A well-designed bonus structure can motivate employees, boost productivity, and align individual goals with company objectives. By clearly defining performance metrics and reward tiers, organizations create transparency and drive sustained engagement. Explore the rest of the article to discover how the right bonus plan can enhance your business success.

Table of Comparison

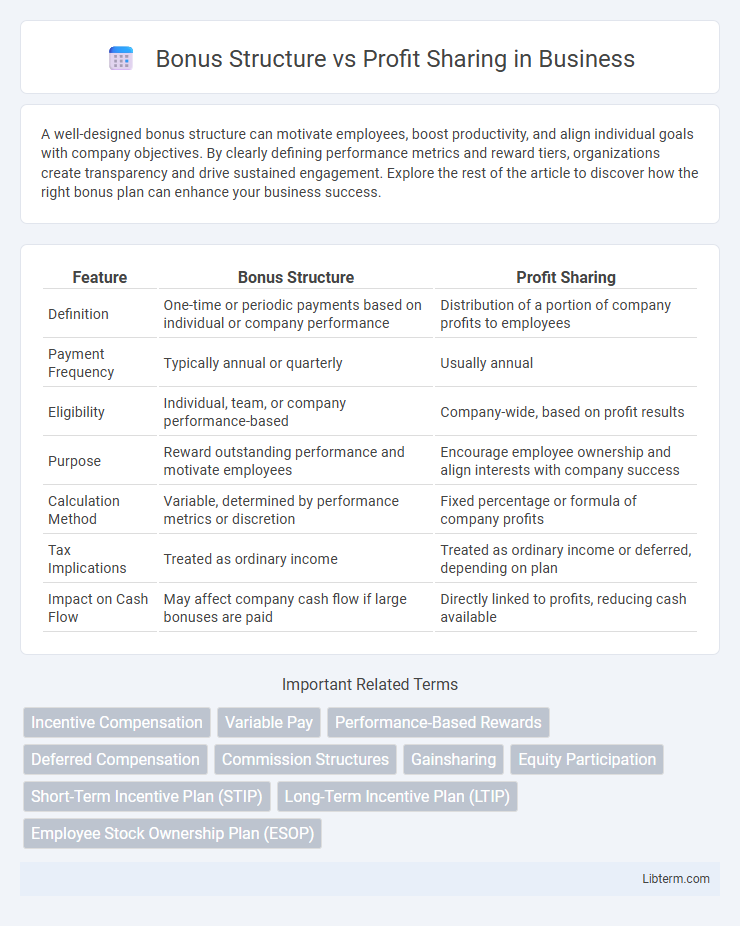

| Feature | Bonus Structure | Profit Sharing |

|---|---|---|

| Definition | One-time or periodic payments based on individual or company performance | Distribution of a portion of company profits to employees |

| Payment Frequency | Typically annual or quarterly | Usually annual |

| Eligibility | Individual, team, or company performance-based | Company-wide, based on profit results |

| Purpose | Reward outstanding performance and motivate employees | Encourage employee ownership and align interests with company success |

| Calculation Method | Variable, determined by performance metrics or discretion | Fixed percentage or formula of company profits |

| Tax Implications | Treated as ordinary income | Treated as ordinary income or deferred, depending on plan |

| Impact on Cash Flow | May affect company cash flow if large bonuses are paid | Directly linked to profits, reducing cash available |

Understanding Bonus Structures

Bonus structures are designed to provide employees with additional financial compensation based on individual, team, or company performance metrics such as sales targets, project completion, or annual goals. Understanding bonus structures involves recognizing the specific criteria, payout frequency, and calculation methods, which often include fixed amounts, percentages of salary, or variable rates tied to performance outcomes. Clarity in these components helps align employee incentives with organizational objectives and improves motivation and retention.

Defining Profit Sharing Plans

Profit sharing plans are incentive programs where employees receive a portion of the company's profits, aligning their interests with long-term business success. Unlike traditional bonus structures that offer fixed or performance-based payouts, profit sharing distributes earnings based on overall profitability, fostering collective motivation. These plans can be structured as cash bonuses or contributions to retirement accounts, enhancing employee engagement and retention.

Key Differences Between Bonus and Profit Sharing

Bonus structure typically involves a predetermined or discretionary payment based on individual or company performance, awarded at specific intervals such as quarterly or annually. Profit sharing distributes a portion of the company's profits to employees, aligning their interests with overall business success, and is often calculated as a percentage of net profits. Key differences include the basis of calculation--bonus depends on performance metrics while profit sharing depends directly on company profitability--and the impact on employee motivation, with profit sharing fostering long-term commitment.

Pros and Cons of Bonus Structures

Bonus structures provide employees with immediate financial rewards tied to individual or team performance, fostering motivation and clear goal alignment. However, they can create short-term focus, potentially discouraging collaboration and risking perceived unfairness if metrics are not transparent or equitable. While bonuses increase engagement during peak performance periods, they may also lead to stress or unhealthy competition among employees.

Advantages and Disadvantages of Profit Sharing

Profit sharing aligns employee interests with company performance by distributing a portion of profits, fostering motivation and collaboration while improving retention rates. However, profit sharing can create uncertainty due to fluctuations in company earnings, leading to inconsistent income and potential dissatisfaction among employees. This system may also dilute the focus on individual performance, as rewards are tied to overall profitability rather than personal contributions.

Impact on Employee Motivation

Bonus structures provide immediate, performance-based financial rewards that directly incentivize employees to achieve short-term goals, significantly boosting motivation and productivity. Profit sharing aligns employee interests with company profitability, fostering long-term commitment and a sense of ownership, which enhances loyalty and collaborative effort. Combining both methods can create a balanced motivational environment, addressing both short-term performance and sustained organizational growth.

Tax Implications for Employers and Employees

Bonus structures typically result in immediate taxable income for employees and are subject to payroll taxes for employers, increasing the overall tax burden. Profit sharing plans often provide tax deferral benefits, allowing employees to postpone taxation until distributions are taken, which can reduce the employer's current payroll tax liabilities. Employers must carefully evaluate the timing and tax treatment of each compensation method to optimize financial outcomes and compliance.

Aligning Incentives with Company Goals

Bonus structures provide employees with short-term rewards based on individual or team performance metrics, enhancing motivation to meet specific company targets. Profit sharing distributes a portion of company profits among employees, fostering a sense of ownership and aligning long-term interests with sustainable business growth. Both methods aim to synchronize employee efforts with organizational objectives but differ in timing and scope of incentive delivery.

Industry Trends: Bonus vs Profit Sharing

Industry trends reveal a growing preference for profit sharing over traditional bonus structures as companies seek to foster long-term employee engagement and align workforce incentives with corporate performance. Data from the WorldatWork 2023 survey indicates that 45% of organizations now incorporate profit sharing plans, highlighting a shift from one-time bonuses, which remain prevalent in 55% of firms but are often criticized for short-term motivation. Profit sharing programs in sectors like technology and manufacturing have demonstrated enhanced employee retention and productivity by linking compensation directly to company profitability.

Choosing the Right Incentive Plan for Your Business

Choosing the right incentive plan for your business depends on aligning employee motivation with company goals; bonus structures provide fixed rewards based on individual or team performance metrics, promoting short-term productivity. Profit sharing distributes a portion of company earnings to employees, fostering a sense of ownership and long-term commitment by directly linking compensation to overall business success. Evaluating factors such as company profitability, employee roles, and desired behavioral outcomes ensures the selected plan maximizes motivation and organizational growth.

Bonus Structure Infographic

libterm.com

libterm.com