Competitive analysis identifies strengths and weaknesses of your market rivals to uncover opportunities for growth. By examining competitors' strategies, products, and customer feedback, you can refine your business approach and gain a competitive edge. Explore the rest of the article to learn how to conduct a thorough competitive analysis effectively.

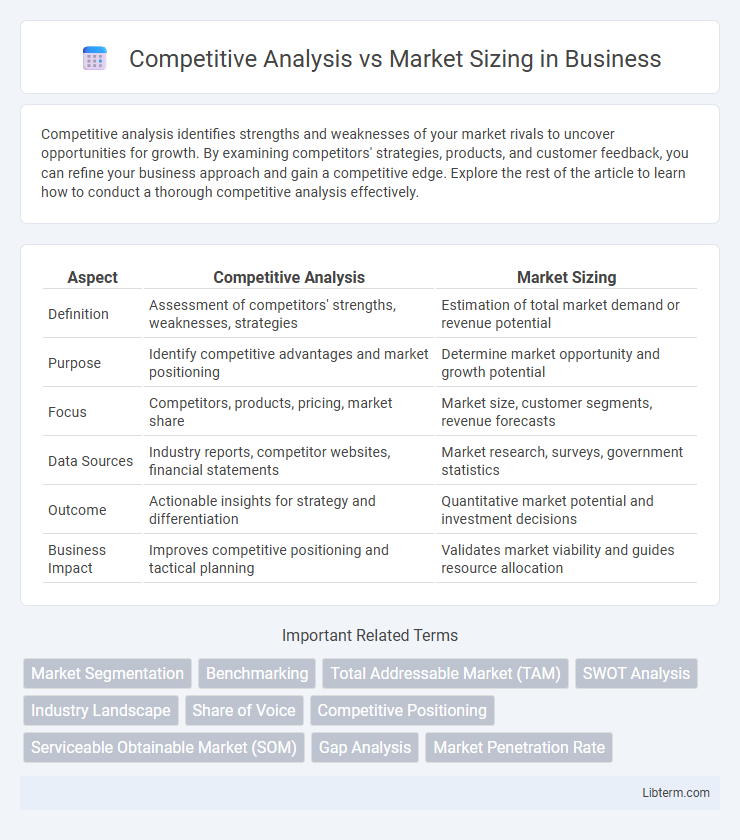

Table of Comparison

| Aspect | Competitive Analysis | Market Sizing |

|---|---|---|

| Definition | Assessment of competitors' strengths, weaknesses, strategies | Estimation of total market demand or revenue potential |

| Purpose | Identify competitive advantages and market positioning | Determine market opportunity and growth potential |

| Focus | Competitors, products, pricing, market share | Market size, customer segments, revenue forecasts |

| Data Sources | Industry reports, competitor websites, financial statements | Market research, surveys, government statistics |

| Outcome | Actionable insights for strategy and differentiation | Quantitative market potential and investment decisions |

| Business Impact | Improves competitive positioning and tactical planning | Validates market viability and guides resource allocation |

Introduction to Competitive Analysis and Market Sizing

Competitive analysis involves identifying key competitors, assessing their strengths and weaknesses, and understanding market positioning to inform strategic decisions. Market sizing estimates the potential market demand for a product or service by calculating the total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM). Both methods provide critical insights for business planning, with competitive analysis focusing on rival dynamics and market sizing quantifying opportunity scope.

Defining Competitive Analysis

Competitive analysis involves systematically evaluating rival companies' strengths, weaknesses, product offerings, market positioning, and customer base to gain actionable insights for strategic decision-making. It focuses on identifying competitive advantages, understanding market dynamics, and anticipating competitor moves to optimize business performance. This process uses tools like SWOT analysis, Porter's Five Forces, and benchmarking to create a detailed landscape of the competitive environment.

Understanding Market Sizing

Market sizing estimates the total revenue opportunity within a specific industry or segment, quantifying potential customer demand and market capacity. It involves analyzing factors such as target demographics, purchasing behavior, geographic reach, and industry trends to determine market volume and value. Understanding market sizing helps businesses prioritize investments, forecast growth, and develop strategic plans based on comprehensive demand-driven metrics.

Key Objectives: Competitive Analysis vs Market Sizing

Competitive analysis aims to evaluate the strengths, weaknesses, strategies, and market positioning of current and potential competitors to identify opportunities for differentiation and risk mitigation. Market sizing focuses on quantifying the total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM) to estimate revenue potential and guide investment decisions. Both approaches provide critical insights, with competitive analysis emphasizing external competitive dynamics and market sizing concentrating on market demand and growth potential.

Methodologies Used in Competitive Analysis

Competitive analysis employs methodologies such as SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis, Porter's Five Forces framework, and benchmarking to evaluate competitors' positions and strategic advantages. Data collection techniques include market share assessment, product feature comparison, pricing strategies, and customer feedback analysis to identify competitive gaps. These methods enable firms to anticipate competitor moves, optimize positioning, and improve decision-making in dynamic markets.

Approaches to Accurate Market Sizing

Accurate market sizing relies on top-down and bottom-up approaches to quantify market potential, utilizing primary research, industry reports, and financial data for precision. Competitive analysis complements this by identifying market share distribution, competitor strengths, and gaps, enabling refined estimates of total addressable and serviceable markets. Combining demographic trends, sales channels, and competitor positioning enhances the reliability of market sizing in strategic business planning.

Data Sources: Competitive Analysis vs Market Sizing

Competitive analysis relies heavily on data from company financial reports, industry benchmarks, customer reviews, and direct competitor intelligence to evaluate market position and strategy. Market sizing predominantly utilizes data from government statistics, industry market reports, economic databases, and consumer surveys to estimate total market potential and demand. Integrating these distinct data sources enhances strategic decision-making by aligning competitive insights with overall market opportunities.

Common Challenges and Pitfalls

Competitive analysis and market sizing both face challenges such as data reliability and accuracy, making it difficult to draw precise conclusions about market dynamics or competitor capabilities. Overlooking niche competitors or emerging trends during competitive analysis can lead to missed opportunities, while market sizing often struggles with defining exact market boundaries and projecting future growth accurately. Both processes are prone to biases in data interpretation and require rigorous validation to avoid strategic missteps.

Strategic Importance for Business Growth

Competitive analysis identifies key industry players, their strengths and weaknesses, enabling businesses to anticipate market moves and refine strategic positioning. Market sizing quantifies total addressable market value and growth potential, guiding resource allocation and investment decisions for scalable expansion. Integrating both analyses supports informed strategy formulation, fostering sustainable business growth and competitive advantage.

Choosing the Right Approach for Your Business

Competitive analysis evaluates direct competitors' strengths, weaknesses, and market positioning to inform strategic decisions and identify opportunities for differentiation. Market sizing estimates the total potential demand within a target market, helping businesses forecast sales and allocate resources effectively. Choosing the right approach depends on whether your priority is understanding competitive dynamics or assessing market potential for growth planning.

Competitive Analysis Infographic

libterm.com

libterm.com