An Initial Public Offering (IPO) marks the first time a company sells its shares to the public, allowing it to raise capital for expansion and operations. This process involves rigorous regulatory scrutiny and provides investors an opportunity to own part of the company and benefit from its growth. Explore the rest of the article to understand how an IPO can impact your investment portfolio and the steps involved in this significant financial event.

Table of Comparison

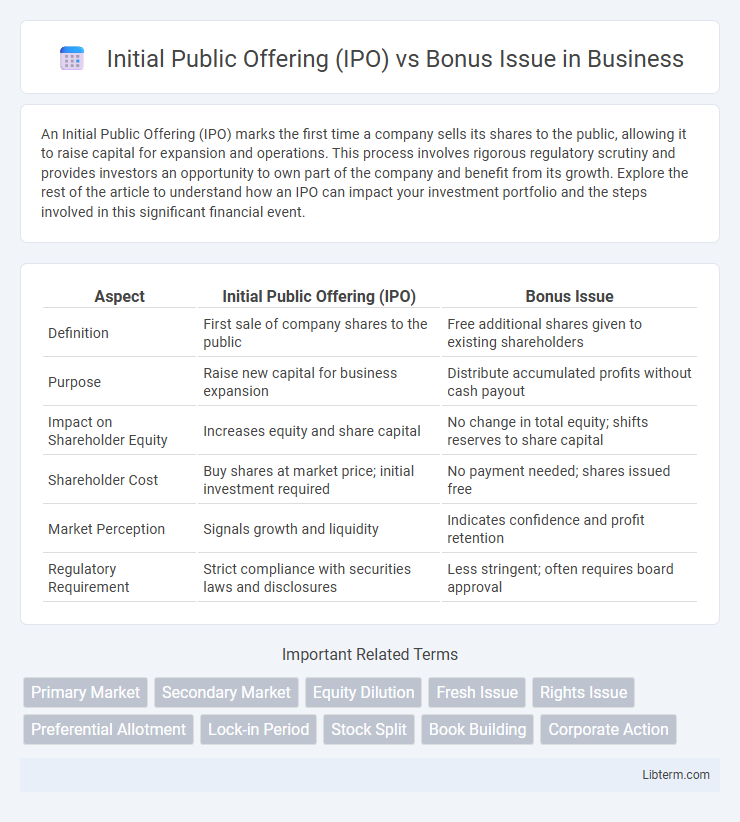

| Aspect | Initial Public Offering (IPO) | Bonus Issue |

|---|---|---|

| Definition | First sale of company shares to the public | Free additional shares given to existing shareholders |

| Purpose | Raise new capital for business expansion | Distribute accumulated profits without cash payout |

| Impact on Shareholder Equity | Increases equity and share capital | No change in total equity; shifts reserves to share capital |

| Shareholder Cost | Buy shares at market price; initial investment required | No payment needed; shares issued free |

| Market Perception | Signals growth and liquidity | Indicates confidence and profit retention |

| Regulatory Requirement | Strict compliance with securities laws and disclosures | Less stringent; often requires board approval |

Introduction to IPOs and Bonus Issues

An Initial Public Offering (IPO) is the process through which a private company offers its shares to the public for the first time, enabling it to raise capital from external investors. Bonus Issues, also known as stock dividends, involve the distribution of additional shares to existing shareholders without any additional cost, typically issued from the company's reserves. While IPOs serve as a primary capital-raising tool, Bonus Issues function as a way to reward shareholders and increase share liquidity without altering the company's market capitalization.

Defining Initial Public Offering (IPO)

An Initial Public Offering (IPO) is the first sale of a company's shares to the public, enabling the company to raise capital from external investors by listing on a stock exchange. Unlike a bonus issue, which involves distributing additional shares to existing shareholders without raising new funds, an IPO is focused on capital generation and expanding the company's shareholder base. The IPO process includes regulatory approvals, underwriting, and pricing, marking a critical transition from a private entity to a publicly traded company.

