Liquidity risk refers to the potential difficulty a company or individual may face when trying to convert assets into cash quickly without significant loss in value. Managing liquidity risk is crucial for ensuring financial stability and meeting short-term obligations effectively. Explore the rest of the article to understand how you can identify, measure, and mitigate liquidity risk in your financial strategy.

Table of Comparison

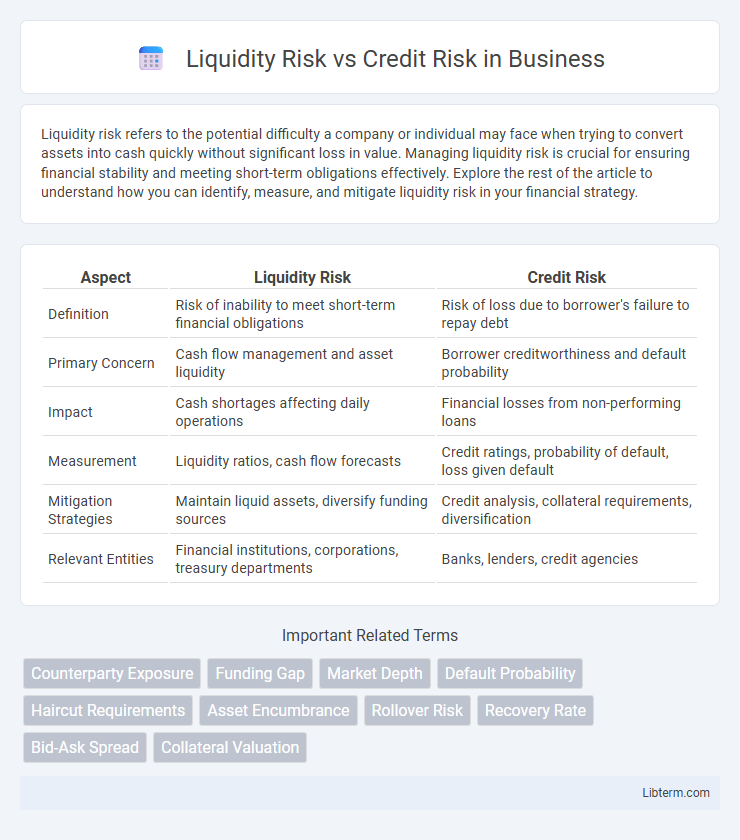

| Aspect | Liquidity Risk | Credit Risk |

|---|---|---|

| Definition | Risk of inability to meet short-term financial obligations | Risk of loss due to borrower's failure to repay debt |

| Primary Concern | Cash flow management and asset liquidity | Borrower creditworthiness and default probability |

| Impact | Cash shortages affecting daily operations | Financial losses from non-performing loans |

| Measurement | Liquidity ratios, cash flow forecasts | Credit ratings, probability of default, loss given default |

| Mitigation Strategies | Maintain liquid assets, diversify funding sources | Credit analysis, collateral requirements, diversification |

| Relevant Entities | Financial institutions, corporations, treasury departments | Banks, lenders, credit agencies |

Understanding Liquidity Risk

Liquidity risk refers to the potential inability of a firm or individual to meet short-term financial obligations due to insufficient liquid assets, which can lead to forced asset sales at unfavorable prices. Unlike credit risk, which concerns the possibility of a borrower defaulting on debt, liquidity risk emphasizes the availability and access to cash or liquid resources to cover immediate liabilities. Effective liquidity risk management involves maintaining adequate cash reserves, monitoring cash flow projections, and ensuring access to funding sources under stressed market conditions.

Defining Credit Risk

Credit risk refers to the potential loss a lender faces when a borrower fails to repay a loan or meet contractual debt obligations, impacting financial institutions and investors. It involves the assessment of a borrower's creditworthiness based on factors such as credit history, financial stability, and repayment capacity. Effective credit risk management incorporates robust credit scoring models, collateral evaluation, and continuous monitoring to mitigate default probabilities and financial losses.

