A Private Limited Company is a popular business structure offering limited liability protection to its shareholders while maintaining flexible management. It enables you to raise capital privately without public share trading, ensuring greater control over operations. Explore the full article to understand how forming a Private Limited Company can benefit your business growth.

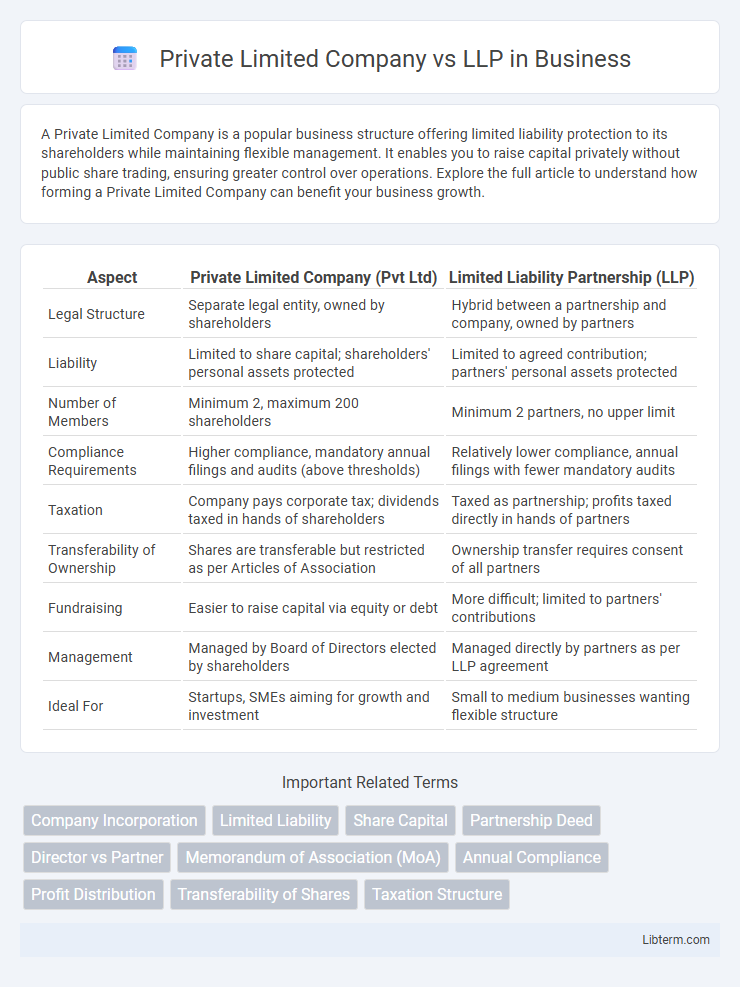

Table of Comparison

| Aspect | Private Limited Company (Pvt Ltd) | Limited Liability Partnership (LLP) |

|---|---|---|

| Legal Structure | Separate legal entity, owned by shareholders | Hybrid between a partnership and company, owned by partners |

| Liability | Limited to share capital; shareholders' personal assets protected | Limited to agreed contribution; partners' personal assets protected |

| Number of Members | Minimum 2, maximum 200 shareholders | Minimum 2 partners, no upper limit |

| Compliance Requirements | Higher compliance, mandatory annual filings and audits (above thresholds) | Relatively lower compliance, annual filings with fewer mandatory audits |

| Taxation | Company pays corporate tax; dividends taxed in hands of shareholders | Taxed as partnership; profits taxed directly in hands of partners |

| Transferability of Ownership | Shares are transferable but restricted as per Articles of Association | Ownership transfer requires consent of all partners |

| Fundraising | Easier to raise capital via equity or debt | More difficult; limited to partners' contributions |

| Management | Managed by Board of Directors elected by shareholders | Managed directly by partners as per LLP agreement |

| Ideal For | Startups, SMEs aiming for growth and investment | Small to medium businesses wanting flexible structure |

Introduction: Private Limited Company vs LLP

A Private Limited Company (PLC) is a business structure that limits shareholders' liability to their investment and restricts share transferability, promoting controlled ownership and easier capital accumulation. A Limited Liability Partnership (LLP) combines partnership flexibility with limited liability protection for partners, making it ideal for professional businesses seeking operational freedom and reduced personal risk. Both entities offer distinct legal advantages, tax implications, and compliance requirements tailored to different business needs.