Understanding Bonus Issue in Corporate Finance

A Bonus Issue in corporate finance involves distributing additional shares to existing shareholders without any extra cost, increasing the total shares outstanding while maintaining the company's market capitalization. Unlike an Initial Public Offering (IPO), where new shares are sold to the public to raise capital, a Bonus Issue is a method of rewarding shareholders by capitalizing reserves into share capital. This strategy enhances liquidity and can improve stock market perception without diluting shareholder value or raising fresh funds.

Key Differences Between IPO and Bonus Issue

An Initial Public Offering (IPO) involves a private company offering its shares to the public for the first time to raise capital, whereas a Bonus Issue is the distribution of additional shares to existing shareholders without any cost, aimed at rewarding shareholders. IPOs create new shareholders and increase the total shares outstanding, while Bonus Issues increase the number of shares held by current investors without raising fresh funds. The IPO process involves regulatory approvals and market listing, whereas Bonus Issues typically require board approval and do not impact company ownership percentages.

Objectives and Purposes of IPOs

Initial Public Offerings (IPOs) primarily aim to raise capital for business expansion, debt reduction, and enhanced market visibility by offering shares to the public for the first time. Unlike bonus issues, which distribute additional shares to existing shareholders without raising new funds, IPOs are strategic moves to attract new investors and fund long-term growth objectives. The capital influx from IPOs supports research and development, infrastructure improvements, and competitive positioning in the market.

Objectives and Purposes of Bonus Issues

Bonus issues aim to reward existing shareholders by distributing additional shares without any cost, enhancing share liquidity and signaling company confidence in future prospects. Unlike an IPO, which raises new capital by offering shares to the public, bonus issues capitalize company reserves to increase the total number of shares. This practice helps maintain share price stability and improves marketability while retaining shareholder value.

Impact on Shareholders: IPO vs Bonus Issue

An Initial Public Offering (IPO) impacts shareholders by introducing new investors and potentially diluting existing ownership, as shares are issued to raise capital from the public. A Bonus Issue, however, benefits existing shareholders by increasing their shareholding proportion without additional investment, as free shares are distributed based on current holdings. While IPOs can alter control dynamics and market perception, Bonus Issues primarily enhance shareholder value through increased share quantity and improved liquidity.

Market Implications and Stock Performance

Initial Public Offerings (IPOs) introduce new shares to the market, often boosting liquidity and attracting investor interest, which can drive stock prices upward due to perceived growth potential. Bonus Issues distribute additional shares to existing shareholders without raising new capital, typically signaling company confidence and enhancing market sentiment, but may dilute earnings per share, leading to mixed effects on stock performance. While IPOs can cause significant short-term volatility as markets price new equity, Bonus Issues tend to stabilize stock prices by rewarding shareholders and maintaining market activity.

Regulatory Framework and Compliance

Initial Public Offerings (IPOs) and Bonus Issues operate under distinct regulatory frameworks with IPOs governed by stringent securities laws, requiring detailed disclosures and approvals from regulatory bodies such as the Securities and Exchange Commission (SEC) or equivalent authorities. Bonus Issues, typically governed by company law and stock exchange regulations, involve the allocation of additional shares to existing shareholders without new capital inflow, requiring compliance with share capital rules and shareholder approval. Both processes mandate adherence to stringent compliance standards to ensure transparency, investor protection, and market integrity.

Choosing Between IPO and Bonus Issue: Strategic Considerations

Choosing between an Initial Public Offering (IPO) and a Bonus Issue depends on a company's strategic goals such as capital raising, shareholder value enhancement, and market positioning. IPOs enable firms to raise fresh equity capital from the public, fueling expansion and debt reduction, whereas Bonus Issues distribute additional shares to existing shareholders without raising new funds, aiming to increase liquidity and marketability. Companies prioritizing external funding and broadening ownership typically favor IPOs, while those focusing on rewarding shareholders and maintaining control often opt for Bonus Issues.

Initial Public Offering (IPO) Infographic

libterm.com

libterm.com