Book value represents the net asset value of a company, calculated by subtracting liabilities from total assets on the balance sheet. It provides a snapshot of a company's intrinsic worth, often used by investors to assess whether a stock is undervalued or overvalued compared to its market price. Explore the full article to understand how book value impacts your investment decisions.

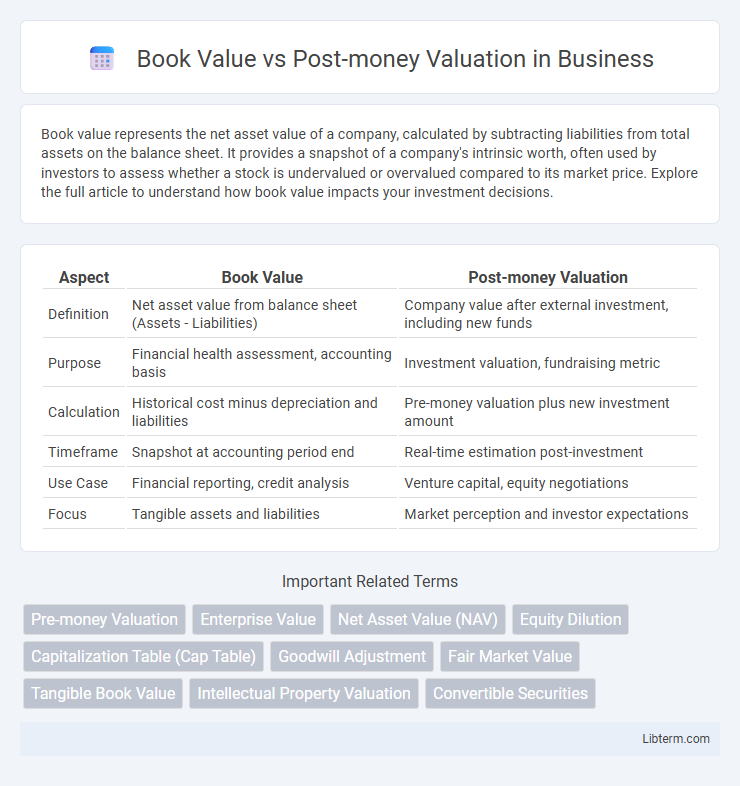

Table of Comparison

| Aspect | Book Value | Post-money Valuation |

|---|---|---|

| Definition | Net asset value from balance sheet (Assets - Liabilities) | Company value after external investment, including new funds |

| Purpose | Financial health assessment, accounting basis | Investment valuation, fundraising metric |

| Calculation | Historical cost minus depreciation and liabilities | Pre-money valuation plus new investment amount |

| Timeframe | Snapshot at accounting period end | Real-time estimation post-investment |

| Use Case | Financial reporting, credit analysis | Venture capital, equity negotiations |

| Focus | Tangible assets and liabilities | Market perception and investor expectations |

Understanding Book Value: Definition and Components

Book value represents a company's net asset value calculated as total assets minus total liabilities, reflecting the tangible worth recorded on the balance sheet. Key components include shareholder equity, retained earnings, and accumulated depreciation, which together indicate the firm's historical cost basis rather than current market value. Understanding book value aids investors in assessing a company's financial stability and underlying asset strength relative to post-money valuation, which focuses on market perception after investment rounds.

What is Post-money Valuation?

Post-money valuation refers to the company's estimated value immediately after receiving external funding or investment, including the new capital injected. It is calculated by adding the investment amount to the pre-money valuation, effectively reflecting the total equity value post-financing. This metric is crucial for investors and founders to understand ownership dilution and equity stakes in startup financing rounds.

Key Differences Between Book Value and Post-money Valuation

Book value represents a company's net asset value calculated by total assets minus total liabilities, reflecting historical cost accounting. Post-money valuation indicates the company's value immediately after a funding round, factoring in new equity investments and future growth expectations. Key differences include book value's reliance on balance sheet data and tangible assets versus post-money valuation's market-driven approach incorporating investor sentiment and projected potential.

How Book Value is Calculated

Book Value is calculated by subtracting a company's total liabilities from its total assets, reflecting the net asset value recorded on the balance sheet. This accounting measure uses historical cost and includes tangible assets, inventory, cash, and receivables, adjusted for depreciation and amortization. In contrast, Post-money Valuation represents the company's value immediately after investment, incorporating market expectations and future growth potential beyond book value.

Steps to Determine Post-money Valuation

Calculate the pre-money valuation by assessing the company's current value based on assets, liabilities, and market conditions before new investment. Add the total amount of new equity investment to the pre-money valuation to determine the post-money valuation. This method helps investors understand the company's worth immediately after funding, differentiating it from book value, which is based solely on accounting data without incorporating investment influx or market sentiment.

Impact of Funding Rounds on Post-money Valuation

Funding rounds directly increase post-money valuation by injecting capital into a company, which adds to its value after the investment. Each new round of funding dilutes existing shareholders while boosting the total equity valuation based on the agreed share price and amount raised. Unlike book value, post-money valuation reflects market perceptions and investor expectations following the latest funding event.

Importance of Book Value for Investors

Book value represents a company's net asset value calculated as total assets minus liabilities, providing investors with a tangible baseline for assessing financial health. It is crucial for investors as it reflects the company's actual equity and serves as a conservative metric compared to post-money valuation, which can be influenced by market sentiment and anticipated growth prospects. Relying on book value helps investors evaluate the intrinsic worth of a business, manage risks, and make informed decisions beyond speculative investment estimates.

When to Use Book Value vs. Post-money Valuation

Book value is best used for assessing a company's net asset value based on historical costs, making it ideal for financial reporting and evaluating tangible assets. Post-money valuation is crucial during fundraising rounds to determine the company's worth immediately after new equity investment, reflecting market perception and investor confidence. Use book value for stability and conservative estimates, while post-money valuation suits growth-stage assessments and negotiation with investors.

Limitations of Book Value and Post-money Valuation

Book Value often underrepresents a company's true worth by relying solely on historical cost and ignoring intangible assets such as intellectual property and brand value. Post-money Valuation can be inflated by recent investment increments without reflecting operational performance or market risks, potentially misleading investors. Both metrics have limitations in accurately capturing a company's comprehensive financial health and future growth prospects.

Book Value and Post-money Valuation: Real-world Examples

Book value represents a company's net asset value based on its balance sheet, calculated as total assets minus total liabilities, often used by investors to assess intrinsic worth. Post-money valuation occurs after a funding round, reflecting the company's total value including the new capital raised, crucial for startup equity distribution. For example, a startup with a pre-money valuation of $10 million receiving $2 million in funding has a post-money valuation of $12 million, while its book value might show a much lower net asset figure during early growth stages.

Book Value Infographic

libterm.com

libterm.com