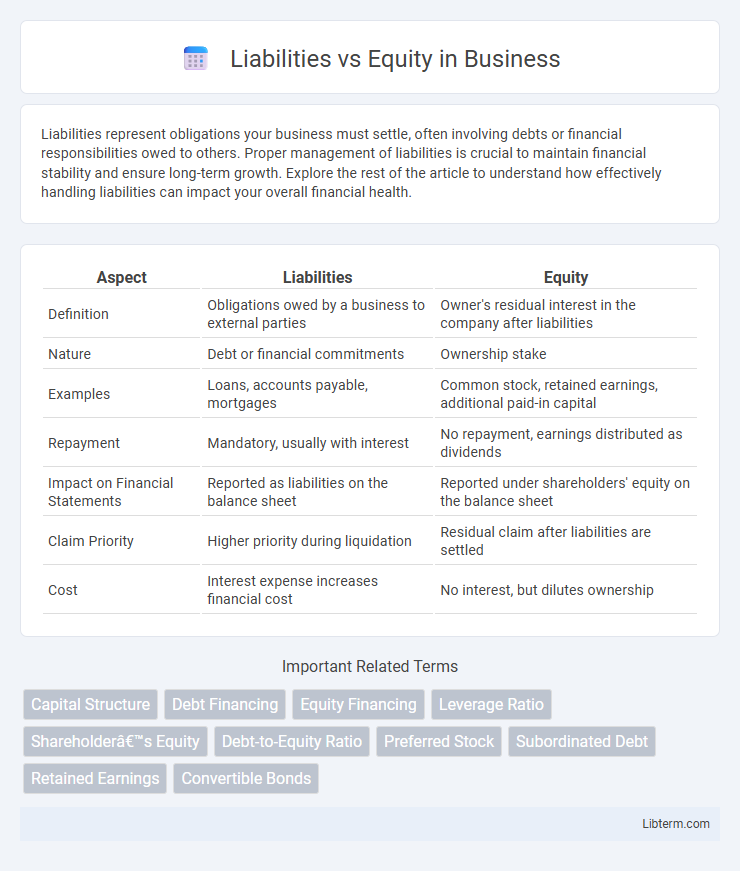

Table of Comparison

| Aspect | Liabilities | Equity |

|---|---|---|

| Definition | Obligations owed by a business to external parties | Owner's residual interest in the company after liabilities |

| Nature | Debt or financial commitments | Ownership stake |

| Examples | Loans, accounts payable, mortgages | Common stock, retained earnings, additional paid-in capital |

| Repayment | Mandatory, usually with interest | No repayment, earnings distributed as dividends |

| Impact on Financial Statements | Reported as liabilities on the balance sheet | Reported under shareholders' equity on the balance sheet |

| Claim Priority | Higher priority during liquidation | Residual claim after liabilities are settled |

| Cost | Interest expense increases financial cost | No interest, but dilutes ownership |

Introduction to Liabilities and Equity

Liabilities represent a company's financial obligations or debts owed to external parties, including loans, accounts payable, and accrued expenses. Equity reflects the owners' residual interest in the company after deducting liabilities, encompassing common stock, retained earnings, and additional paid-in capital. Understanding the balance between liabilities and equity is essential for analyzing a firm's financial stability and capital structure.

Definition of Liabilities

Liabilities represent a company's financial obligations or debts owed to external parties, including loans, accounts payable, and accrued expenses. They are classified as current liabilities, payable within a year, or long-term liabilities, due after one year. Understanding liabilities is crucial for assessing a company's financial health and its ability to meet short-term and long-term obligations.

Definition of Equity

Equity represents the residual interest in the assets of a company after deducting liabilities, reflecting the owners' claim on the business. It includes components such as common stock, retained earnings, and additional paid-in capital, indicating the net worth of the company. Unlike liabilities, which denote obligations to external parties, equity signifies ownership and the value attributable to shareholders.

Key Differences Between Liabilities and Equity

Liabilities represent an organization's financial obligations or debts that must be repaid to creditors, while equity reflects the owners' residual interest in the company's assets after liabilities are settled. Liabilities typically have fixed payment terms and prioritize claims during liquidation, whereas equity involves ownership stakes with variable returns through dividends or capital gains. Understanding the distinction between liabilities and equity is crucial for accurate balance sheet analysis and financial decision-making.

Types of Liabilities

Current liabilities include obligations such as accounts payable, short-term loans, and accrued expenses that must be settled within one year. Long-term liabilities consist of debts like bonds payable and mortgage loans, which extend beyond the 12-month period. Understanding these classifications helps in assessing a company's financial structure and liquidity risk accurately.

Types of Equity

Equity consists primarily of common stock, preferred stock, retained earnings, and additional paid-in capital, each representing different ownership stakes and rights within a company. Common stock grants shareholders voting rights and residual claims on assets, while preferred stock typically provides fixed dividends and priority during liquidation. Retained earnings reflect accumulated profits reinvested into the business, enhancing shareholder value without issuing new shares.

Impact on Financial Statements

Liabilities represent obligations that a company must settle, directly increasing debt on the balance sheet and reducing net income through interest expenses on the income statement. Equity reflects ownership interest, appearing as shareholders' equity on the balance sheet and impacting retained earnings in the statement of changes in equity. The balance between liabilities and equity determines the company's financial leverage, risk profile, and overall capital structure, influencing key financial ratios such as debt-to-equity and return on equity.

Role in Capital Structure

Liabilities represent borrowed funds that require scheduled repayments with interest, directly impacting a company's debt obligations and financial risk in the capital structure. Equity reflects ownership interest, providing residual claims on assets after liabilities are settled, and contributes to financial stability through retained earnings and shareholder investment. Balancing liabilities and equity is crucial for optimizing cost of capital, maintaining creditworthiness, and supporting sustainable growth.

Advantages and Disadvantages

Liabilities provide businesses with immediate funds without diluting ownership, allowing for tax-deductible interest payments but increase financial risk due to mandatory repayment obligations. Equity financing avoids debt pressures and enhances creditworthiness but can dilute control and requires sharing profits with investors. Balancing liabilities and equity is crucial for maintaining optimal capital structure and minimizing overall financing costs.

Liabilities vs Equity: Which is Better for Funding?

Liabilities provide immediate funding through loans or bonds but require fixed repayments and interest, affecting cash flow and increasing financial risk. Equity funding involves selling ownership shares, reducing repayment pressure but diluting control and potentially sharing future profits. Choosing between liabilities and equity depends on a company's risk tolerance, growth prospects, and cost of capital objectives.

Liabilities Infographic

libterm.com

libterm.com