Institutional investors play a crucial role in global financial markets by managing large pools of capital and influencing market trends through strategic investments. Understanding their investment behavior can provide valuable insights for individual investors aiming to optimize portfolio performance. Discover how institutional investor strategies impact your financial decisions by reading the rest of this article.

Table of Comparison

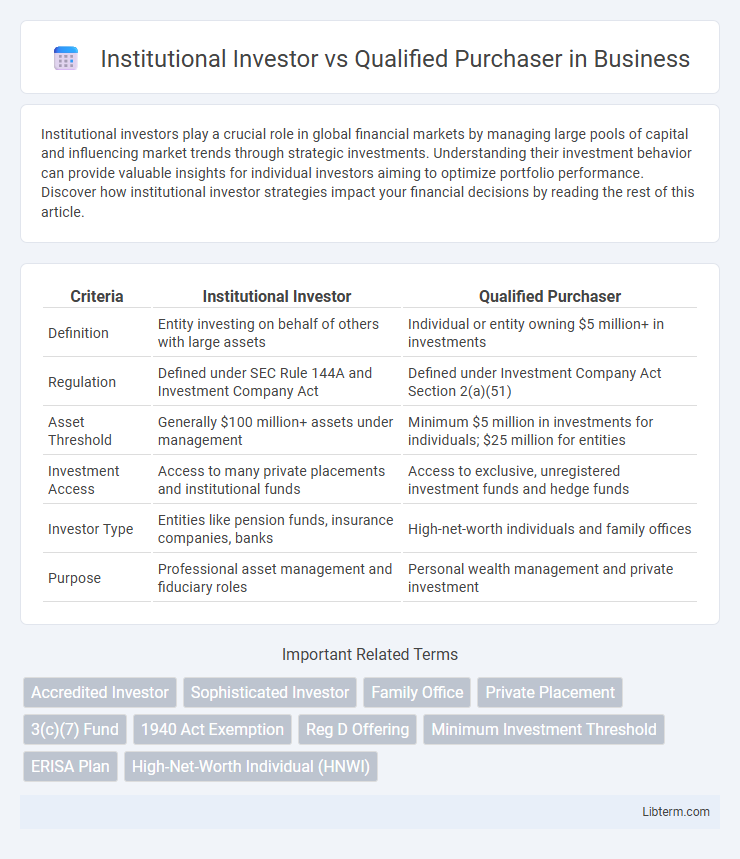

| Criteria | Institutional Investor | Qualified Purchaser |

|---|---|---|

| Definition | Entity investing on behalf of others with large assets | Individual or entity owning $5 million+ in investments |

| Regulation | Defined under SEC Rule 144A and Investment Company Act | Defined under Investment Company Act Section 2(a)(51) |

| Asset Threshold | Generally $100 million+ assets under management | Minimum $5 million in investments for individuals; $25 million for entities |

| Investment Access | Access to many private placements and institutional funds | Access to exclusive, unregistered investment funds and hedge funds |

| Investor Type | Entities like pension funds, insurance companies, banks | High-net-worth individuals and family offices |

| Purpose | Professional asset management and fiduciary roles | Personal wealth management and private investment |

Understanding Institutional Investors

Institutional investors are entities such as pension funds, insurance companies, and mutual funds that invest large sums of money on behalf of clients, aiming for diversified, long-term growth. They differ from qualified purchasers, who are typically high-net-worth individuals or entities meeting specific asset thresholds under the Investment Company Act of 1940. Understanding institutional investors involves recognizing their regulatory frameworks, fiduciary responsibilities, and preference for investment vehicles that offer transparency and risk management.

Defining Qualified Purchasers

Qualified Purchasers are defined under Section 2(a)(51) of the Investment Company Act of 1940 as individuals or entities owning at least $5 million in investments, positioning them as more sophisticated investors compared to Institutional Investors. While Institutional Investors typically include banks, insurance companies, and pension funds actively managing large portfolios, Qualified Purchasers hold a higher threshold of investment power, often enabling access to exclusive hedge funds and private equity offerings. This designation ensures they possess the financial sophistication and capacity to bear the risks associated with complex investment opportunities, distinguishing their regulatory treatment and eligibility from general Institutional Investors.

