A comfort letter serves as a formal assurance from a third party, typically a parent company or auditor, to provide financial or operational support during a transaction. It helps reduce the risk perceived by lenders or investors by outlining a commitment or confirmation of certain facts. Explore the following article to understand how a comfort letter can safeguard your business interests and when to request one.

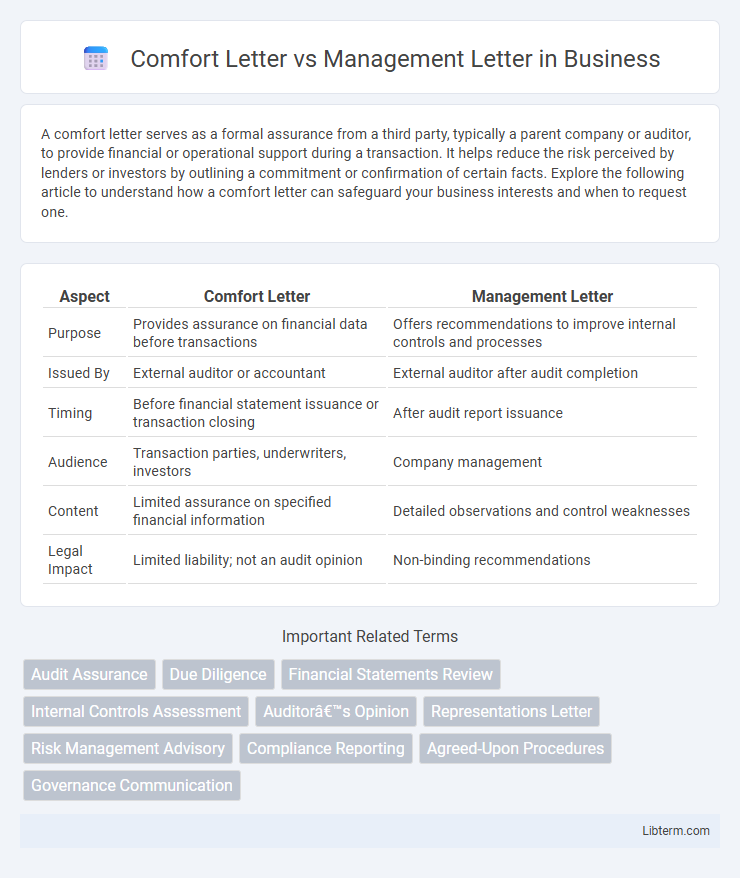

Table of Comparison

| Aspect | Comfort Letter | Management Letter |

|---|---|---|

| Purpose | Provides assurance on financial data before transactions | Offers recommendations to improve internal controls and processes |

| Issued By | External auditor or accountant | External auditor after audit completion |

| Timing | Before financial statement issuance or transaction closing | After audit report issuance |

| Audience | Transaction parties, underwriters, investors | Company management |

| Content | Limited assurance on specified financial information | Detailed observations and control weaknesses |

| Legal Impact | Limited liability; not an audit opinion | Non-binding recommendations |

Introduction to Comfort Letters and Management Letters

Comfort letters provide assurance from auditors or third parties regarding financial information without constituting an audit opinion, commonly used in financial transactions to instill confidence in stakeholders. Management letters, issued by auditors, highlight internal control weaknesses, operational deficiencies, and recommendations for improvement based on audit findings. Both documents serve distinct purposes: comfort letters support external financial assurance, while management letters inform internal management of areas needing attention.

Definition of Comfort Letter

A Comfort Letter is a written assurance provided by an auditor or accountant to a third party, confirming specific financial information or compliance prior to a transaction. This letter offers limited assurance about the accuracy and completeness of financial statements or other data without constituting a formal audit opinion. Unlike a Management Letter, which highlights internal control weaknesses and recommendations for management, a Comfort Letter primarily serves to provide assurance to underwriters, investors, or regulators during financial deals.

Definition of Management Letter

A Management Letter is a formal document issued by auditors following an audit, highlighting internal control weaknesses, operational inefficiencies, and recommendations for improvement within an organization. It complements the audit report by providing management with actionable insights to enhance financial reporting accuracy and compliance. Unlike a Comfort Letter, which offers assurance on specific financial statement assertions, the Management Letter focuses on internal processes and risk management practices.

Key Differences Between Comfort Letter and Management Letter

Comfort letters provide third-party assurance on financial information for transactions, primarily addressing compliance and verification issues, while management letters focus on internal control weaknesses and operational improvements identified during an audit. Comfort letters are usually issued by auditors to underwriters or investors before securities offerings, emphasizing assurance on specific financial data. Management letters, intended for company management, contain detailed recommendations for enhancing accounting practices and internal controls based on audit findings.

Purposes of Comfort Letters

Comfort letters primarily serve to provide third parties, such as lenders or investors, with assurances regarding financial statements or other information without the formality of an audit opinion. They aim to reduce uncertainty by confirming the accuracy or completeness of data submitted during transactions like securities offerings or loan agreements. Unlike management letters, comfort letters focus on external assurance rather than internal control recommendations.

Purposes of Management Letters

Management letters primarily serve to communicate internal control weaknesses, operational inefficiencies, and compliance issues identified during an audit. They provide recommendations for improving organizational processes and risk management practices to enhance overall governance. Unlike comfort letters that address third-party assurance, management letters focus on internal feedback to support management's decision-making and corrective actions.

Recipients and Stakeholders Involved

Comfort letters are primarily addressed to external stakeholders such as underwriters, lenders, or investors seeking assurance on financial statements during securities offerings. Management letters are directed to a company's internal management, highlighting audit findings, control weaknesses, and recommendations for operational improvements. The key recipients of comfort letters are external parties relying on financial accuracy, while management letters serve internal stakeholders responsible for governance and risk management.

Typical Content and Format

Comfort letters typically provide assurance about financial information accuracy and often include confirmation of specific data, representations, and limited scope reviews, presented in a formal letter format addressed to third parties. Management letters focus on internal control deficiencies and recommendations for improvements, detailing findings from audits or evaluations, usually formatted as a detailed report to management. Both documents maintain professional tone but differ in audience, purpose, and the inclusion of actionable insights versus assurance statements.

Regulatory and Compliance Aspects

Comfort Letters provide assurance from auditors on financial information primarily to underwriters and regulators, ensuring compliance with securities regulations and reducing the risk of material misstatements in financial disclosures. Management Letters highlight internal control weaknesses and compliance deficiencies identified during audits, offering recommendations to improve regulatory adherence and strengthen corporate governance. Both documents support regulatory oversight by enhancing transparency and fostering accountability within an organization's financial reporting and internal processes.

Summary: Choosing Between Comfort Letter and Management Letter

Choosing between a comfort letter and a management letter depends on the intended audience and purpose; comfort letters provide assurance to third parties, often in financial transactions, while management letters deliver internal insights and recommendations to company leadership. Comfort letters emphasize financial statement reliability and regulatory compliance, aiding auditors and investors, whereas management letters focus on internal controls, operational improvements, and risk management for executive decision-making. Selecting the appropriate letter ensures clear communication of assurance levels, aligning with stakeholder needs and organizational objectives.

Comfort Letter Infographic

libterm.com

libterm.com