Stock options offer a unique opportunity to benefit from the potential growth of a company's stock by allowing you to purchase shares at a predetermined price. These financial instruments can serve as powerful incentives for employees and investors to align their interests with the company's success. Explore the rest of the article to understand how stock options can enhance your investment strategy.

Table of Comparison

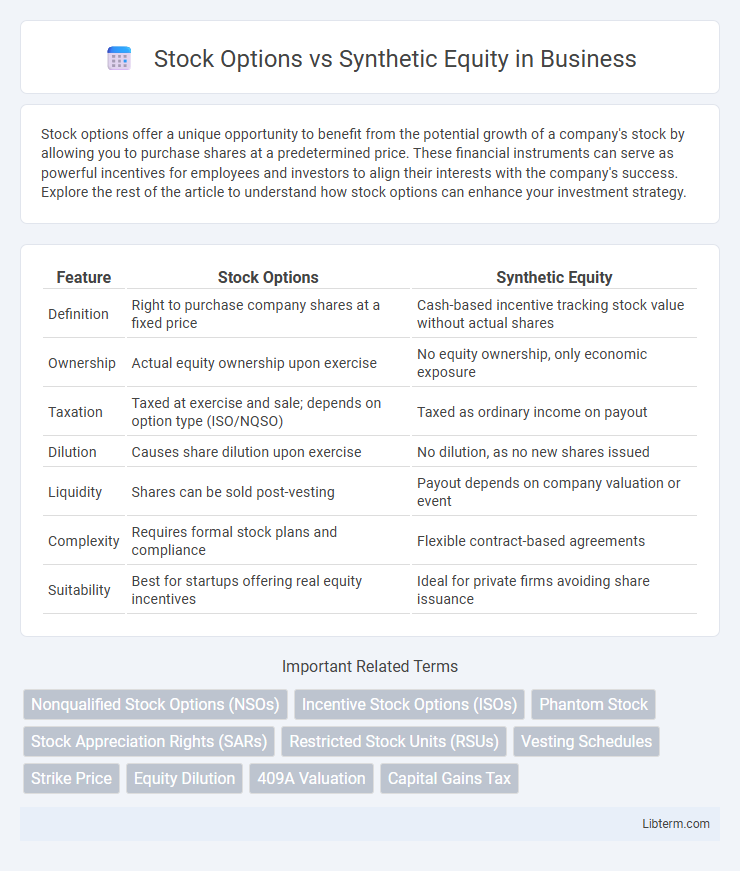

| Feature | Stock Options | Synthetic Equity |

|---|---|---|

| Definition | Right to purchase company shares at a fixed price | Cash-based incentive tracking stock value without actual shares |

| Ownership | Actual equity ownership upon exercise | No equity ownership, only economic exposure |

| Taxation | Taxed at exercise and sale; depends on option type (ISO/NQSO) | Taxed as ordinary income on payout |

| Dilution | Causes share dilution upon exercise | No dilution, as no new shares issued |

| Liquidity | Shares can be sold post-vesting | Payout depends on company valuation or event |

| Complexity | Requires formal stock plans and compliance | Flexible contract-based agreements |

| Suitability | Best for startups offering real equity incentives | Ideal for private firms avoiding share issuance |

Introduction to Stock Options and Synthetic Equity

Stock options grant employees the right to purchase company shares at a predetermined price, offering potential financial gain if the stock value increases. Synthetic equity mimics the economic benefits of stock ownership without actual equity issuance, often through instruments like stock appreciation rights or phantom shares. Both tools aim to incentivize employees by aligning their interests with company performance, but differ in legal structure and ownership implications.

Defining Stock Options: Key Concepts

Stock options grant employees the right to buy company shares at a predetermined price, known as the strike price, within a specified time frame. These options typically vest over a period, aligning employee incentives with company performance and long-term growth. Understanding key concepts such as strike price, vesting schedule, and expiration is essential for evaluating the value and potential financial benefits of stock options.

