Income plays a crucial role in determining your financial stability and ability to meet daily expenses, invest, and save for the future. Understanding different sources of income, such as salaries, investments, and passive earnings, helps you plan more effectively and maximize wealth. Explore the full article to learn strategies for increasing your income and managing it wisely.

Table of Comparison

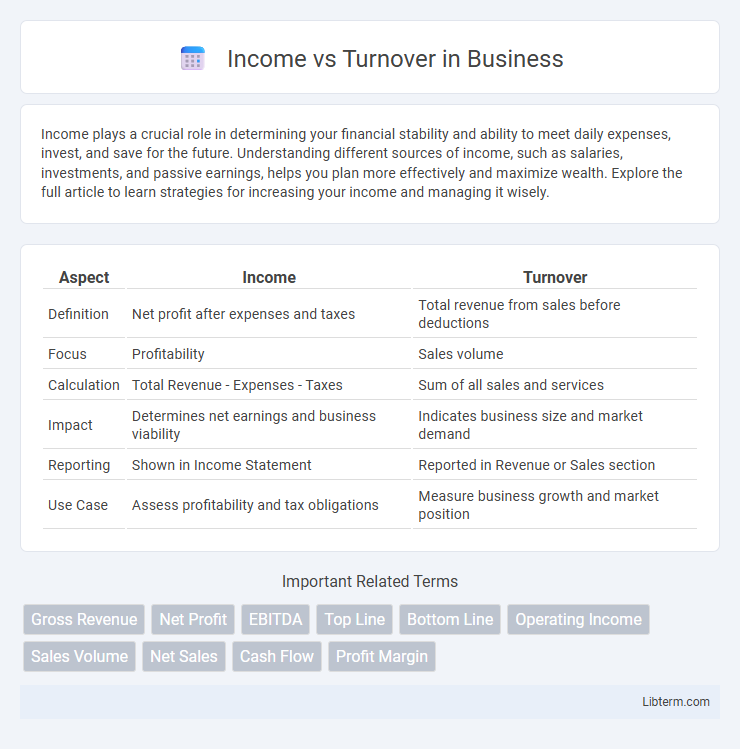

| Aspect | Income | Turnover |

|---|---|---|

| Definition | Net profit after expenses and taxes | Total revenue from sales before deductions |

| Focus | Profitability | Sales volume |

| Calculation | Total Revenue - Expenses - Taxes | Sum of all sales and services |

| Impact | Determines net earnings and business viability | Indicates business size and market demand |

| Reporting | Shown in Income Statement | Reported in Revenue or Sales section |

| Use Case | Assess profitability and tax obligations | Measure business growth and market position |

Defining Income and Turnover

Income refers to the total earnings or profit generated by a business after deducting all expenses, taxes, and costs within a specific period. Turnover, also known as revenue, represents the total value of sales or services provided by a company before any deductions. Understanding the distinction between income and turnover is crucial for accurate financial analysis and business performance assessment.

Key Differences Between Income and Turnover

Income represents the net profit earned by a business after deducting all expenses from total revenue, while turnover refers to the total sales or revenue generated within a specific period. Income indicates the company's profitability, whereas turnover measures the scale of operations or business activity. Understanding the distinction is crucial for financial analysis, with turnover providing insight into sales performance and income reflecting actual financial health.

Importance of Understanding Financial Terms

Understanding the distinction between income and turnover is crucial for accurate financial analysis and decision-making in business. Turnover represents the total revenue generated from sales before any expenses, while income reflects the net profit after deducting costs, taxes, and other expenditures. Clear comprehension of these financial terms enables stakeholders to assess company performance, manage cash flow effectively, and strategize for sustainable growth.

How Turnover is Calculated

Turnover is calculated by summing the total sales or revenue generated by a company within a specific period before any expenses are deducted. It represents the gross inflow of economic benefits from the ordinary activities of a business. Understanding turnover involves analyzing invoices, sales receipts, and contracts to accurately capture all trading income.

Methods for Measuring Income

Income measurement methods include cash accounting, which records revenue when cash is received, and accrual accounting, recognizing income when earned regardless of cash flow. Percentage-of-completion and completed-contract methods are common in project-based industries for matching income with project progress. Accurate income measurement ensures compliance with accounting standards such as GAAP or IFRS and supports reliable financial analysis compared to turnover, which reflects total sales volume without expense deductions.

Impact of Turnover on Business Health

Turnover, representing the total sales revenue within a specific period, directly impacts business health by influencing cash flow and operational capacity. High turnover can indicate strong market demand and business growth potential, but without corresponding income (net profit), it may mask underlying issues such as high costs or inefficient operations. Monitoring turnover alongside profit margins is essential to assess sustainable financial performance and make informed strategic decisions.

Income as an Indicator of Profitability

Income, often referred to as net income or profit, provides a clearer measure of profitability by reflecting the company's earnings after all expenses, taxes, and costs have been deducted from turnover. Unlike turnover, which represents total sales revenue without accounting for operational costs, income highlights the efficiency of business operations and cost management. Monitoring income allows investors and management to assess true financial performance and make informed decisions regarding business growth and sustainability.

Common Confusions: Income vs Turnover

Income often refers to net earnings after expenses and taxes, whereas turnover denotes the total revenue generated from sales or services before any deductions. A common confusion arises when businesses or individuals equate turnover with income, overlooking that turnover represents gross figures while income indicates profitability. Clarifying this distinction is crucial for accurate financial analysis and reporting.

Relevance of Income and Turnover in Financial Reporting

Income and turnover are critical metrics in financial reporting, serving distinct yet complementary roles. Turnover, representing total sales or revenues generated by a company within a period, offers insight into business scale and market demand. Income, often referring to net profit, reflects the company's ability to manage expenses and generate earnings, providing a clearer picture of financial health and operational efficiency.

Choosing the Right Metric: Income or Turnover?

Choosing the right metric between income and turnover depends on the specific financial insight you seek; income measures net profitability by accounting for expenses, while turnover represents total sales or revenue generated within a period. Turnover provides a broad view of business volume and market demand, making it ideal for assessing operational scale and growth potential. Income, reflecting profitability, is crucial for evaluating financial health, efficiency, and long-term sustainability of a company.

Income Infographic

libterm.com

libterm.com