Certificates of Deposit (CDs) offer a secure way to grow your savings with fixed interest rates over a specified term, ensuring predictable returns. They are ideal for risk-averse investors looking to diversify their portfolio with low-risk financial instruments. Explore the rest of the article to understand how CDs can fit into your financial strategy and maximize your earnings.

Table of Comparison

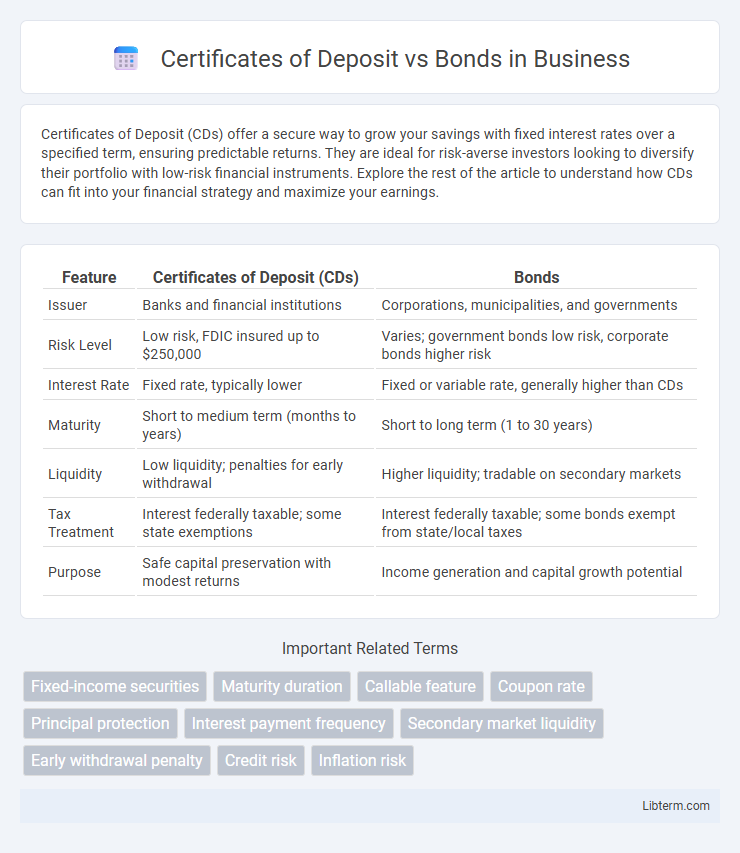

| Feature | Certificates of Deposit (CDs) | Bonds |

|---|---|---|

| Issuer | Banks and financial institutions | Corporations, municipalities, and governments |

| Risk Level | Low risk, FDIC insured up to $250,000 | Varies; government bonds low risk, corporate bonds higher risk |

| Interest Rate | Fixed rate, typically lower | Fixed or variable rate, generally higher than CDs |

| Maturity | Short to medium term (months to years) | Short to long term (1 to 30 years) |

| Liquidity | Low liquidity; penalties for early withdrawal | Higher liquidity; tradable on secondary markets |

| Tax Treatment | Interest federally taxable; some state exemptions | Interest federally taxable; some bonds exempt from state/local taxes |

| Purpose | Safe capital preservation with modest returns | Income generation and capital growth potential |

Introduction to Certificates of Deposit and Bonds

Certificates of Deposit (CDs) are time-bound deposit accounts offered by banks that provide a fixed interest rate over a specified term, typically ranging from a few months to several years. Bonds are debt securities issued by corporations, municipalities, or governments, which pay periodic interest and return the principal at maturity, serving as a tool for long-term investment and capital raising. Both instruments differ in liquidity, risk, and return profiles, making them suitable for diverse investment strategies.

Key Differences Between CDs and Bonds

Certificates of Deposit (CDs) offer fixed interest rates with guaranteed returns over a set term, typically insured by the FDIC up to $250,000, making them low-risk investments, while bonds vary widely in risk, maturity, and yield depending on the issuer, including government or corporate entities. CDs usually have shorter maturities ranging from a few months to several years, whereas bonds can have maturities spanning from one year to 30 years or more, affecting liquidity and potential returns. Interest payments on bonds often occur semi-annually, offering periodic income, whereas CDs pay interest at maturity or periodically depending on the product structure.