What is Synthetic Equity?

Synthetic equity refers to a financial instrument designed to mimic the economic benefits of actual equity ownership without granting legal equity or shareholder rights. Common types of synthetic equity include stock appreciation rights (SARs), phantom stock, and restricted stock units (RSUs), which provide employees with a share in the company's value growth or dividends. Synthetic equity enables companies to offer equity-like incentives while avoiding dilution of ownership and maintaining control over the business.

Core Differences Between Stock Options and Synthetic Equity

Stock options grant employees the right to purchase company shares at a specified price, linking compensation directly to stock value appreciation and offering potential capital gains. Synthetic equity provides economic benefits similar to stock ownership, such as cash payouts tied to company valuation or exit events, without conferring actual shares or voting rights. The core difference lies in stock options involving actual equity issuance and ownership, while synthetic equity mimics equity rewards using contractual agreements without diluting shareholders.

Tax Implications: Stock Options vs Synthetic Equity

Stock options typically trigger taxable events upon exercise or sale, with potential capital gains or ordinary income tax depending on the option type and holding period, whereas synthetic equity often results in tax liabilities at payout, classified as ordinary income. Stock options can offer favorable long-term capital gains treatment if holding requirements are met, while synthetic equity payouts are taxed as compensation, affecting the employer's payroll tax obligations. Understanding the timing and nature of these taxable events is essential for optimizing tax efficiency between stock options and synthetic equity plans.

Employee Motivation and Retention

Stock options provide employees with the potential for future financial gain by granting the right to purchase company shares at a set price, aligning their interests with company growth and enhancing long-term motivation. Synthetic equity, such as phantom shares or stock appreciation rights, offers cash-based rewards tied to stock value without actual ownership, reducing tax complexity and appealing to employees prioritizing immediate or guaranteed returns. Companies using synthetic equity can retain talent by delivering flexible, performance-linked incentives that simulate stock ownership benefits while avoiding dilution and administrative burdens typical of stock options.

Legal and Regulatory Considerations

Stock options are subject to extensive regulatory frameworks, including compliance with SEC rules, tax regulations under IRC Section 409A, and securities laws governing issuance and disclosure. Synthetic equity instruments, such as stock appreciation rights (SARs) or phantom shares, offer more flexibility but require careful contractual design to align with employment laws and avoid unintended tax consequences. Both require thorough legal scrutiny to mitigate risks related to shareholder rights, valuation, and reporting obligations.

Implementation and Administration

Stock options require formal issuance, regulatory compliance, and meticulous tracking of grant dates, strike prices, and vesting schedules to ensure proper accounting and legal adherence. Synthetic equity involves contract-based arrangements such as phantom shares or stock appreciation rights, simplifying administration by avoiding actual share issuance while still aligning employee incentives with company performance. Implementing synthetic equity reduces complexity in recordkeeping and shareholder dilution but demands careful design of payout formulas and tax treatment to maintain fairness and compliance.

When to Choose Stock Options or Synthetic Equity

Choose stock options when seeking traditional equity incentives that offer potential for capital gains through company share appreciation and when employees prefer straightforward ownership tied to actual stock. Synthetic equity is optimal for companies wanting to provide equity-like rewards without diluting ownership or issuing actual shares, particularly useful for private firms or startups aiming to retain control while motivating employees. Consider the company's stage, tax implications, liquidity preferences, and employee goals when deciding between stock options and synthetic equity.

Conclusion: Making the Right Choice

Choosing between stock options and synthetic equity depends on factors such as company stage, employee goals, and tax implications. Stock options offer potential upside through actual ownership but may involve complex exercising processes and tax events. Synthetic equity provides cash or stock rewards tied to company performance without granting actual shares, often simplifying tax treatment and liquidity timelines, making it ideal for companies seeking flexible or tax-efficient compensation structures.

Stock Options Infographic

libterm.com

libterm.com