Strategic consulting helps businesses identify growth opportunities and optimize operational efficiency through expert analysis and tailored solutions. By leveraging market insights and innovative strategies, your company can achieve sustainable competitive advantage. Explore the rest of the article to discover how strategic consulting can transform your business outcomes.

Table of Comparison

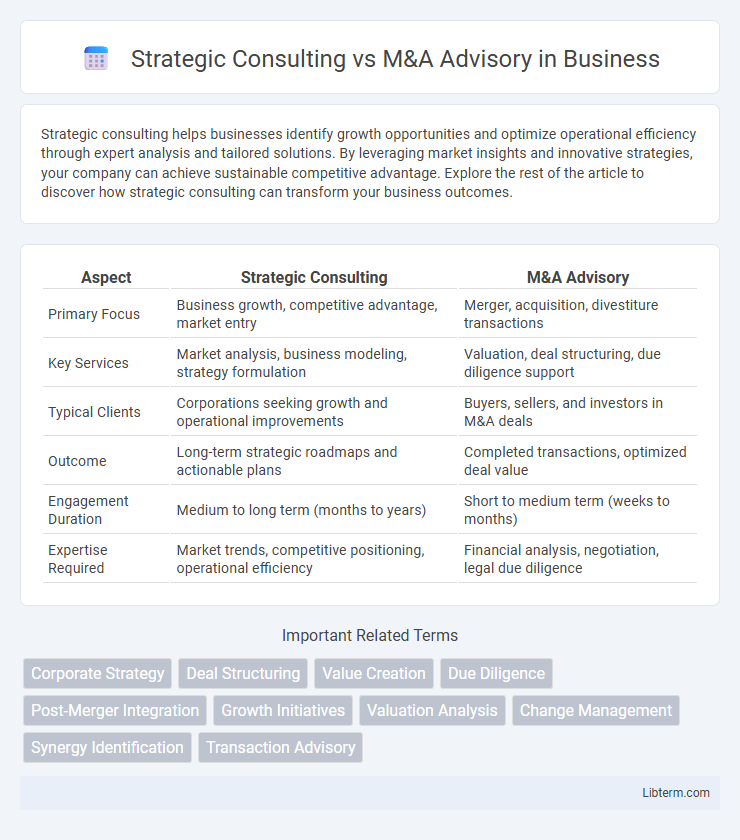

| Aspect | Strategic Consulting | M&A Advisory |

|---|---|---|

| Primary Focus | Business growth, competitive advantage, market entry | Merger, acquisition, divestiture transactions |

| Key Services | Market analysis, business modeling, strategy formulation | Valuation, deal structuring, due diligence support |

| Typical Clients | Corporations seeking growth and operational improvements | Buyers, sellers, and investors in M&A deals |

| Outcome | Long-term strategic roadmaps and actionable plans | Completed transactions, optimized deal value |

| Engagement Duration | Medium to long term (months to years) | Short to medium term (weeks to months) |

| Expertise Required | Market trends, competitive positioning, operational efficiency | Financial analysis, negotiation, legal due diligence |

Overview of Strategic Consulting and M&A Advisory

Strategic consulting focuses on helping organizations develop long-term goals, improve operational efficiency, and create competitive advantages through comprehensive market analysis and business model evaluation. M&A advisory specializes in guiding companies through mergers, acquisitions, divestitures, and capital raising by providing due diligence, valuation, and negotiation support. Both fields require deep industry knowledge, financial expertise, and strategic insight, but strategic consulting prioritizes overarching business growth, while M&A advisory centers on transaction execution and deal structuring.

Defining Strategic Consulting: Goals and Scope

Strategic consulting focuses on helping organizations define long-term goals, identify growth opportunities, and optimize overall business performance through market analysis, competitive positioning, and operational improvements. It encompasses a broad scope including corporate strategy, digital transformation, organizational restructuring, and innovation management. Unlike M&A advisory, which centers on transaction execution and valuation, strategic consulting guides decision-making to create sustainable competitive advantages and align resources with company vision.

