Gross profit reflects the difference between your company's revenue and the cost of goods sold, serving as a key indicator of financial health. Understanding this metric can help you assess pricing strategies and operational efficiency to maximize profitability. Explore the rest of the article to learn how to effectively analyze and improve your gross profit.

Table of Comparison

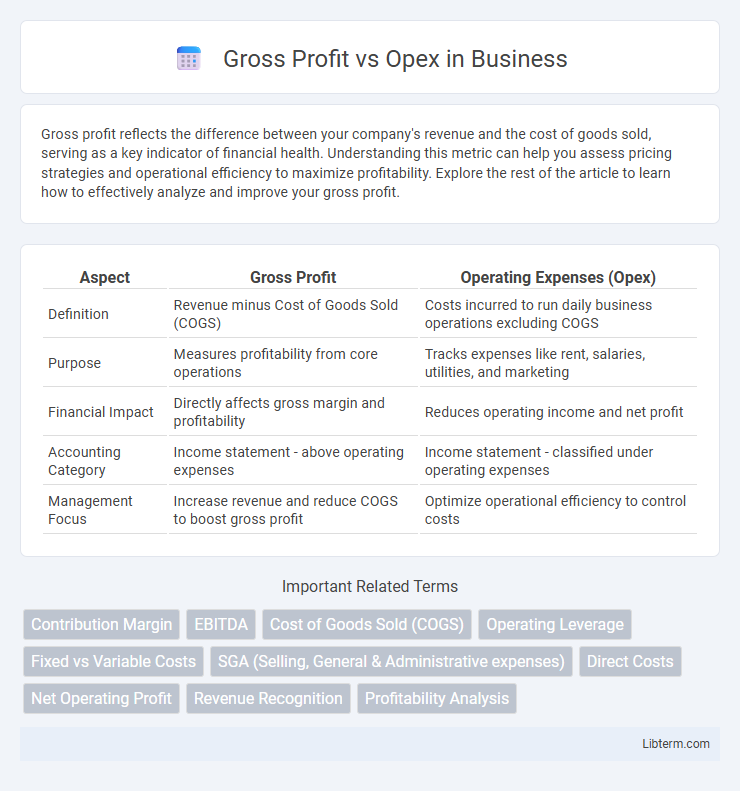

| Aspect | Gross Profit | Operating Expenses (Opex) |

|---|---|---|

| Definition | Revenue minus Cost of Goods Sold (COGS) | Costs incurred to run daily business operations excluding COGS |

| Purpose | Measures profitability from core operations | Tracks expenses like rent, salaries, utilities, and marketing |

| Financial Impact | Directly affects gross margin and profitability | Reduces operating income and net profit |

| Accounting Category | Income statement - above operating expenses | Income statement - classified under operating expenses |

| Management Focus | Increase revenue and reduce COGS to boost gross profit | Optimize operational efficiency to control costs |

Introduction to Gross Profit and Operating Expenses (OPEX)

Gross profit represents the revenue remaining after subtracting the cost of goods sold (COGS), highlighting the core profitability of a company's products or services. Operating expenses (OPEX) include costs related to day-to-day business operations such as rent, utilities, salaries, and marketing expenses. Analyzing gross profit alongside OPEX provides insight into a company's operational efficiency and overall financial health.

Defining Gross Profit: Meaning and Calculation

Gross profit represents the difference between total revenue and the cost of goods sold (COGS), highlighting the core profitability of a company's production activities. It is calculated by subtracting COGS from total sales revenue, providing insight into how efficiently a business produces and sells its products. Understanding gross profit helps organizations assess their pricing strategies, production costs, and inventory management before accounting for operational expenses (Opex).

Understanding Operating Expenses (OPEX)

Operating Expenses (OPEX) represent the regular costs a business incurs to maintain its daily operations, including salaries, rent, utilities, and marketing expenses. Unlike Gross Profit, which reflects revenue minus the cost of goods sold (COGS), OPEX impacts net profit by encompassing overhead and administrative costs not directly tied to production. Efficient management of OPEX is crucial for sustaining profitability and supporting long-term business growth.

Key Differences Between Gross Profit and OPEX

Gross profit represents the revenue remaining after deducting the cost of goods sold (COGS), highlighting the core profitability from production or sales activities. Operating expenses (OPEX) include costs such as salaries, rent, utilities, and marketing, reflecting the day-to-day expenses necessary to run the business. The key difference lies in gross profit measuring direct production efficiency, while OPEX captures overhead costs unrelated to production.

Gross Profit vs OPEX: Impact on Financial Statements

Gross profit reflects the revenue remaining after deducting the cost of goods sold, directly indicating a company's production efficiency and pricing strategy. Operating expenses (OPEX), including selling, general, and administrative costs, impact the income statement by reducing operating income and overall profitability. Analyzing the relationship between gross profit and OPEX is crucial for assessing operational efficiency, cost management, and the company's ability to generate sustainable earnings on financial statements.

Why Tracking Gross Profit Matters

Tracking gross profit matters because it reveals the core profitability of a company's products or services by subtracting direct costs from revenue, highlighting operational efficiency. Monitoring gross profit allows businesses to identify cost control opportunities and price optimization strategies crucial for sustainable growth. Ignoring this metric risks overlooking declining product margins that could erode overall financial health despite stable revenue streams.

Importance of Managing Operating Expenses

Gross profit represents the revenue remaining after deducting the cost of goods sold, highlighting a company's core profitability, while operating expenses (Opex) include costs like salaries, rent, and utilities necessary to run daily operations. Efficient management of operating expenses is crucial for maintaining healthy profit margins and ensuring sustainable business growth, as uncontrolled Opex can erode gross profit and reduce net income. Strategic cost control and regular Opex analysis enable businesses to optimize resource allocation, improve cash flow, and strengthen competitive advantage.

Gross Profit Margin vs Operating Profit Margin

Gross Profit Margin measures the percentage of revenue remaining after deducting cost of goods sold, highlighting efficiency in production and pricing strategies. Operating Profit Margin goes further by accounting for operating expenses (Opex), reflecting overall operational efficiency and management effectiveness. Comparing these margins helps identify whether high gross profits are offset by excessive operating costs, impacting the company's profitability and financial health.

Common Mistakes in Analyzing Gross Profit and OPEX

Confusing gross profit with operating expenses leads to inaccurate financial analysis, as gross profit represents revenue minus cost of goods sold while OPEX covers daily operational costs excluding production. Overlooking the impact of non-operational expenses and failing to separate fixed and variable operational costs often skews budget forecasting and profitability assessments. Misinterpreting gross profit margins without considering OPEX fluctuations distorts the true operational efficiency and company performance.

Strategies to Optimize Gross Profit and Control OPEX

Maximizing gross profit involves increasing revenue through pricing strategies, product mix optimization, and improving sales efficiency while reducing the cost of goods sold (COGS) via supplier negotiations and inventory management. Controlling operating expenses (OPEX) requires rigorous budgeting, streamlining administrative processes, and leveraging automation technologies to lower fixed and variable costs. Businesses that balance gross profit enhancement with disciplined OPEX control achieve stronger operating margins and sustainable profitability.

Gross Profit Infographic

libterm.com

libterm.com