Leveraged Buyouts (LBOs) are strategic acquisitions where a company is purchased primarily using borrowed funds, with the acquired company's assets often serving as collateral. This financial approach can amplify returns but carries significant risks if cash flows fail to cover debt obligations. Explore the full article to understand how LBOs impact companies and investors, and whether they are suitable for your financial goals.

Table of Comparison

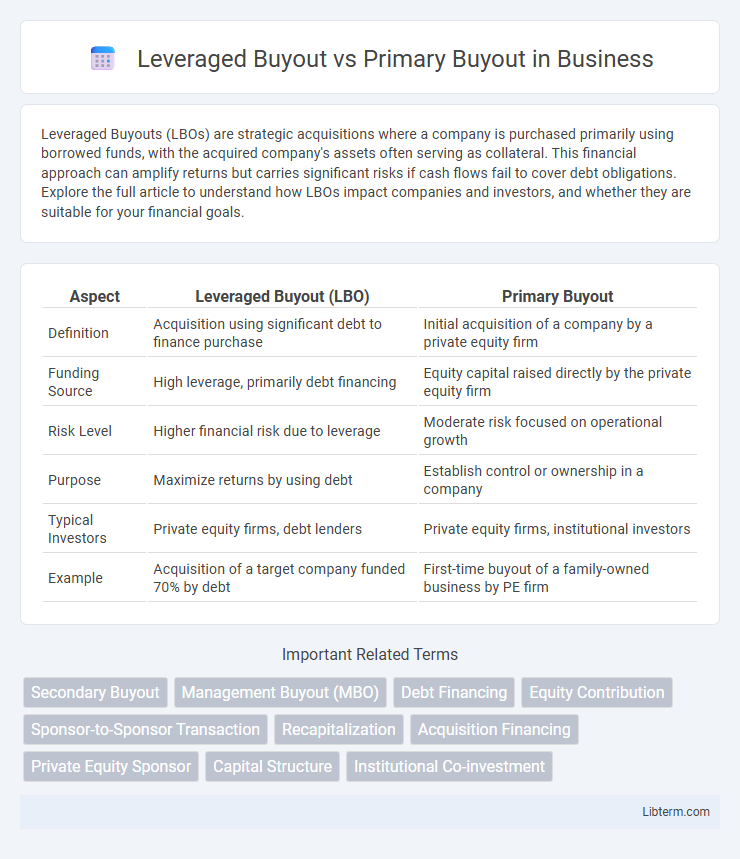

| Aspect | Leveraged Buyout (LBO) | Primary Buyout |

|---|---|---|

| Definition | Acquisition using significant debt to finance purchase | Initial acquisition of a company by a private equity firm |

| Funding Source | High leverage, primarily debt financing | Equity capital raised directly by the private equity firm |

| Risk Level | Higher financial risk due to leverage | Moderate risk focused on operational growth |

| Purpose | Maximize returns by using debt | Establish control or ownership in a company |

| Typical Investors | Private equity firms, debt lenders | Private equity firms, institutional investors |

| Example | Acquisition of a target company funded 70% by debt | First-time buyout of a family-owned business by PE firm |

Introduction to Buyouts

Buyouts involve acquiring a controlling interest in a company, with leveraged buyouts (LBOs) using significant debt to finance the purchase, whereas primary buyouts typically refer to initial acquisitions made by private equity firms. Leveraged buyouts optimize capital structure by combining equity and borrowed funds to enhance returns, often targeting mature companies with stable cash flows. Primary buyouts serve as foundational investments, establishing control and strategic direction for portfolio growth.

Defining Leveraged Buyout (LBO)

A Leveraged Buyout (LBO) involves acquiring a company primarily through debt financing, where the assets of the target company serve as collateral for the borrowed funds. This strategy aims to maximize returns by using leverage to increase the potential equity gain, often leading to significant operational improvements post-acquisition. In contrast, a Primary Buyout typically refers to the initial acquisition of a company's shares, often by private equity firms, without the extensive use of debt characteristic of LBOs.