Understanding M&A Advisory: Core Functions

M&A advisory primarily involves guiding clients through the complexities of mergers and acquisitions, including target identification, valuation, due diligence, and deal structuring. Core functions emphasize negotiation support, regulatory compliance, and post-merger integration planning to maximize transaction value. Strategic consulting, in contrast, concentrates on long-term business growth, competitive positioning, and operational improvements without the transactional focus inherent in M&A advisory services.

Key Differences Between Strategic Consulting and M&A Advisory

Strategic consulting focuses on long-term business growth, market positioning, and operational efficiency, while M&A advisory specializes in the execution of mergers, acquisitions, and divestitures. Strategic consultants analyze industry trends, competitive landscapes, and internal capabilities to develop actionable business strategies; M&A advisors handle deal structuring, valuation, due diligence, and negotiation processes. The primary difference lies in strategic consulting's broad organizational focus versus M&A advisory's transaction-centric expertise.

When to Choose Strategic Consulting Services

Strategic consulting services are ideal when businesses seek to enhance long-term growth, optimize operational efficiency, or navigate market entry and competitive positioning challenges. Organizations facing complex decisions around corporate strategy, digital transformation, or innovation development benefit most from strategic consulting expertise. Choose strategic consulting when the focus is on holistic business improvements rather than immediate transactional goals associated with mergers and acquisitions.

When M&A Advisory is the Right Solution

M&A advisory is the right solution when companies seek specialized expertise in transaction execution, including deal structuring, valuation, and negotiation support. Organizations preparing for mergers, acquisitions, or divestitures require tailored guidance that addresses legal, financial, and market complexities to maximize deal value. Strategic consulting focuses more broadly on long-term growth and operational improvements, whereas M&A advisory zeroes in on transactional success and integration planning.

Skills and Expertise Required in Each Field

Strategic consulting demands strong analytical skills, market research expertise, and proficiency in corporate strategy development to guide organizational growth and competitive positioning. M&A advisory requires deep financial acumen, expertise in valuation, due diligence, negotiation skills, and thorough knowledge of regulatory frameworks governing mergers and acquisitions. Both fields benefit from effective communication and problem-solving abilities, but M&A advisory places a higher emphasis on transactional experience and financial modeling.

Common Challenges Faced by Strategic Consultants vs M&A Advisors

Strategic consultants and M&A advisors both encounter challenges related to aligning stakeholder expectations and managing complex data integration, yet strategic consultants focus more on navigating organizational change and long-term planning uncertainties. M&A advisors frequently face challenges in due diligence accuracy, valuation disputes, and regulatory compliance during transaction execution. Both roles require adept communication and risk management skills to ensure successful client outcomes in rapidly evolving market conditions.

Impact on Business Growth and Value Creation

Strategic consulting drives business growth by optimizing operational efficiency, market positioning, and long-term planning, enabling companies to capitalize on competitive advantages and emerging opportunities. M&A advisory specifically enhances value creation through expert guidance on mergers, acquisitions, and divestitures, ensuring deal structuring maximizes financial returns and strategic synergy. Both approaches contribute to sustained growth, with strategic consulting fostering organic development and M&A advisory accelerating expansion through targeted transactions.

How to Select the Right Advisory Service for Your Business

Selecting the right advisory service depends on your business goals; strategic consulting focuses on long-term growth, market positioning, and operational improvements, while M&A advisory specializes in mergers, acquisitions, and divestitures. If your priority is expanding market share, enhancing competitive advantage, or developing new business strategies, strategic consulting firms like McKinsey or BCG offer tailored solutions. Conversely, when navigating complex transactions, valuation, due diligence, or deal structuring, engaging an M&A advisory firm such as Goldman Sachs or Lazard ensures expert guidance aligned with financial and legal requirements.

Strategic Consulting Infographic

libterm.com

libterm.com