A leveraged buyout (LBO) involves acquiring a company primarily using borrowed funds, with the assets of the acquired company often serving as collateral. This strategy allows investors to increase potential returns by using debt to finance the acquisition while minimizing their own capital outlay. Explore this article to understand how leveraged buyouts impact financial risk, ownership control, and investment opportunities tailored to your financial goals.

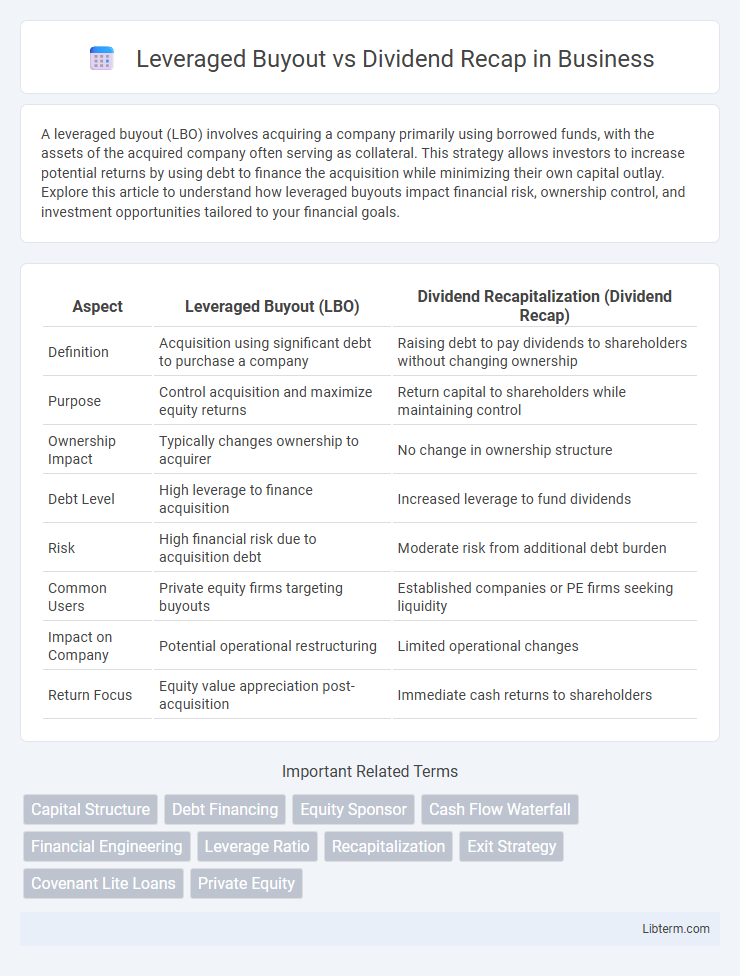

Table of Comparison

| Aspect | Leveraged Buyout (LBO) | Dividend Recapitalization (Dividend Recap) |

|---|---|---|

| Definition | Acquisition using significant debt to purchase a company | Raising debt to pay dividends to shareholders without changing ownership |

| Purpose | Control acquisition and maximize equity returns | Return capital to shareholders while maintaining control |

| Ownership Impact | Typically changes ownership to acquirer | No change in ownership structure |

| Debt Level | High leverage to finance acquisition | Increased leverage to fund dividends |

| Risk | High financial risk due to acquisition debt | Moderate risk from additional debt burden |

| Common Users | Private equity firms targeting buyouts | Established companies or PE firms seeking liquidity |

| Impact on Company | Potential operational restructuring | Limited operational changes |

| Return Focus | Equity value appreciation post-acquisition | Immediate cash returns to shareholders |

Introduction to Leveraged Buyout and Dividend Recapitalization

A Leveraged Buyout (LBO) involves acquiring a company using a significant amount of borrowed funds, with the target company's assets often serving as collateral, aiming to achieve high returns through operational improvements and strategic management. Dividend Recapitalization is a financial strategy where a company takes on new debt to pay a special dividend to shareholders, allowing owners to extract cash without selling equity or relinquishing control. Both tactics are common in private equity to optimize capital structure, enhance liquidity, and maximize shareholder value.

