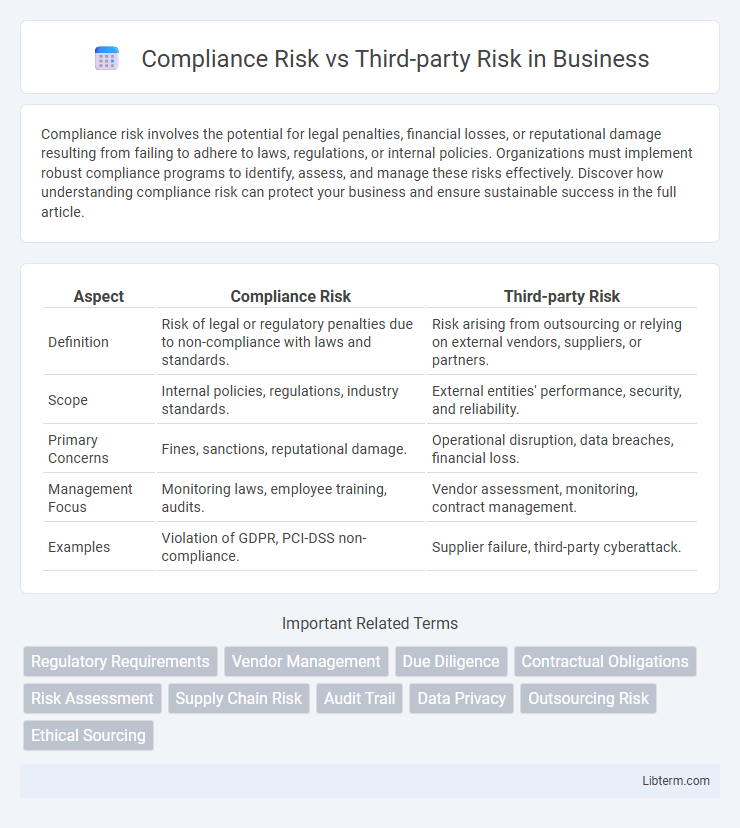

Compliance risk involves the potential for legal penalties, financial losses, or reputational damage resulting from failing to adhere to laws, regulations, or internal policies. Organizations must implement robust compliance programs to identify, assess, and manage these risks effectively. Discover how understanding compliance risk can protect your business and ensure sustainable success in the full article.

Table of Comparison

| Aspect | Compliance Risk | Third-party Risk |

|---|---|---|

| Definition | Risk of legal or regulatory penalties due to non-compliance with laws and standards. | Risk arising from outsourcing or relying on external vendors, suppliers, or partners. |

| Scope | Internal policies, regulations, industry standards. | External entities' performance, security, and reliability. |

| Primary Concerns | Fines, sanctions, reputational damage. | Operational disruption, data breaches, financial loss. |

| Management Focus | Monitoring laws, employee training, audits. | Vendor assessment, monitoring, contract management. |

| Examples | Violation of GDPR, PCI-DSS non-compliance. | Supplier failure, third-party cyberattack. |

Understanding Compliance Risk

Understanding compliance risk involves recognizing the potential for legal penalties, financial forfeiture, and reputational damage due to violations of laws, regulations, or internal policies. It requires continuous monitoring of evolving regulatory requirements and implementing effective controls to ensure adherence across all organizational functions. Managing compliance risk proactively reduces exposure to audits, fines, and operational disruptions, safeguarding the company's integrity and stakeholder trust.

Defining Third-party Risk

Third-party risk refers to the potential threats and vulnerabilities a company faces when engaging with external vendors, suppliers, or partners that can impact data security, operational continuity, and regulatory compliance. This type of risk encompasses issues such as data breaches, financial instability, and non-compliance with laws like GDPR or HIPAA by third-party entities. Identifying and managing third-party risk is crucial for minimizing exposure to compliance violations and safeguarding organizational assets.

Key Differences Between Compliance and Third-party Risks

Compliance risk involves potential legal or regulatory penalties due to failure to adhere to laws, standards, and internal policies, while third-party risk focuses on vulnerabilities arising from external vendors, suppliers, or partners. Compliance risks are typically internal and control-focused, requiring ongoing monitoring of policy adherence and regulatory updates. Third-party risks demand rigorous vendor assessments, contract management, and continuous oversight to mitigate supply chain or service delivery disruptions.

Common Sources of Compliance Risk

Common sources of compliance risk include regulatory changes, inadequate internal controls, and employee non-compliance with established policies. Third-party risk often arises from vendors, suppliers, or contractors who fail to meet regulatory standards or cause data breaches. Both risks demand thorough due diligence and continuous monitoring to mitigate legal penalties and reputational damage.

Typical Third-party Risk Scenarios

Typical third-party risk scenarios include vendor data breaches, regulatory non-compliance by suppliers, and disruptions in supply chain operations. These risks can lead to significant compliance violations, financial penalties, and reputational damage for organizations relying heavily on third-party services. Effective third-party risk management involves continuous monitoring, due diligence, and contractual safeguards to mitigate potential compliance risks originating from external partners.

Impact of Compliance Failures

Compliance failures can lead to significant financial penalties, legal actions, and reputational damage, negatively affecting stakeholder trust and business continuity. Third-party risk amplifies these consequences as external vendors' non-compliance can expose organizations to regulatory violations and operational disruptions. Integrating robust compliance management with third-party risk assessments mitigates the overall impact on organizational resilience and regulatory adherence.

Consequences of Third-party Risk Events

Third-party risk events can lead to severe compliance breaches, resulting in regulatory fines, legal penalties, and reputational damage for organizations. Failure to monitor vendors and suppliers effectively increases vulnerabilities to data breaches, operational disruptions, and fraud. Mitigating third-party risk is critical to maintaining regulatory compliance and protecting business continuity.

Integrating Compliance and Third-party Risk Management

Integrating compliance risk and third-party risk management enhances organizational resilience by creating a unified framework that addresses regulatory requirements and vendor-related vulnerabilities simultaneously. Leveraging advanced analytics and automated monitoring tools enables continuous assessment of third-party compliance, reducing operational disruptions and reputational damage. This holistic approach ensures comprehensive risk mitigation, aligns with industry standards such as ISO 31000, and supports strategic decision-making across procurement and legal teams.

Best Practices for Mitigating Compliance and Third-party Risks

Implementing comprehensive due diligence processes and continuous monitoring of third-party vendors enhances compliance risk management by ensuring adherence to regulatory requirements. Establishing clear contractual obligations and regularly updating risk assessments mitigates potential breaches and operational disruptions associated with third-party relationships. Leveraging automated compliance tools and fostering cross-functional collaboration strengthens overall risk governance and resilience.

Future Trends in Risk Management

Future trends in compliance risk management emphasize the integration of AI-driven analytics to detect regulatory breaches proactively, enhancing real-time monitoring capabilities. Third-party risk management is evolving with blockchain technology to ensure transparent and immutable audit trails, fostering trust and accountability across supply chains. Increasing regulatory complexity and digital transformation demand a unified risk management framework combining compliance and third-party risks for holistic enterprise risk mitigation.

Compliance Risk Infographic

libterm.com

libterm.com