Legal Structure and Formation

A Private Limited Company (PLC) is a separate legal entity owned by shareholders, requiring at least two directors and shareholders for incorporation under the Companies Act, with a defined share capital. In contrast, a Limited Liability Partnership (LLP) combines the flexibility of a partnership with limited liability protection, formed by at least two designated partners under the LLP Act, and does not require share capital. The PLC is subject to stringent compliance and governance norms, while LLPs benefit from simpler regulatory requirements, making each suitable for different business needs based on legal structure and formation processes.

Ownership and Management

A Private Limited Company is owned by shareholders, with ownership divided through equity shares, while an LLP (Limited Liability Partnership) is owned by partners who contribute capital and share profits as per agreement. In a Private Limited Company, management is typically handled by a board of directors appointed by shareholders, enabling structured corporate governance. Conversely, in an LLP, partners actively manage operations, granting flexibility and direct control over business decisions.

Liability of Members

In a Private Limited Company, the liability of members is limited to the amount unpaid on their shares, protecting personal assets beyond their investment. In contrast, an LLP (Limited Liability Partnership) offers limited liability protection to all partners, restricting their liability to their agreed contribution without exposing personal assets. Both structures provide a safeguard against business debts, but LLPs combine elements of partnership flexibility with limited liability.

Compliance and Regulatory Requirements

Private Limited Companies (PLCs) face more stringent compliance requirements, including mandatory annual general meetings, detailed financial disclosures, and adherence to the Companies Act, 2013, whereas Limited Liability Partnerships (LLPs) benefit from simplified compliance with fewer mandatory filings under the LLP Act, 2008. PLCs must maintain a prescribed board of directors and conduct regular board meetings, while LLPs require designated partners but have more flexible operational regulations. Both entities must file annual returns and financial statements, but the procedural burden is significantly lower for LLPs, making them preferable for businesses seeking minimal regulatory interference.

Taxation Differences

Private Limited Companies (PLCs) are taxed at a corporate tax rate of 25-30%, with dividends distributed to shareholders often subject to additional taxation, leading to potential double taxation. Limited Liability Partnerships (LLPs) are taxed as partnerships, with profits directly taxed at individual partners' income tax rates, avoiding corporate-level tax and providing a more flexible tax structure. While PLCs benefit from easier access to capital markets and credibility, LLPs offer simplified compliance and tax efficiency for small to medium-sized enterprises.

Fundraising and Investment Opportunities

Private Limited Companies have greater access to fundraising through equity investment by issuing shares to multiple investors, including venture capitalists and angel investors, providing a scalable route for capital infusion. Limited Liability Partnerships (LLPs) face more restrictions in attracting external equity investors as they cannot issue shares, limiting their ability to raise funds primarily to partner contributions and debt. Consequently, Private Limited Companies offer more structured opportunities for investment rounds and expansion, making them more favorable for startups seeking significant growth funding.

Transferability of Ownership

Transferability of ownership in a Private Limited Company is relatively straightforward, as shares can be transferred to new or existing shareholders subject to company approval and restrictions in the Articles of Association. In contrast, an LLP requires the consent of all partners to transfer ownership interests, making the process more restrictive and requiring changes to the LLP agreement. The Private Limited Company structure offers greater liquidity and ease of ownership transfer compared to the more controlled and consensual transfer process in an LLP.

Suitability for Different Types of Businesses

Private Limited Companies suit startups and small to medium enterprises seeking equity funding with defined shareholder roles, providing limited liability and easier access to investors. Limited Liability Partnerships (LLPs) are ideal for professional services firms and businesses valuing flexible management structures and minimal compliance requirements while maintaining limited liability for partners. Choosing between the two depends on factors like business scale, funding needs, management preferences, and regulatory compliance.

Conclusion: Choosing the Right Structure

Choosing between a Private Limited Company and an LLP depends on factors such as liability protection, compliance requirements, and tax implications. A Private Limited Company offers easier access to funding and is suitable for businesses planning large-scale operations, while an LLP provides flexible management and is ideal for professional services with fewer compliance burdens. Assessing long-term business goals, capital needs, and operational complexity will help determine the optimal legal structure for growth and risk mitigation.

Private Limited Company Infographic

libterm.com

libterm.com