How Certificates of Deposit Work

Certificates of Deposit (CDs) are time-bound deposits offered by banks with a fixed interest rate, where investors commit their funds for a specified term ranging from a few months to several years, receiving interest payments upon maturity. Unlike bonds, which can be traded in the secondary market, CDs typically cannot be sold before maturity without incurring penalties, making them less liquid but safer due to federal insurance (FDIC) up to $250,000. The predictable returns and fixed timeline of CDs provide a low-risk investment option ideal for conservative investors seeking guaranteed income.

How Bonds Function in the Financial Market

Bonds function in the financial market as debt securities issued by corporations, municipalities, or governments to raise capital, with investors receiving periodic interest payments known as coupons until maturity. Unlike Certificates of Deposit (CDs), which are time deposits with banks offering fixed interest rates and federal insurance, bonds trade on secondary markets providing liquidity and price fluctuations based on interest rates, credit risk, and market demand. This dynamic allows investors to potentially earn higher returns though with greater risk compared to the stability of CDs.

Risk Factors: CDs vs. Bonds

Certificates of Deposit (CDs) offer lower risk due to FDIC insurance up to $250,000, providing principal protection and fixed interest rates. Bonds carry varying risk levels depending on issuer credit rating, with government bonds being safer than corporate bonds, but they remain subject to market volatility and interest rate fluctuations. Both investment options differ significantly in liquidity and interest rate risk, influencing their suitability for conservative or risk-tolerant investors.

Returns and Yield Comparison

Certificates of Deposit (CDs) typically offer fixed interest rates with lower yields compared to bonds, providing predictable but modest returns over short to medium terms. Bonds, especially corporate and government types, often deliver higher yields influenced by market conditions, credit risk, and maturity duration, which can result in varying returns. Investors seeking stable, guaranteed income may prefer CDs, while those willing to accept greater risk for potentially higher yields often choose bonds.

Liquidity and Accessibility

Certificates of Deposit (CDs) typically offer lower liquidity compared to bonds, as funds are locked in for a fixed term with penalties for early withdrawal. Bonds, especially those traded on secondary markets, provide greater accessibility and liquidity, allowing investors to buy or sell before maturity without significant loss of value. Investors seeking flexible access to capital often prefer bonds, while CDs suit those aiming for guaranteed returns with less concern about immediate access.

Tax Implications for Investors

Certificates of Deposit (CDs) generate interest income taxed as ordinary income at federal and state levels, potentially increasing an investor's tax liability. Bonds may produce taxable interest income, but certain types like municipal bonds offer tax-exempt interest, reducing overall tax burden for investors in higher tax brackets. Evaluating the tax treatment of returns is crucial when choosing between CDs and bonds to maximize after-tax investment gains.

Suitability for Different Investment Goals

Certificates of Deposit (CDs) are ideal for conservative investors seeking low-risk, fixed returns over a short to medium term, typically offering guaranteed principal protection and predictable interest rates. Bonds, suitable for investors aiming for higher income potential and willing to accept moderate risk, provide opportunities for capital appreciation and varying maturities across government, municipal, and corporate issuers. Matching investment goals with the risk tolerance and liquidity needs of CDs versus bonds ensures optimized portfolio diversification and financial planning.

Deciding Between CDs and Bonds: Which Is Right for You?

Certificates of Deposit (CDs) offer fixed interest rates with low risk and guaranteed returns, making them ideal for conservative investors seeking short- to medium-term savings options. Bonds provide potentially higher yields and diversification benefits but come with varying risk levels tied to issuer creditworthiness and market fluctuations. Evaluating your investment horizon, risk tolerance, and liquidity needs is essential for choosing between the stability of CDs and the growth potential of bonds.

Certificates of Deposit Infographic

libterm.com

libterm.com