Book value represents the net asset value of a company, calculated by subtracting liabilities from total assets, reflecting the company's intrinsic worth on the balance sheet. It serves as a fundamental metric for investors to assess whether a stock is undervalued or overvalued compared to its market price. Discover how understanding book value can enhance your investment decisions by reading the full article.

Table of Comparison

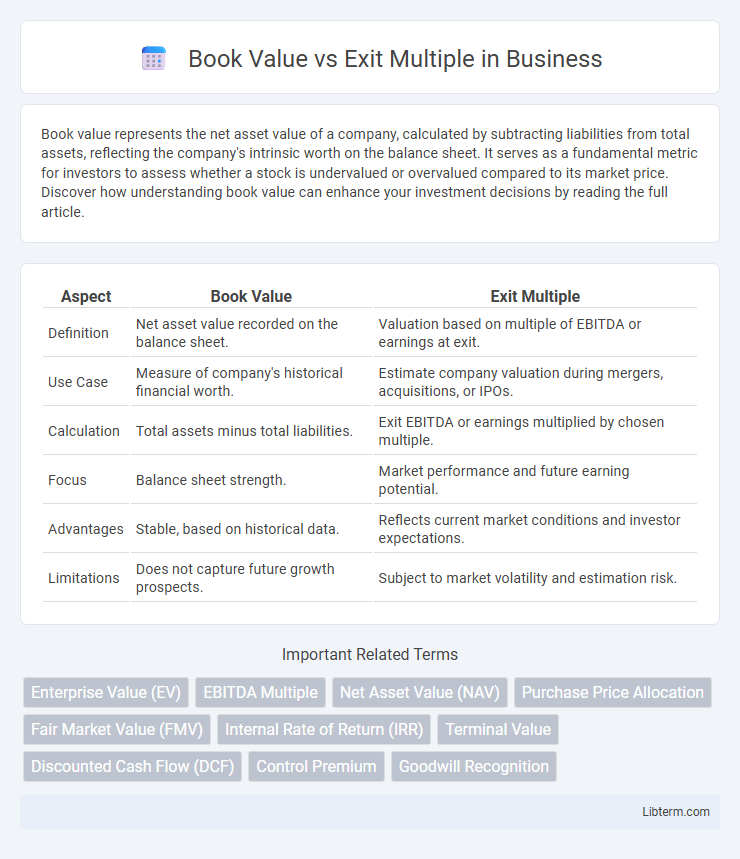

| Aspect | Book Value | Exit Multiple |

|---|---|---|

| Definition | Net asset value recorded on the balance sheet. | Valuation based on multiple of EBITDA or earnings at exit. |

| Use Case | Measure of company's historical financial worth. | Estimate company valuation during mergers, acquisitions, or IPOs. |

| Calculation | Total assets minus total liabilities. | Exit EBITDA or earnings multiplied by chosen multiple. |

| Focus | Balance sheet strength. | Market performance and future earning potential. |

| Advantages | Stable, based on historical data. | Reflects current market conditions and investor expectations. |

| Limitations | Does not capture future growth prospects. | Subject to market volatility and estimation risk. |

Introduction to Book Value and Exit Multiple

Book value represents the net asset value of a company, calculated as total assets minus total liabilities, serving as a fundamental measure of a firm's intrinsic worth. Exit multiple is a valuation metric used in private equity and mergers, reflecting the expected selling price of a business relative to a financial metric like EBITDA, revenue, or earnings. Comparing book value and exit multiple helps investors assess a company's current net asset value against projected market-based exit valuations for strategic decision-making.

Key Definitions: Book Value vs Exit Multiple

Book Value represents a company's net asset value, calculated as total assets minus liabilities, reflecting the accounting value on the balance sheet. Exit Multiple, commonly used in valuation, measures a company's value relative to a financial metric such as EBITDA or earnings, indicating the price at which the business can be sold. Understanding the distinction between Book Value and Exit Multiple is crucial for investors to assess intrinsic worth versus market-driven exit pricing.

Importance of Book Value in Business Valuation

Book Value represents a company's net asset value calculated as total assets minus total liabilities, serving as a fundamental baseline in business valuation. It provides a tangible measure of a company's worth based on historical cost, reflecting the equity available to shareholders in case of liquidation. Investors and analysts use Book Value to assess financial stability and compare with Exit Multiple, which estimates future sale price based on earnings metrics, ensuring a balanced valuation between intrinsic value and market expectations.

Role of Exit Multiple in Valuation Assessments

Exit multiple plays a critical role in valuation assessments by providing a market-based benchmark to estimate a company's future sale value. It reflects the expected multiple of financial metrics, such as EBITDA or revenue, that buyers are willing to pay during a transaction. Unlike book value, which measures a company's net asset value, exit multiple incorporates market conditions and growth prospects, offering a forward-looking perspective essential for investment decisions.

Core Differences Between Book Value and Exit Multiple

Book value represents a company's net asset value recorded on the balance sheet, reflecting historical cost minus liabilities. Exit multiple is a valuation metric derived from comparable company transactions, expressing enterprise value as a multiple of financial metrics like EBITDA or revenue. The core difference lies in book value's basis in accounting data versus exit multiple's market-driven approach to estimate potential sale price.

Factors Influencing Book Value Calculations

Book value calculations are influenced by factors such as asset depreciation methods, inventory valuation techniques, and the recognition of intangible assets, which directly impact a company's net asset value on the balance sheet. Market conditions and accounting policies also affect the adjustments made to asset values and liabilities, altering the precision of book value as a representation of a company's intrinsic worth. Understanding these variables is crucial when comparing book value to exit multiples, as exit multiples rely heavily on market-based valuations rather than accounting figures.

Determinants Affecting Exit Multiples

Exit multiples are primarily influenced by industry growth rates, market conditions, and comparable company performance, reflecting investors' expectations of future profitability and risk. Company-specific factors such as revenue growth, EBITDA margins, and operational efficiency directly impact the exit multiple by signaling financial health and scalability. Macroeconomic variables, including interest rates and economic cycles, also play a crucial role in shaping the valuation multiples applied during final investment exits.

Practical Applications in Mergers and Acquisitions

Book value provides a historical cost-based measure of a company's net assets, serving as a baseline for valuation during mergers and acquisitions. Exit multiple, derived from comparable company analysis or past transactions, offers a market-driven metric to estimate the acquisition price based on earnings or EBITDA multiples. Practical application involves balancing the conservative approach of book value with the market-reflective nature of exit multiples to arrive at a fair and strategic purchase price in M&A negotiations.

Pros and Cons: Book Value vs Exit Multiple

Book Value reflects a company's net asset value, offering a stable, conservative measure useful for assessing intrinsic worth but may undervalue intangible assets and growth potential. Exit Multiple provides a market-based valuation linked to comparable company transactions, capturing growth prospects and market sentiment but is susceptible to volatility and may overstate value during market peaks. Choosing between Book Value and Exit Multiple depends on the preference for asset-based stability versus market-driven growth insights in valuation analysis.

Choosing the Right Valuation Method for Your Business

Selecting the right valuation method depends on your business goals and industry standards, with Book Value emphasizing asset-based valuation by assessing net accounting value, while Exit Multiple relies on market-based benchmarks comparing company earnings or revenue to similar transactions. Book Value suits asset-intensive industries seeking a conservative estimate, whereas Exit Multiple is preferable for high-growth businesses where market comparisons reflect future earning potential more accurately. Understanding these distinctions ensures accurate valuation aligned with strategic objectives and investor expectations.

Book Value Infographic

libterm.com

libterm.com