Operational efficiency enhances your business by minimizing waste and maximizing productivity through streamlined processes and resource management. Implementing proven strategies like automation, process optimization, and continuous improvement lowers costs and boosts overall performance. Explore the rest of the article to discover actionable steps to elevate your operational efficiency.

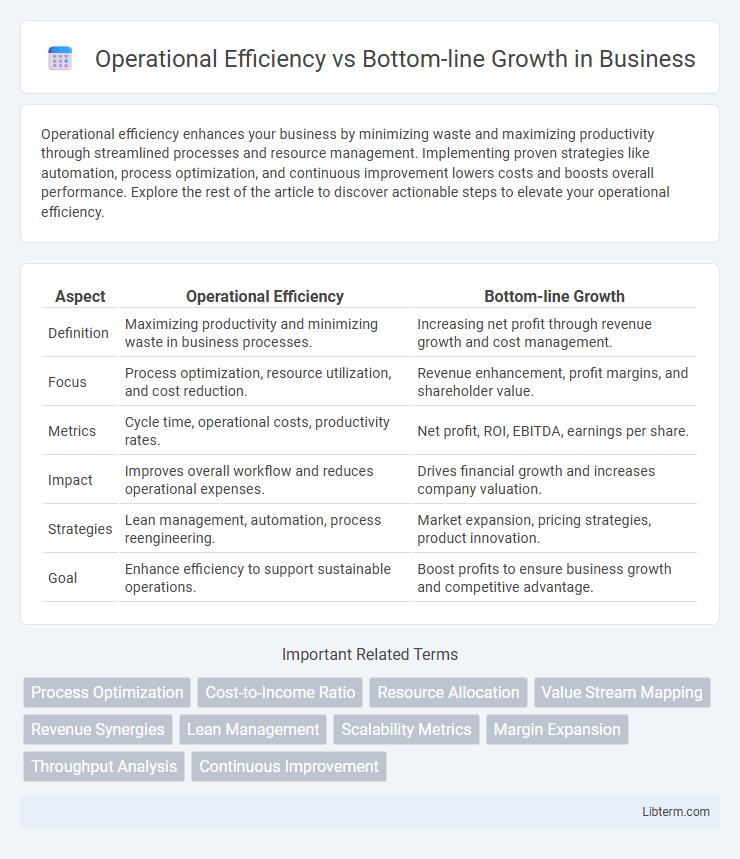

Table of Comparison

| Aspect | Operational Efficiency | Bottom-line Growth |

|---|---|---|

| Definition | Maximizing productivity and minimizing waste in business processes. | Increasing net profit through revenue growth and cost management. |

| Focus | Process optimization, resource utilization, and cost reduction. | Revenue enhancement, profit margins, and shareholder value. |

| Metrics | Cycle time, operational costs, productivity rates. | Net profit, ROI, EBITDA, earnings per share. |

| Impact | Improves overall workflow and reduces operational expenses. | Drives financial growth and increases company valuation. |

| Strategies | Lean management, automation, process reengineering. | Market expansion, pricing strategies, product innovation. |

| Goal | Enhance efficiency to support sustainable operations. | Boost profits to ensure business growth and competitive advantage. |

Defining Operational Efficiency and Bottom-line Growth

Operational efficiency measures how well an organization utilizes its resources to maximize output while minimizing waste and costs, often evaluated through metrics like throughput rates, cycle times, and cost per unit. Bottom-line growth refers to the increase in net profit on a company's income statement, reflecting revenue growth, cost reductions, and improved profit margins. Understanding the distinction between these concepts helps businesses align process improvements with financial performance objectives to drive sustainable growth.

Key Differences Between Operational Efficiency and Bottom-line Growth

Operational efficiency focuses on optimizing business processes, reducing waste, and improving productivity to minimize costs and enhance resource utilization. Bottom-line growth targets increasing net profit by expanding revenue streams, increasing sales, and improving profit margins. While operational efficiency emphasizes cost control and process improvements, bottom-line growth prioritizes financial outcomes and business expansion strategies.

The Role of Cost Management in Operational Efficiency

Cost management plays a crucial role in operational efficiency by systematically controlling and reducing expenses, which directly impacts a company's ability to streamline processes and optimize resource allocation. Effective cost management enables businesses to minimize waste, improve productivity, and maintain consistent quality, thereby enhancing operational workflows and reducing overheads. This improved operational efficiency contributes to stronger bottom-line growth by increasing profit margins without necessarily raising revenue.

Strategies to Improve Operational Efficiency

Strategies to improve operational efficiency include implementing automation technologies to streamline processes and reduce human error, adopting lean management principles to eliminate waste, and enhancing supply chain coordination for faster turnaround times. Investing in employee training and performance analytics also drives productivity gains by identifying bottlenecks and enabling data-driven decision-making. These targeted actions contribute to optimized resource utilization, directly impacting cost reduction and sustainable bottom-line growth.

Impact of Operational Efficiency on Bottom-line Performance

Operational efficiency directly influences bottom-line growth by reducing operational costs through streamlined processes and resource optimization. Enhanced efficiency minimizes waste and improves productivity, leading to higher profit margins and increased net income. Companies that prioritize operational efficiency can achieve sustainable bottom-line performance improvements while maintaining competitive market positioning.

Revenue Enhancement Versus Cost Reduction Approaches

Operational efficiency targets cost reduction by streamlining processes and minimizing waste, directly lowering expenses to improve profit margins. Revenue enhancement approaches focus on top-line growth through expanding sales, entering new markets, or innovating products and services to increase income streams. Balancing cost control with strategic revenue initiatives drives sustainable bottom-line growth in competitive markets.

Common Metrics for Measuring Efficiency and Profitability

Operational efficiency is commonly measured using metrics such as cycle time, throughput, and resource utilization rate, reflecting how well an organization uses its assets and processes. Bottom-line growth focuses on profitability indicators like net profit margin, return on investment (ROI), and earnings before interest and taxes (EBIT), highlighting financial performance and value creation. Together, these metrics provide a comprehensive view of balancing efficient operations with sustainable profit growth.

Aligning Operational Goals with Financial Objectives

Aligning operational goals with financial objectives drives both operational efficiency and bottom-line growth by ensuring resource allocation directly impacts profitability. Integrating key performance indicators (KPIs) such as cost per unit and return on investment (ROI) streamlines processes while maximizing financial returns. Clear communication between departments fosters collaboration, enabling data-driven decisions that enhance productivity and revenue simultaneously.

Challenges in Balancing Efficiency and Growth Initiatives

Balancing operational efficiency and bottom-line growth presents significant challenges as optimizing processes often demands cost-cutting, which can stifle innovation and limit investments in growth initiatives. Organizations struggle to allocate resources effectively between streamlining operations and funding market expansion or product development, risking either operational bottlenecks or missed revenue opportunities. Achieving equilibrium requires data-driven strategies and agile management to synchronize efficiency improvements with scalable growth efforts.

Case Studies: Success Stories of Operational and Financial Alignment

Case studies from leading companies like Toyota and Amazon demonstrate how aligning operational efficiency with bottom-line growth drives exceptional financial results and sustainable scalability. Toyota's implementation of lean manufacturing principles reduced waste and increased productivity, directly boosting profit margins and shareholder value. Amazon's investment in supply chain optimization and automation not only lowered operational costs but also enhanced customer satisfaction and revenue growth.

Operational Efficiency Infographic

libterm.com

libterm.com