Operational risk involves the potential for loss resulting from inadequate or failed internal processes, people, systems, or external events. Managing this risk is crucial for maintaining business continuity and protecting your organization's assets and reputation. Explore the rest of the article to learn effective strategies for identifying and mitigating operational risk.

Table of Comparison

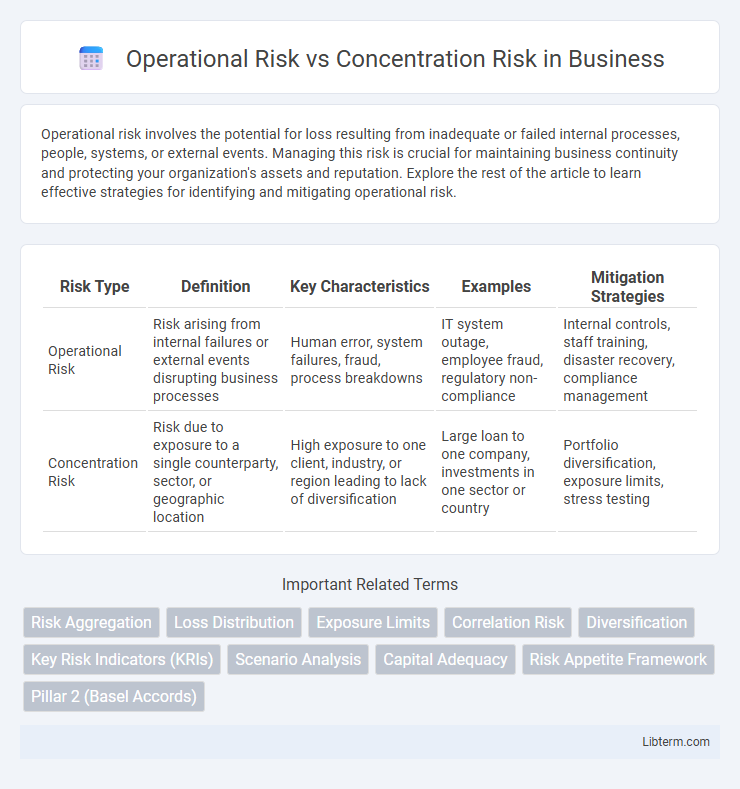

| Risk Type | Definition | Key Characteristics | Examples | Mitigation Strategies |

|---|---|---|---|---|

| Operational Risk | Risk arising from internal failures or external events disrupting business processes | Human error, system failures, fraud, process breakdowns | IT system outage, employee fraud, regulatory non-compliance | Internal controls, staff training, disaster recovery, compliance management |

| Concentration Risk | Risk due to exposure to a single counterparty, sector, or geographic location | High exposure to one client, industry, or region leading to lack of diversification | Large loan to one company, investments in one sector or country | Portfolio diversification, exposure limits, stress testing |

Understanding Operational Risk

Operational risk encompasses losses from failed internal processes, systems, human errors, or external events in financial institutions, posing threats beyond market and credit risks. Common causes include fraud, system failures, regulatory breaches, and natural disasters, which can disrupt operations and damage reputation. Effective management relies on risk identification, internal controls, incident tracking, and robust contingency planning to mitigate potential operational losses.

Defining Concentration Risk

Concentration risk refers to the potential for significant financial loss resulting from exposure to a single counterparty, sector, geographic region, or asset type, which lacks diversification. Unlike operational risk, which arises from internal process failures, human errors, or system breakdowns, concentration risk specifically highlights the vulnerability due to insufficient spread of investments or credit exposures. Effective management requires identifying and limiting large exposures to prevent disproportionate impact on an institution's financial stability.

Key Differences Between Operational and Concentration Risk

Operational risk arises from internal process failures, human errors, or system malfunctions within an organization, whereas concentration risk involves the exposure to losses due to a large portion of assets or liabilities being tied to a single counterparty, industry, or geographic region. Operational risk is primarily managed through robust internal controls, staff training, and technology upgrades, while concentration risk requires diversification strategies and exposure limits to mitigate potential impacts. Understanding the distinct sources and management approaches is crucial for effective risk mitigation and regulatory compliance in financial institutions.

Sources of Operational Risk

Operational risk arises from failures in internal processes, human errors, system malfunctions, and external events such as fraud or natural disasters, impacting an organization's day-to-day operations. Concentration risk, however, stems from excessive exposure to a single counterparty, sector, or geographic region, increasing vulnerability to specific market shocks. Understanding the diverse sources of operational risk, including technology breakdowns, regulatory breaches, and inadequate controls, is essential for effective risk management and mitigation.

Sources of Concentration Risk

Sources of concentration risk primarily stem from excessive exposure to single counterparties, geographic regions, industries, or financial instruments, which can magnify potential losses during adverse events. Unlike operational risk, which arises from internal process failures, system errors, or human mistakes, concentration risk originates from portfolio imbalances and lack of diversification. Identifying and monitoring these concentrated positions is crucial for effective risk management and regulatory compliance.

Impact on Financial Institutions

Operational risk in financial institutions leads to losses from internal failures, fraud, or system breakdowns, directly affecting capital reserves and regulatory compliance. Concentration risk arises from excessive exposure to a single counterparty, sector, or geographic area, increasing vulnerability to market shocks and undermining portfolio diversification. Both risks impact financial stability, but operational risk primarily disrupts internal processes, while concentration risk threatens asset quality and credit risk profiles.

Measurement and Assessment Techniques

Operational risk measurement employs loss event databases, Key Risk Indicators (KRIs), and scenario analysis to quantify potential internal failures or external disruptions. Concentration risk assessment uses exposure concentration metrics, Herfindahl-Hirschman Index (HHI), and stress testing to identify risk buildup across borrowers, sectors, or geographies. Both risk types rely on qualitative and quantitative techniques, but concentration risk demands greater focus on portfolio diversification and correlation analysis to mitigate systemic impact.

Mitigation Strategies for Each Risk

Operational risk mitigation involves implementing robust internal controls, continuous staff training, and advanced technology systems to detect and prevent errors or fraud. Concentration risk management requires diversification of asset portfolios, setting exposure limits across sectors or counterparties, and ongoing stress testing to assess vulnerability to single points of failure. Both strategies emphasize proactive monitoring and governance frameworks to minimize potential losses and ensure organizational resilience.

Regulatory Perspectives on Risk Management

Regulatory frameworks emphasize operational risk management by mandating robust internal controls, loss data collection, and stress testing to mitigate failures in processes, systems, and human errors. Concentration risk requires regulators to enforce diversification limits and capital buffers to prevent excessive exposure to single counterparties, sectors, or geographic areas. Risk management guidelines from Basel III and regional regulators underscore the importance of integrating both operational and concentration risk assessments into enterprise-wide risk management strategies.

Best Practices for Balancing Both Risks

Effective management of operational risk involves implementing robust internal controls, continuous staff training, and adopting advanced risk monitoring technologies to minimize errors and system failures. Balancing this with concentration risk requires diversification strategies, setting exposure limits, and ongoing portfolio analysis to prevent excessive risk accumulation in any single area. Integrating both risk management frameworks ensures comprehensive risk mitigation, enhancing overall organizational resilience and stability.

Operational Risk Infographic

libterm.com

libterm.com