Solvency II is a comprehensive regulatory framework designed to ensure the financial stability of insurance companies by setting robust capital requirements and risk management standards. It enhances transparency and protects policyholders by requiring insurers to maintain sufficient solvency margins and disclose detailed risk information. Explore the rest of this article to understand how Solvency II impacts your insurance investments and industry practices.

Table of Comparison

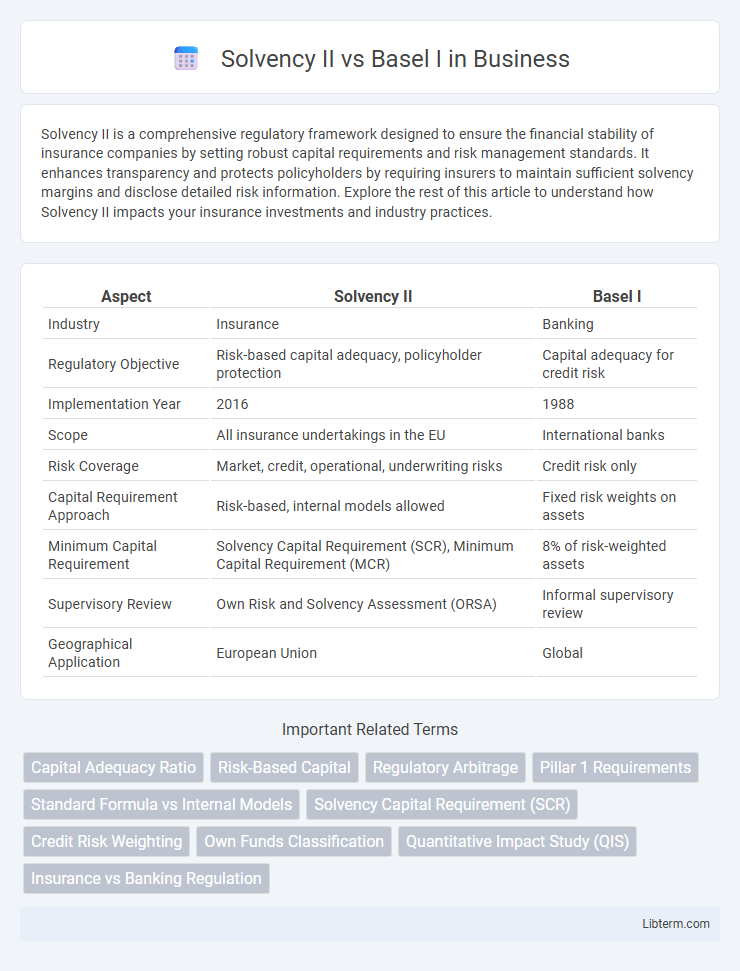

| Aspect | Solvency II | Basel I |

|---|---|---|

| Industry | Insurance | Banking |

| Regulatory Objective | Risk-based capital adequacy, policyholder protection | Capital adequacy for credit risk |

| Implementation Year | 2016 | 1988 |

| Scope | All insurance undertakings in the EU | International banks |

| Risk Coverage | Market, credit, operational, underwriting risks | Credit risk only |

| Capital Requirement Approach | Risk-based, internal models allowed | Fixed risk weights on assets |

| Minimum Capital Requirement | Solvency Capital Requirement (SCR), Minimum Capital Requirement (MCR) | 8% of risk-weighted assets |

| Supervisory Review | Own Risk and Solvency Assessment (ORSA) | Informal supervisory review |

| Geographical Application | European Union | Global |

Introduction to Solvency II and Basel I

Solvency II is a comprehensive regulatory framework established by the European Union to ensure the financial stability of insurance companies, focusing on risk-based capital requirements, governance, and transparency. Basel I, introduced by the Basel Committee on Banking Supervision, sets the minimum capital reserves for banks primarily based on credit risk to promote banking sector stability worldwide. While Solvency II targets insurance firms with a detailed three-pillar approach, Basel I primarily addresses banking institutions with a simpler capital adequacy ratio framework.

Historical Context and Development

Solvency II emerged from the European Union's efforts in the early 2000s to create a harmonized regulatory framework for insurance companies, replacing the prior Solvency I directive with more risk-sensitive capital requirements and enhanced governance standards. Basel I, introduced by the Basel Committee on Banking Supervision in 1988, was the first international regulatory accord focusing on credit risk and capital adequacy for banks, setting minimum capital requirements primarily based on risk-weighted assets. Both frameworks evolved in response to financial crises and market developments, with Solvency II emphasizing insurer-specific risk profiles and Basel I laying the groundwork for subsequent Basel Accords that broadened the scope of bank regulation.