Understanding Primary Buyout

Primary buyout involves the acquisition of a company directly from the original owners or founders, often through private equity firms purchasing a controlling stake. This type of leveraged buyout (LBO) focuses on capital infusion for growth, restructuring, or to drive operational improvements, distinguishing it from secondary buyouts where ownership is transferred between financial investors. Understanding primary buyouts is crucial for recognizing early-stage value creation and strategic repositioning within private equity investments.

Key Differences Between LBO and Primary Buyout

Leveraged Buyouts (LBOs) involve acquiring a company using a significant amount of borrowed funds, leveraging the target's assets as collateral, while Primary Buyouts specifically denote the initial purchase of a company's equity directly from its founders or original owners. A key difference lies in the transaction stage: LBOs can occur at multiple company lifecycle points, but Primary Buyouts signify the first institutional private equity investment in the business. Additionally, Primary Buyouts typically emphasize growth potential and operational improvement, whereas LBOs often focus on financial engineering and debt repayment strategies.

Financial Structure and Funding Sources

Leveraged Buyouts (LBOs) primarily rely on high levels of debt financing, often comprising 60-80% of the acquisition price, with the remainder funded by equity from private equity firms. Primary Buyouts typically involve a greater equity proportion, sourced directly from private equity investors or institutional funds, with lower reliance on leverage to enhance control and reduce financial risk. The financial structure of LBOs emphasizes debt service capability through target company cash flows, while Primary Buyouts focus on strategic equity investment to support growth and operational improvements.

Risk Assessment and Mitigation

Leveraged buyouts (LBOs) involve significant debt financing, increasing financial risk due to high leverage ratios and potential cash flow constraints, requiring rigorous risk assessment through stress testing and scenario analysis. Primary buyouts, often involving private equity firms acquiring a company for the first time, carry risks related to market entry and asset valuation, necessitating thorough due diligence and strategic negotiation to mitigate overpayment and integration challenges. Effective risk mitigation in both involves rigorous financial modeling, diversification strategies, and structured covenants to protect investment returns and reduce exposure under volatile conditions.

Strategic Objectives and Value Creation

Leveraged buyouts (LBOs) primarily focus on acquiring undervalued companies using significant debt to enhance returns through financial engineering and operational improvements, aiming to maximize short- to medium-term value creation. Primary buyouts target companies at earlier growth stages or newly formed entities, emphasizing strategic expansion, market penetration, and long-term value through active management and capital investment. Both strategies seek operational efficiencies and revenue growth but differ in risk profiles, investment horizons, and the balance between financial leverage and strategic growth initiatives.

Common Industries and Market Trends

Leveraged buyouts (LBOs) frequently target industries with stable cash flows such as manufacturing, healthcare, and consumer goods to support high debt levels, while primary buyouts often focus on technology, fintech, and renewable energy sectors with strong growth potential. Market trends indicate an increasing preference for primary buyouts in emerging markets driven by innovation and digital transformation, whereas LBOs remain prominent in mature industries with established market positions. Private equity firms are adapting strategies by leveraging sector-specific expertise and data analytics to optimize deal structures and value creation in both buyout types.

Legal and Regulatory Considerations

Legal and regulatory considerations for leveraged buyouts (LBOs) emphasize compliance with debt covenants, securities regulations, and antitrust laws due to the high leverage and complex financing structures involved. Primary buyouts, often funded by private equity firms acquiring a company's equity stake, require thorough due diligence to ensure adherence to fiduciary duties and shareholder approval under corporate governance rules. Both transaction types must navigate jurisdiction-specific disclosure requirements, tax implications, and potential regulatory approvals to mitigate legal risks and ensure deal validity.

Conclusion: Choosing the Right Buyout Approach

Selecting the appropriate buyout approach depends on the company's financial structure and growth objectives, where leveraged buyouts (LBOs) utilize significant debt to maximize returns and require strong cash flows for debt servicing. Primary buyouts, often involving minority or majority equity stakes without excessive leverage, focus on operational improvements and strategic growth. A careful assessment of risk tolerance, market conditions, and long-term value creation goals ensures the chosen buyout aligns with investor and company priorities.

Leveraged Buyout Infographic

libterm.com

libterm.com