Defining Leveraged Buyout (LBO)

A Leveraged Buyout (LBO) is a financial transaction where a company is acquired primarily using borrowed funds, with the assets of the acquired company often serving as collateral. The goal of an LBO is to generate high returns by improving operational efficiency and eventually selling the company at a profit, while minimizing equity investment. This strategy contrasts with a Dividend Recapitalization, which involves restructuring the company's debt to pay a special dividend, often increasing financial risk without a change in ownership.

Understanding Dividend Recapitalization

Dividend recapitalization involves a company taking on new debt to pay a special dividend to shareholders, increasing financial leverage without transferring ownership. This strategy differs from a leveraged buyout (LBO), where external investors acquire a controlling stake using significant borrowed funds. Understanding dividend recapitalization is critical for assessing its impact on a company's capital structure, risk profile, and shareholder value.

Key Differences Between LBO and Dividend Recap

A Leveraged Buyout (LBO) involves acquiring a company primarily through debt, with the goal of gaining controlling ownership and improving operational efficiency to increase value over time. In contrast, a Dividend Recapitalization (Dividend Recap) is a strategy where a company takes on additional debt to pay a dividend to existing shareholders without changing ownership. Key differences include that LBOs focus on ownership transfer and long-term value creation, while Dividend Recaps prioritize returning capital to shareholders without ownership changes, often leading to higher leverage on the company's balance sheet.

Advantages of Leveraged Buyouts

Leveraged buyouts (LBOs) offer significant advantages by enabling companies to acquire or restructure with minimal initial equity, maximizing return on investment through debt financing. This strategy enhances operational control and aligns management interests by requiring strict financial discipline and performance improvements. Compared to dividend recaps, LBOs provide comprehensive control over the company's future, facilitating strategic growth and value creation.

Benefits of Dividend Recapitalizations

Dividend recapitalizations unlock immediate liquidity for shareholders without requiring a full exit, enabling companies to return capital while maintaining operational control. This strategy improves shareholder value by leveraging existing assets to distribute cash dividends, often enhancing balance sheet efficiency and financial flexibility. Compared to Leveraged Buyouts, dividend recaps reduce transaction complexity and preserve strategic autonomy, making them ideal for mature companies seeking growth or restructuring without ownership dilution.

Risks and Challenges of Leveraged Buyouts

Leveraged buyouts (LBOs) pose significant risks including high debt burdens that can strain cash flow and increase bankruptcy potential during economic downturns. Management may face operational challenges due to pressure to meet aggressive debt covenants, limiting strategic flexibility and investment in growth initiatives. Unlike dividend recaps, LBOs rely heavily on leverage, amplifying financial risk and potentially leading to loss of control if default occurs.

Risks and Drawbacks of Dividend Recapitalizations

Dividend recapitalizations increase a company's debt load without corresponding asset growth, raising the risk of financial distress and impairing credit ratings. This elevated leverage can strain cash flows, limiting the firm's ability to invest in growth or weather economic downturns. Unlike leveraged buyouts, which often involve ownership changes and operational restructuring, dividend recaps primarily transfer risk to lenders while benefiting shareholders, potentially leading to long-term value erosion.

Strategic Scenarios: When to Use LBO vs Dividend Recap

Leveraged Buyouts (LBOs) are strategically used for acquiring companies with stable cash flows and growth potential, enabling private equity firms to gain control and implement operational improvements. Dividend Recapitalizations (Dividend Recaps) are ideal in mature businesses with strong, predictable cash flows that need to return capital to shareholders without ownership changes. Choosing between LBO and Dividend Recap hinges on objectives like acquisition control versus shareholder liquidity while leveraging company financial strengths.

Conclusion: Choosing the Right Financial Strategy

Selecting the appropriate financial strategy depends on a company's liquidity needs, growth prospects, and risk tolerance. Leveraged Buyouts (LBOs) provide control and potential operational improvements through high debt but carry substantial risk and require strong cash flows for debt service. Dividend Recapitalizations offer immediate shareholder returns with less control change but increase leverage and financial risk, making the choice a balance between growth objectives and risk management.

Leveraged Buyout Infographic

libterm.com

libterm.com