High working capital indicates that a company has ample short-term assets to cover its short-term liabilities, reflecting strong liquidity and operational efficiency. This financial strength enables businesses to invest in growth opportunities, manage unexpected expenses, and maintain smooth day-to-day operations. Discover how managing your working capital effectively can boost your company's financial health by reading the rest of the article.

Table of Comparison

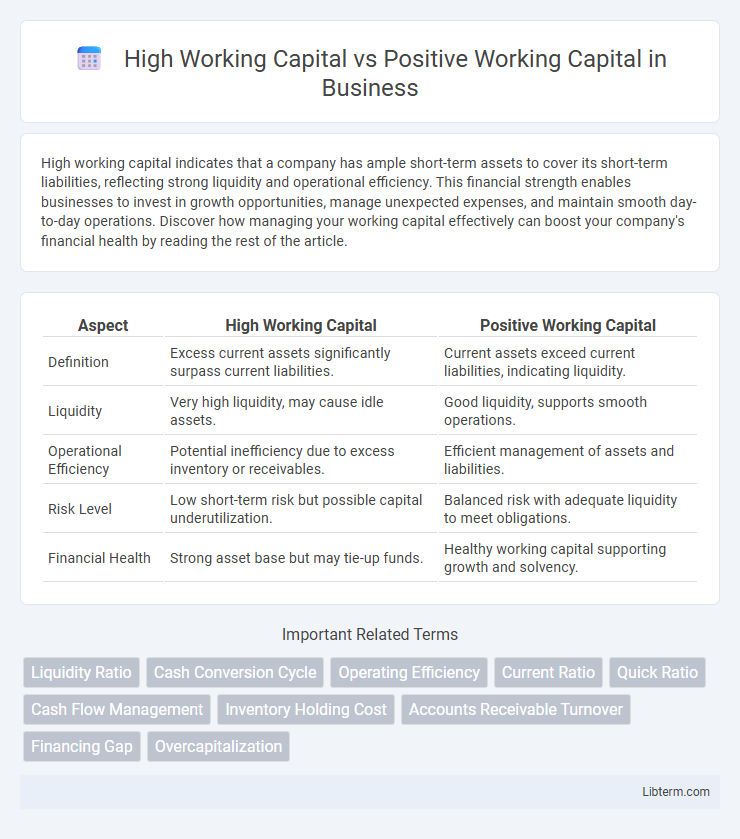

| Aspect | High Working Capital | Positive Working Capital |

|---|---|---|

| Definition | Excess current assets significantly surpass current liabilities. | Current assets exceed current liabilities, indicating liquidity. |

| Liquidity | Very high liquidity, may cause idle assets. | Good liquidity, supports smooth operations. |

| Operational Efficiency | Potential inefficiency due to excess inventory or receivables. | Efficient management of assets and liabilities. |

| Risk Level | Low short-term risk but possible capital underutilization. | Balanced risk with adequate liquidity to meet obligations. |

| Financial Health | Strong asset base but may tie-up funds. | Healthy working capital supporting growth and solvency. |

Understanding Working Capital: A Brief Overview

High working capital indicates a company has substantial current assets exceeding its current liabilities, ensuring liquidity and operational stability. Positive working capital means current assets are greater than current liabilities, signaling the firm can cover short-term obligations and invest in growth opportunities. Analyzing working capital ratios helps businesses maintain financial health and avoid cash flow issues that could hinder daily operations.

Defining High Working Capital

High working capital refers to an excess amount of current assets surpassing current liabilities by a significant margin, indicating strong liquidity but potential inefficiencies in asset utilization. Positive working capital means current assets exceed current liabilities, enabling smooth operational flow and meeting short-term financial obligations. While both reflect financial health, high working capital may signal overstocking or slow receivables, requiring careful management.

What is Positive Working Capital?

Positive working capital indicates a company's current assets exceed its current liabilities, reflecting strong liquidity and the ability to meet short-term obligations. High working capital generally means a large surplus of assets over liabilities, but excessively high working capital can suggest inefficient use of resources or excess inventory. Maintaining positive working capital is crucial for operational stability, ensuring funds are available for daily expenses and unexpected costs.

Key Differences Between High and Positive Working Capital

High working capital indicates a large surplus of current assets over current liabilities but may suggest inefficient asset management or tied-up funds, whereas positive working capital simply means current assets exceed current liabilities, ensuring short-term financial stability. The key difference lies in magnitude and implication: high working capital can signal potential liquidity issues due to excess inventory or receivables, while positive working capital reflects a healthy operational liquidity cushion. Understanding this distinction helps businesses optimize cash flow and operational efficiency by balancing asset utilization and liquidity requirements.

Advantages of High Working Capital

High working capital indicates a company's robust liquidity, ensuring it can meet short-term obligations and invest in growth opportunities without financial strain. It reduces the risk of insolvency and enhances supplier and creditor confidence by demonstrating strong operational stability. Companies with high working capital can capitalize on market trends quickly, optimize inventory management, and maintain smooth day-to-day operations.

Risks Associated with Excessive Working Capital

Excessive working capital can lead to inefficiencies such as tied-up funds in inventory or receivables, reducing liquidity and limiting opportunities for investment or growth. High working capital increases carrying costs and the risk of obsolescence, especially in industries with rapidly changing products. Maintaining an optimal balance is crucial to avoid financial strain and ensure operational flexibility.

Benefits of Maintaining Positive Working Capital

Maintaining positive working capital ensures a company has sufficient liquidity to cover short-term liabilities, enabling smooth operational continuity and effective cash flow management. High working capital reflects strong financial health, which enhances creditworthiness and supports timely payment of obligations, reducing the risk of insolvency. Efficient working capital management allows businesses to seize growth opportunities by funding inventory and receivables without relying heavily on external financing.

Negative Impacts of Inadequate Working Capital

High working capital indicates a robust liquidity position, whereas positive working capital confirms the company's ability to meet short-term obligations; however, inadequate working capital can lead to cash flow shortages, delayed payments to suppliers, and increased borrowing costs. Insufficient working capital often causes operational disruptions, reduced creditworthiness, and missed business opportunities. Managing working capital effectively is crucial to maintaining financial stability and supporting sustainable growth.

Optimizing Working Capital for Business Growth

High working capital indicates a strong liquidity position but may signal inefficient asset utilization, while positive working capital ensures sufficient short-term assets to cover liabilities without excessive idle funds. Optimizing working capital involves balancing receivables, payables, and inventory to maximize cash flow and support sustainable business growth. Effective working capital management reduces financing costs, improves operational efficiency, and enhances the company's ability to invest in growth opportunities.

Strategies to Balance High and Positive Working Capital

High working capital indicates abundant current assets over liabilities, potentially leading to inefficient asset utilization, while positive working capital ensures sufficient short-term liquidity to meet obligations. Strategies to balance both include optimizing inventory management to reduce excess stock, accelerating receivables collection to improve cash flow, and negotiating favorable payment terms with suppliers. Implementing these tactics enhances operational efficiency and sustains financial stability.

High Working Capital Infographic

libterm.com

libterm.com