Revenue represents the total income generated by a business from its core operations, including sales of goods or services. It serves as a key indicator of business performance and financial health. Discover how understanding revenue can optimize Your business strategies by reading the rest of the article.

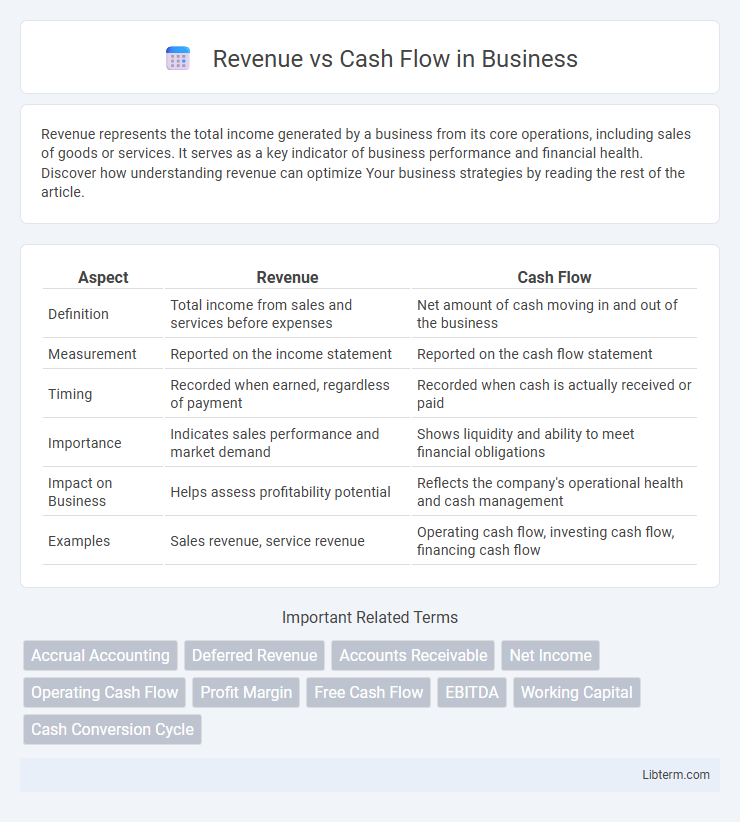

Table of Comparison

| Aspect | Revenue | Cash Flow |

|---|---|---|

| Definition | Total income from sales and services before expenses | Net amount of cash moving in and out of the business |

| Measurement | Reported on the income statement | Reported on the cash flow statement |

| Timing | Recorded when earned, regardless of payment | Recorded when cash is actually received or paid |

| Importance | Indicates sales performance and market demand | Shows liquidity and ability to meet financial obligations |

| Impact on Business | Helps assess profitability potential | Reflects the company's operational health and cash management |

| Examples | Sales revenue, service revenue | Operating cash flow, investing cash flow, financing cash flow |

Understanding Revenue: Definition and Importance

Revenue represents the total income generated from the sale of goods or services before any expenses are deducted, serving as a key indicator of a company's market demand and operational scale. It is crucial for assessing business growth potential and attracting investors, as higher revenue often signals strong sales performance and customer interest. Accurate tracking of revenue ensures reliable financial reporting and forms the foundation for calculating profitability metrics such as gross profit and net income.

What is Cash Flow? Key Concepts Explained

Cash flow represents the net amount of cash and cash equivalents moving in and out of a business during a specific period, reflecting its liquidity position. It includes operating cash flow, investment cash flow, and financing cash flow, each detailing different sources and uses of cash. Positive cash flow indicates a company's ability to maintain and grow operations, pay debts, and invest in assets, highlighting financial health beyond just reported revenue.

Revenue vs Cash Flow: Core Differences

Revenue represents the total income generated from sales of goods or services before expenses, reflecting a company's top-line performance. Cash flow measures the actual inflow and outflow of cash within a period, indicating liquidity and operational efficiency. The core difference lies in revenue recognizing earned income on an accrual basis, while cash flow tracks real-time cash transactions essential for daily business sustainability.

How Revenue is Calculated in Business

Revenue in business is calculated by multiplying the price of goods or services by the quantity sold during a specific period, reflecting total sales before expenses. It includes all income generated from primary operations, such as product sales, service fees, and other core activities. This figure serves as a crucial indicator of business performance, distinct from cash flow which accounts for actual cash movement including expenses and investments.

Types of Cash Flow: Operating, Investing, Financing

Revenue represents a company's total income from sales, while cash flow measures the actual inflow and outflow of cash during a specific period. Operating cash flow reflects cash generated from core business activities, investing cash flow involves cash used for acquiring or selling assets like equipment or investments, and financing cash flow pertains to cash movements related to borrowing, repaying debt, or equity transactions. Understanding these types of cash flow helps assess a company's liquidity, financial health, and operational efficiency beyond just revenue figures.

The Impact of Revenue on Financial Statements

Revenue represents the total income generated from sales of goods or services and directly influences the income statement by increasing net income. Higher revenue boosts earnings before interest and taxes (EBIT), which impacts retained earnings on the equity section of the balance sheet. Although revenue enhances profitability, it does not immediately affect cash flow until cash is collected, emphasizing the distinction between revenue recognition and actual cash inflows on the cash flow statement.

Why Cash Flow Matters for Business Survival

Cash flow represents the actual liquidity available to cover daily operations, making it critical for business survival, while revenue reflects total sales without indicating liquid assets. Negative cash flow can quickly lead to insolvency despite high revenue figures, as fixed costs like payroll, rent, and supplier payments require timely cash outflows. Maintaining positive cash flow ensures businesses can meet obligations, invest in growth, and withstand financial fluctuations, underpinning long-term sustainability.

Common Misconceptions About Revenue and Cash Flow

Revenue represents the total income generated from sales before any expenses are deducted, often leading to the misconception that high revenue directly equates to strong financial health. Cash flow, however, measures the actual liquidity available by accounting for cash inflows and outflows, highlighting that a business can be profitable yet still face cash shortages. Understanding the distinction helps clarify that revenue alone does not guarantee positive cash flow or sustainable operations.

Revenue Growth vs Positive Cash Flow: Which to Prioritize?

Revenue growth indicates a company's ability to increase its sales over time, signaling market demand and potential scalability, which attracts investors seeking long-term value. Positive cash flow reflects the company's liquidity and operational efficiency, ensuring it can meet immediate expenses and sustain business operations without relying on external financing. Prioritizing cash flow over revenue growth is essential for maintaining financial health, especially for startups and small businesses aiming for sustainable profitability.

Strategies to Improve Both Revenue and Cash Flow

Implementing dynamic pricing models increases revenue by optimizing sales based on demand fluctuations while enhancing cash flow through faster payment cycles. Streamlining accounts receivable processes with automated invoicing and early payment incentives improves cash flow timing without sacrificing revenue growth. Diversifying product offerings expands market reach, boosting revenue streams and stabilizing cash inflows to support operational expenses.

Revenue Infographic

libterm.com

libterm.com