Key Regulatory Differences

Institutional Investors are defined under the Investment Company Act of 1940 and primarily include entities managing large pools of capital, such as banks and insurance companies, subject to broad regulatory scrutiny. Qualified Purchasers, outlined in the Investment Company Act Section 2(a)(51), represent wealthier individuals or entities holding at least $5 million in investments, enabling access to certain private investment funds with fewer regulatory restrictions. Key regulatory differences include the scope of permissible investments, disclosure requirements, and eligibility for private fund offerings, with Qualified Purchasers enjoying greater exemptions from registration and reporting compared to general Institutional Investors.

Eligibility Criteria Compared

Institutional investors typically qualify based on assets under management (AUM) thresholds, often requiring at least $100 million in investable assets, while qualified purchasers must meet higher net worth criteria of $5 million in investments for individuals or $25 million for institutions. Institutional investor status is primarily determined by regulatory definitions under securities laws such as the Investment Company Act of 1940, whereas qualified purchaser status is defined under the Investment Advisers Act of 1940 for more exclusive private placements. The qualified purchaser category targets a more sophisticated investor base with greater financial capacity and market experience than the broader institutional investor group, impacting eligibility for certain private fund offerings.

Investment Opportunities and Access

Institutional Investors, such as pension funds and insurance companies, typically have broader access to diverse investment opportunities, including mutual funds and large-scale private placements, due to regulatory standards and asset size. Qualified Purchasers, defined by the SEC as individuals or entities owning at least $5 million in investments, gain exclusive entry to certain private investment funds and limited partnerships unavailable to others. This distinction enhances Qualified Purchasers' access to niche markets and alternative investments, optimizing portfolio diversification and potential returns.

Legal Framework and Compliance

Institutional investors operate under regulatory frameworks such as the Investment Company Act of 1940 and the SEC's rules, ensuring adherence to strict disclosure and compliance requirements to protect client assets. Qualified purchasers, defined under Section 2(a)(51) of the Investment Company Act, represent individuals or entities with at least $5 million in investments, exempting them from certain regulatory protections but requiring sophisticated knowledge and compliance with private fund regulations. Both categories require meticulous compliance programs to navigate securities laws and maintain eligibility for specialized investment opportunities.

Risk Profiles and Investment Strategies

Institutional investors typically manage large pools of capital, such as pension funds or insurance companies, and often pursue diversified, risk-managed strategies with a focus on long-term returns and regulatory compliance. Qualified purchasers, defined by the SEC as individuals or entities owning at least $5 million in investments, generally have higher risk tolerance and access to exclusive private placements and hedge funds that employ aggressive growth and alternative investment strategies. The risk profile of qualified purchasers allows them to engage in less liquid and more volatile investments compared to institutional investors who prioritize stability and regulatory constraints.

Role in Private Markets

Institutional investors, including pension funds, insurance companies, and endowments, play a critical role in private markets by providing significant capital and long-term investment horizons that support private equity and real estate funds. Qualified purchasers, defined by the SEC as individuals or entities with at least $5 million in investments, are essential for accessing exclusive private market opportunities such as hedge funds and private placements that require higher levels of investor sophistication and financial capacity. The distinction between institutional investors and qualified purchasers influences regulatory requirements and investment strategies, shaping the dynamics and accessibility of private market investments.

Advantages and Limitations

Institutional investors benefit from regulatory exemptions and access to a wide range of investment opportunities but face stricter compliance requirements and potential limitations on capital deployment. Qualified purchasers enjoy greater investment flexibility, lower regulatory burdens, and eligibility for exclusive private placements, though they must meet higher asset thresholds, limiting accessibility. Both categories offer distinct advantages for portfolio diversification and risk management, yet their limitations impact investor eligibility and investment scope.

Choosing the Right Investor Category

Choosing the right investor category between Institutional Investor and Qualified Purchaser hinges on regulatory definitions under the Investment Company Act of 1940 and the Investment Advisers Act of 1940. Institutional Investors typically include entities such as banks, insurance companies, pension plans, and mutual funds with substantial assets under management, while Qualified Purchasers are high-net-worth individuals or family-owned companies owning at least $5 million in investments or institutions with $25 million or more in investments. Accurate classification impacts access to private funds, exemption availability, and compliance complexity, optimizing capital raising strategies and legal safeguards.

Institutional Investor Infographic

libterm.com

libterm.com