Floor traded markets involve the buying and selling of financial instruments through open outcry systems on exchange trading floors, enabling traders to execute orders in real-time with direct interaction. This method contrasts with electronic trading by offering greater transparency and human judgment in fast-moving markets. Explore the rest of the article to understand how floor traded systems impact market dynamics and your trading strategies.

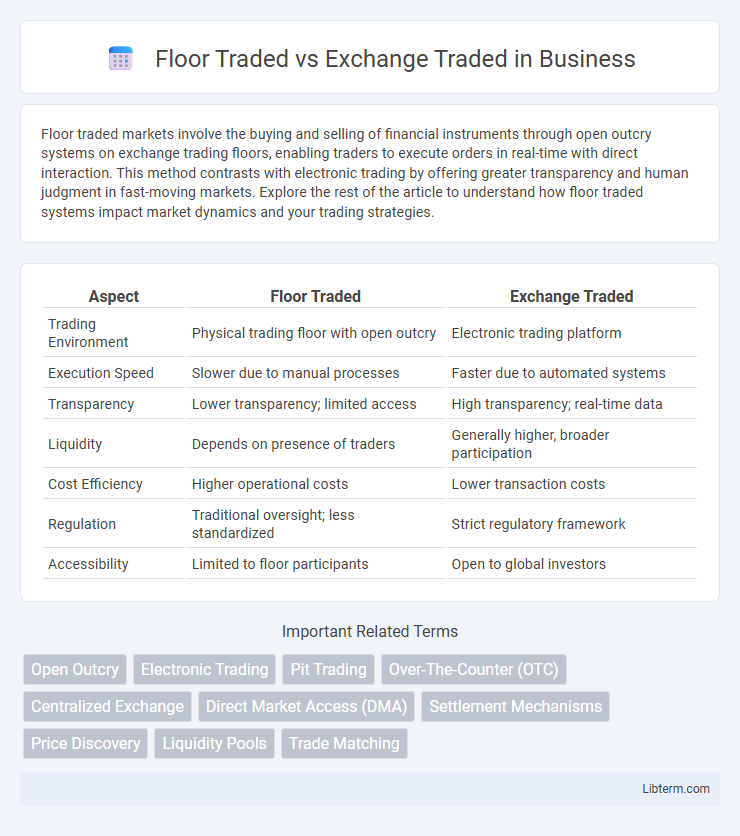

Table of Comparison

| Aspect | Floor Traded | Exchange Traded |

|---|---|---|

| Trading Environment | Physical trading floor with open outcry | Electronic trading platform |

| Execution Speed | Slower due to manual processes | Faster due to automated systems |

| Transparency | Lower transparency; limited access | High transparency; real-time data |

| Liquidity | Depends on presence of traders | Generally higher, broader participation |

| Cost Efficiency | Higher operational costs | Lower transaction costs |

| Regulation | Traditional oversight; less standardized | Strict regulatory framework |

| Accessibility | Limited to floor participants | Open to global investors |

Introduction to Floor Trading and Exchange Trading

Floor trading involves buyers and sellers executing trades in a physical marketplace where brokers and traders interact face-to-face, offering transparency and immediate negotiation. Exchange trading occurs electronically through a computerized system on regulated platforms such as the New York Stock Exchange or NASDAQ, enabling faster execution and broader market access. Both methods facilitate securities transactions but differ in execution style, liquidity, and technology reliance.

Key Differences Between Floor Traded and Exchange Traded

Floor traded markets involve face-to-face transactions on a physical trading floor where brokers and traders communicate directly, whereas exchange traded markets rely on electronic platforms facilitating automated order matching. Price discovery in floor traded environments depends heavily on open outcry and human negotiation, contrasting with the algorithm-driven, real-time price setting in exchange traded systems. Liquidity and transparency tend to be higher in exchange traded markets due to standardized rules and centralized order books, while floor traded markets may exhibit less liquidity and slower execution times.

How Floor Trading Works

Floor trading operates through physical trading pits where brokers and traders execute buy and sell orders verbally or with hand signals, facilitating immediate price discovery in commodities, stocks, or derivatives markets. This system relies on human interaction and open outcry methods, allowing traders to negotiate prices directly and capitalize on market movements in real time. While less common today, floor trading remains integral in some commodity exchanges, providing liquidity and price transparency through face-to-face transactions.

The Evolution of Exchange Traded Markets

The evolution of exchange traded markets has transformed financial trading from traditional floor traded systems, which relied on physical presence and open outcry, to sophisticated electronic platforms that enable faster execution and greater transparency. Modern exchange traded markets utilize advanced algorithms, real-time data dissemination, and regulatory frameworks to enhance market efficiency and reduce counterparty risk. This digital transformation supports higher liquidity, global access, and improved price discovery compared to the historical floor traded environment.

Advantages of Floor Traded Markets

Floor traded markets offer enhanced transparency through open outcry systems, allowing traders to observe real-time bids and offers directly. The physical presence of brokers fosters immediate price discovery and greater liquidity, crucial for smaller or less liquid securities. These markets also reduce the risk of erroneous trades by enabling face-to-face negotiations and confirmations.

Benefits of Exchange Traded Markets

Exchange traded markets offer enhanced transparency with real-time price quotes and standardized contracts, providing investors with greater market efficiency and price discovery. These markets also ensure higher liquidity due to centralized order matching, enabling faster execution of trades and tighter bid-ask spreads. Regulatory oversight in exchange traded platforms reduces counterparty risk, promoting investor protection and market integrity compared to floor traded settings.

Technology’s Impact on Trading Methods

Technology has revolutionized trading methods by shifting the focus from traditional floor traded systems, which relied on physical presence and manual order matching, to highly efficient exchange traded platforms utilizing electronic order books and automated matching engines. Advanced algorithms and real-time data analytics enhance liquidity and price discovery on electronic exchanges, reducing latency and operational costs compared to floor trading. The integration of high-frequency trading and digital interfaces has significantly increased market accessibility and transparency in exchange traded environments.

Cost and Liquidity Comparison

Floor traded markets typically incur higher transaction costs due to broker fees and physical presence requirements, whereas exchange traded platforms benefit from lower fees and streamlined electronic processes. Liquidity in exchange traded markets is generally superior, supported by continuous, transparent order books and a larger pool of participants compared to floor trading's limited, auction-style environment. The cost-efficiency and enhanced liquidity of exchange trading make it more attractive for high-frequency and institutional investors seeking swift order execution.

Risks and Challenges in Both Trading Systems

Floor traded markets face risks such as limited transparency, slower order execution, and potential human errors due to manual processes, increasing the chance of mispricing and manipulation. Exchange traded systems mitigate these challenges through electronic platforms that provide real-time price discovery, automated order matching, and enhanced regulatory oversight, but they encounter risks related to technological failures, cyberattacks, and algorithmic trading errors. Both systems must address liquidity constraints, market volatility, and counterparty risk, impacting traders' ability to execute orders efficiently and maintain market stability.

Future Trends in Financial Market Trading

Floor traded markets are increasingly being supplemented or replaced by electronic exchange traded platforms, driven by advances in algorithmic trading and real-time data analytics. The shift enables greater transparency, reduced transaction costs, and enhanced liquidity through digital order matching systems. Future trends indicate continued growth in hybrid models combining human oversight with automated systems to optimize market efficiency and regulatory compliance.

Floor Traded Infographic

libterm.com

libterm.com