A market order ensures your trade is executed immediately at the best available price, prioritizing speed over price control. This type of order is ideal when you need to enter or exit a position quickly in volatile markets. Discover how using a market order can impact your trading strategy as you read further.

Table of Comparison

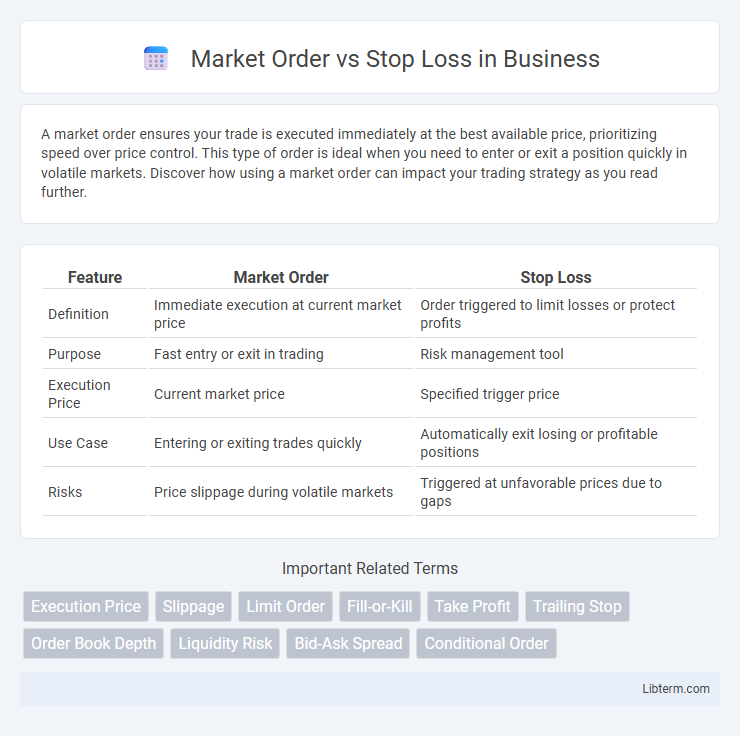

| Feature | Market Order | Stop Loss |

|---|---|---|

| Definition | Immediate execution at current market price | Order triggered to limit losses or protect profits |

| Purpose | Fast entry or exit in trading | Risk management tool |

| Execution Price | Current market price | Specified trigger price |

| Use Case | Entering or exiting trades quickly | Automatically exit losing or profitable positions |

| Risks | Price slippage during volatile markets | Triggered at unfavorable prices due to gaps |

Market Order vs Stop Loss: Key Differences

Market orders execute trades immediately at the current market price, ensuring fast transaction completion without price guarantees. Stop loss orders activate a market or limit order only when a specified price threshold is reached, providing risk management by limiting potential losses. The key difference lies in timing and purpose: market orders prioritize speed and execution, while stop loss orders focus on protecting investments by triggering trades under adverse price movements.

Understanding Market Orders

Market orders execute trades immediately at the current best available price, ensuring quick transaction completion in fast-moving markets. These orders prioritize speed over price certainty, making them ideal for traders seeking instant entry or exit. Understanding market orders helps investors manage liquidity and capitalize on rapid price changes without delay.

How Stop Loss Orders Work

Stop loss orders automatically trigger a market sell or buy order once an asset's price reaches a specified level, helping traders limit potential losses and protect profits in volatile markets. Unlike market orders, which execute immediately at the current price, stop loss orders remain inactive until the stop price is hit, ensuring disciplined exit strategies. This conditional execution reduces emotional decision-making and helps manage risk effectively in dynamic trading environments.

Pros and Cons of Market Orders

Market orders provide immediate execution by buying or selling assets at the current market price, ensuring quick entry or exit from positions. A key advantage is their certainty of execution, but this often comes at the cost of price slippage, especially in volatile markets or with low liquidity. However, market orders expose traders to potentially unfavorable prices, making them less ideal for precise price control compared to limit or stop orders.

Advantages and Risks of Stop Loss Orders

Stop loss orders provide traders with a strategic tool to limit potential losses by automatically selling an asset when its price falls to a predetermined level, offering risk management and emotional discipline. They help protect profits and minimize exposure during volatile market conditions but carry risks such as slippage and execution at unfavorable prices during rapid price movements. Unlike market orders that execute immediately at current prices, stop loss orders ensure exits are only triggered under specified conditions, enhancing control over trade outcomes.

When to Use Market Orders

Market orders should be used when immediate execution of a trade is crucial, such as in rapidly moving markets or when entering or exiting a position quickly is a priority. They guarantee trade execution at the current market price, making them ideal for high liquidity assets like stocks, forex, or cryptocurrencies during active trading hours. Traders prioritize market orders when price certainty is less important than speed and certainty of execution to capitalize on time-sensitive opportunities or manage risk swiftly.

Best Scenarios for Stop Loss Orders

Stop loss orders are best utilized in volatile markets to limit potential losses by automatically selling an asset once it reaches a predetermined price, helping traders manage risk effectively. They are particularly beneficial during sudden price declines or unexpected market events where prompt exit is crucial. Employing stop loss orders in trending markets also helps lock in profits by protecting gains without requiring constant monitoring.

Impact on Trading Strategy

Market orders execute trades immediately at the current best available price, ensuring entry or exit but exposing traders to potential slippage during high volatility. Stop loss orders automatically trigger a market order once a specified price is reached, effectively limiting downside risk and preserving capital in volatile markets. Integrating both order types strategically enhances trade management by balancing execution certainty with risk control, crucial for optimizing overall trading performance.

Common Mistakes to Avoid

Traders often confuse market orders with stop loss orders, leading to unintended executions and losses. A common mistake is placing a market order expecting it to act like a stop loss, which can result in buying or selling at unfavorable prices during volatile market conditions. Another error involves setting stop loss orders too close to the current price, causing premature exits triggered by normal market fluctuations instead of genuine trend reversals.

Choosing the Right Order Type for Your Goals

Choosing the right order type depends on your trading goals and risk tolerance, with market orders prioritizing immediate execution at the current price and stop loss orders designed to limit losses by triggering a sell when a specified price is reached. Market orders are ideal for traders seeking quick entry or exit, while stop loss orders are essential for risk management and protecting profits in volatile markets. Understanding your investment strategy helps determine whether speed or controlled risk mitigation aligns better with your financial objectives.

Market Order Infographic

libterm.com

libterm.com