Navigating the real estate market requires understanding key factors like location, market trends, and property values to make informed decisions. Your investment success depends on careful research and strategic planning tailored to current economic conditions. Explore the rest of the article to uncover essential tips for maximizing your real estate opportunities.

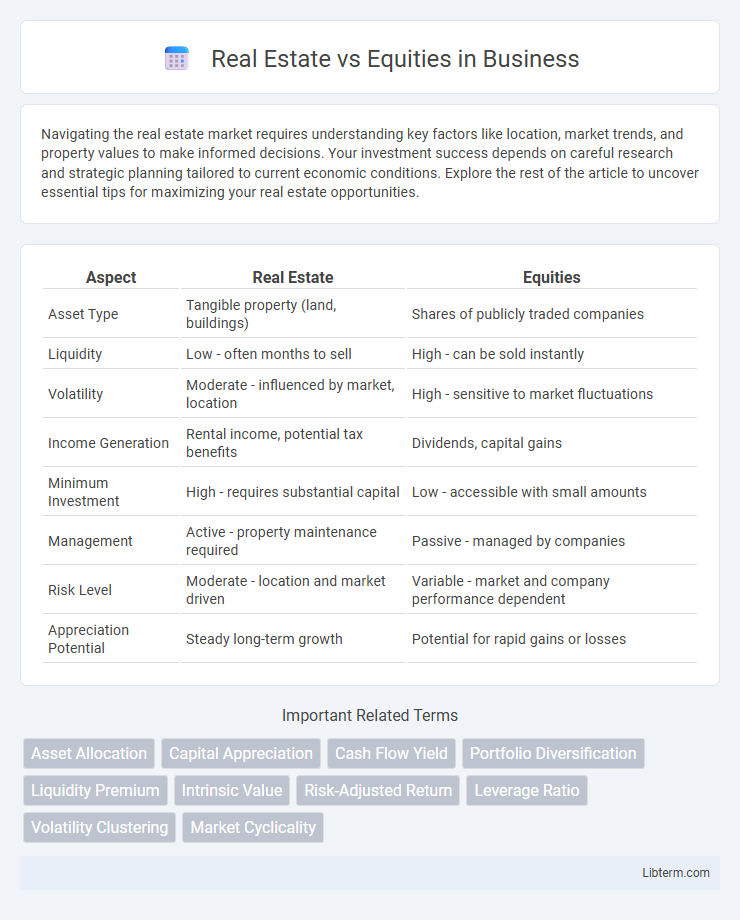

Table of Comparison

| Aspect | Real Estate | Equities |

|---|---|---|

| Asset Type | Tangible property (land, buildings) | Shares of publicly traded companies |

| Liquidity | Low - often months to sell | High - can be sold instantly |

| Volatility | Moderate - influenced by market, location | High - sensitive to market fluctuations |

| Income Generation | Rental income, potential tax benefits | Dividends, capital gains |

| Minimum Investment | High - requires substantial capital | Low - accessible with small amounts |

| Management | Active - property maintenance required | Passive - managed by companies |

| Risk Level | Moderate - location and market driven | Variable - market and company performance dependent |

| Appreciation Potential | Steady long-term growth | Potential for rapid gains or losses |

Introduction to Real Estate and Equities

Real estate encompasses physical properties such as residential, commercial, and industrial buildings, often generating income through rent or capital appreciation. Equities represent ownership shares in publicly traded companies, providing returns via dividends and stock price growth. Both asset classes offer diversification benefits, but they differ in liquidity, risk profiles, and market dynamics.

Key Differences Between Real Estate and Equities

Real estate investments involve owning physical property, offering tangible assets and potential rental income, while equities represent ownership in companies, providing liquidity and dividend opportunities. Real estate typically requires higher initial capital, has lower market volatility, and offers tax benefits like depreciation, whereas equities allow for easier diversification and quicker transactions. Both asset classes differ in risk profiles, liquidity, and income generation, making them suitable for different investment strategies.

Risk and Return Profiles

Real estate investments typically offer lower volatility and steady income through rental yields, making them less risky compared to equities, which exhibit higher price fluctuations but potentially greater capital appreciation. Equities provide liquidity and diversified sector exposure, delivering higher long-term returns but accompanied by market risk and economic sensitivity. Understanding the distinct risk-return profiles helps investors balance portfolio stability and growth objectives effectively.

Liquidity Comparison

Real estate investments typically exhibit lower liquidity due to lengthy transaction times and high entry costs, often requiring weeks to months to convert assets into cash. Equities provide significantly higher liquidity, enabling investors to buy or sell shares almost instantly on stock exchanges during trading hours. This liquidity advantage makes equities more suitable for investors seeking quick access to funds or the ability to respond rapidly to market changes.

Capital Requirements and Accessibility

Real estate typically requires substantial capital investment upfront, including down payments, closing costs, and maintenance expenses, which can limit accessibility for many investors. Equities offer lower capital requirements, enabling individuals to purchase shares with relatively small amounts of money and access fractional ownership through brokerage platforms. This difference in capital demands and ease of entry makes equities generally more accessible for retail investors compared to the higher financial barriers of real estate investment.

Income Generation Potential

Real estate offers stable income generation through regular rental payments, often providing predictable cash flow and potential tax advantages. Equities generate income primarily via dividends, which can vary based on company performance and market conditions, leading to less predictable income streams. Investors seeking consistent income may prefer real estate's tangible asset base, while those comfortable with volatility might benefit from equities' growth potential alongside dividend payouts.

Tax Implications for Investors

Real estate investments offer tax benefits such as depreciation deductions, mortgage interest deductions, and potential 1031 exchanges to defer capital gains taxes, providing significant advantages for investors seeking tax efficiency. Equities typically incur capital gains tax upon sale and dividends taxed at either qualified or ordinary income rates, but lack depreciation benefits available in real estate. Understanding these tax implications helps investors optimize portfolio returns through strategic allocation between real estate and equity assets.

Portfolio Diversification Benefits

Real estate offers portfolio diversification benefits by providing a tangible asset class with low correlation to equities, reducing overall portfolio volatility. Equities, characterized by higher liquidity and growth potential, complement real estate's income stability and inflation hedge features. Combining real estate and equities enhances risk-adjusted returns through diverse income streams and market behavior patterns.

Market Volatility and Economic Sensitivity

Real estate investments typically exhibit lower market volatility compared to equities, as property values tend to fluctuate less abruptly due to their physical and illiquid nature. Equities are more sensitive to economic cycles, reacting quickly to macroeconomic indicators, corporate earnings reports, and geopolitical events, resulting in higher short-term price swings. During economic downturns, real estate may offer more stability through rental income, whereas equities may experience sharper declines reflecting market sentiment and investor risk aversion.

Which Investment Suits Your Financial Goals?

Real estate investments offer tangible assets that provide steady cash flow and potential tax benefits, making them ideal for long-term wealth building and income generation. Equities deliver higher liquidity and growth potential, suitable for investors aiming for capital appreciation and diversified portfolios. Choosing between real estate and equities depends on your risk tolerance, investment horizon, and income requirements.

Real Estate Infographic

libterm.com

libterm.com