Regulatory Objectives and Scope

Solvency II targets the insurance sector, emphasizing risk-based capital requirements to ensure insurer solvency and policyholder protection, while Basel I focuses on banking, establishing minimum capital adequacy standards to promote financial system stability. Solvency II employs a three-pillar approach covering quantitative requirements, governance, and disclosure, with a comprehensive risk-sensitive framework, contrasting with Basel I's simpler, credit-risk-focused capital ratio rules. The regulatory scope of Solvency II includes insurance groups across the European Union, whereas Basel I applies to internationally active banks globally, prioritizing credit risk and operational risk controls.

Key Components and Framework Structure

Solvency II establishes a risk-based framework for insurance companies with three pillars: quantitative requirements for capital adequacy, qualitative requirements for governance and risk management, and market transparency through disclosure. Basel I, designed for banks, primarily focuses on credit risk and sets a minimum capital requirement based on standardized risk weights for various asset classes. The Solvency II framework is more comprehensive by incorporating market, credit, and operational risks, while Basel I provides a simpler, asset-based approach to ensure banking sector stability.

Capital Requirements: A Comparative Analysis

Solvency II establishes risk-sensitive capital requirements for insurers based on a three-pillar approach, emphasizing market, credit, and operational risks, with a focus on maintaining a 99.5% confidence level over a one-year horizon. Basel I, designed for banks, sets fixed minimum capital ratios primarily against credit risk, with a tiered framework requiring 8% total capital relative to risk-weighted assets. The Solvency II framework offers a more comprehensive and granular assessment of capital adequacy compared to Basel I's simpler, credit-risk-centric model.

Risk Management Approaches

Solvency II emphasizes a risk-based framework tailored for insurance firms, integrating market, credit, operational, and underwriting risks to ensure adequate capital reserves. Basel I, designed primarily for banking, focuses on credit risk and sets fixed capital requirements based on asset classifications without detailed risk sensitivity. The Solvency II approach promotes dynamic risk management through internal models and stress testing, whereas Basel I applies standardized, less granular regulatory measures.

Supervisory Review and Reporting Standards

Solvency II imposes comprehensive Supervisory Review Processes (SRP) emphasizing risk-based capital adequacy for insurance firms, requiring detailed Own Risk and Solvency Assessment (ORSA) reports and continuous risk exposure evaluation. Basel I, primarily targeting banking institutions, mandates basic capital adequacy ratios with less emphasis on qualitative supervisory review, focusing on credit risk through standardized risk weights and quarterly reporting. Reporting standards under Solvency II include granular quantitative templates aligned with Solvency Capital Requirement (SCR) calculations, whereas Basel I employs simpler capital adequacy reporting with reliance on aggregate risk-weighted assets and minimal qualitative disclosures.

Impact on Financial Institutions

Solvency II establishes rigorous risk-based capital requirements and comprehensive supervisory frameworks for insurance companies, significantly enhancing their risk management and financial stability. Basel I, designed for banking institutions, introduced minimum capital adequacy standards primarily focused on credit risk but offered less granularity compared to later frameworks. The differing regulatory scopes of Solvency II and Basel I lead to distinct impacts, with insurers facing detailed risk assessments and capital charge calculations, while banks under Basel I encounter standardized capital requirements that influence their lending and operational strategies.

Criticisms and Limitations of Each Framework

Solvency II faces criticism for its complexity and high implementation costs, which can burden smaller insurers and create challenges in consistent application across the EU. Basel I, as an earlier banking regulation framework, is limited by its simplistic risk weighting approach, failing to adequately differentiate between varying credit risks and leaving banks exposed to unforeseen financial stress. Both frameworks struggle with calibration issues, where overly rigid or generalized rules may not effectively capture the true risk profiles of institutions.

Future Trends in Financial Regulation

Future trends in financial regulation highlight increased integration of Solvency II and Basel frameworks to enhance risk sensitivity and capital adequacy across banking and insurance sectors. Emphasis on advanced quantitative models, ESG risk incorporation, and real-time data analytics are driving regulatory evolution. Enhanced transparency and harmonization efforts aim to mitigate systemic risk and foster resilient financial markets worldwide.

Solvency II Infographic

libterm.com

libterm.com