Key Differences Between Liquidity and Credit Risk

Liquidity risk refers to the potential inability to meet short-term financial obligations due to the lack of sufficient liquid assets, while credit risk involves the possibility of loss from a borrower failing to repay a loan or meet contractual debt obligations. Key differences include liquidity risk's focus on cash flow timing and market conditions affecting asset convertibility, whereas credit risk centers on borrower creditworthiness and default probability. Managing liquidity risk involves maintaining adequate cash reserves and accessible funding sources, whereas credit risk management requires thorough credit assessments and ongoing monitoring of borrower performance.

Causes of Liquidity Risk

Liquidity risk arises primarily from an organization's inability to meet short-term financial obligations due to a mismatch in cash flows or unforeseen withdrawals, often caused by market disruptions, poor cash flow management, or excessive reliance on short-term funding. Sudden spikes in demand for liquid assets or restrictions in market access can exacerbate liquidity challenges, leading to forced asset sales at distressed prices. In contrast to credit risk--which stems from borrower default or counterparty failure--liquidity risk centers on the firm's capacity to convert assets to cash quickly without significant loss.

Factors Influencing Credit Risk

Credit risk is primarily influenced by factors such as the borrower's credit history, collateral quality, and prevailing economic conditions, which affect the likelihood of default. Financial ratios, credit scores, and debt-to-income levels also play critical roles in assessing creditworthiness and repayment capacity. External elements like regulatory changes and market volatility further impact the credit risk profile by altering borrowers' ability to meet obligations.

Impact on Financial Institutions

Liquidity risk affects financial institutions by limiting their ability to meet short-term obligations, potentially leading to insolvency during market stress. Credit risk involves losses from borrowers failing to repay loans, directly impacting asset quality and capital reserves. Effective management of both risks is critical for maintaining stability and regulatory compliance in banking operations.

Risk Measurement and Assessment Techniques

Liquidity risk measurement involves stress testing cash flow projections and evaluating liquidity coverage ratios to ensure short-term obligations can be met under adverse conditions. Credit risk assessment relies on credit scoring models, probability of default (PD), loss given default (LGD), and exposure at default (EAD) metrics to quantify potential losses from borrower defaults. Both risks utilize scenario analysis and Monte Carlo simulations to model uncertainties, but liquidity risk emphasizes cash flow timing while credit risk focuses on borrower creditworthiness and repayment capacity.

Mitigation Strategies for Liquidity Risk

Mitigation strategies for liquidity risk focus on maintaining adequate cash reserves, establishing committed credit lines, and conducting regular stress testing to assess potential liquidity shortfalls. Financial institutions implement robust cash flow forecasting and diversify funding sources to enhance liquidity buffers and reduce dependency on single funding channels. Effective liquidity risk management also includes establishing contingency funding plans and adhering to regulatory liquidity requirements, such as the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR).

Managing and Reducing Credit Risk

Managing and reducing credit risk involves implementing rigorous credit assessment processes, including thorough borrower creditworthiness evaluation and continuous monitoring of financial health. Employing diversification strategies across industries and geographic regions minimizes exposure to any single counterparty default. Utilizing credit derivatives and setting appropriate credit limits further mitigate potential losses by transferring and capping credit risk.

Real-World Examples: Liquidity vs Credit Risk

Liquidity risk materialized dramatically during the 2008 financial crisis when major banks like Lehman Brothers faced sudden cash shortages, leading to bankruptcy despite having high-quality assets. Credit risk was evident in the subprime mortgage collapse, where borrowers defaulted en masse, causing massive losses for institutions like Bear Stearns. These examples demonstrate that liquidity risk affects a firm's ability to meet short-term obligations, while credit risk pertains to the likelihood of borrower default impacting long-term asset value.

Liquidity Risk Infographic

libterm.com

libterm.com