Forensic audit involves a detailed examination of financial records to detect fraud, embezzlement, or other financial discrepancies. It combines accounting, auditing, and investigative skills to provide evidence suitable for legal proceedings. Explore the rest of this article to understand how forensic audits protect your business from financial misconduct.

Table of Comparison

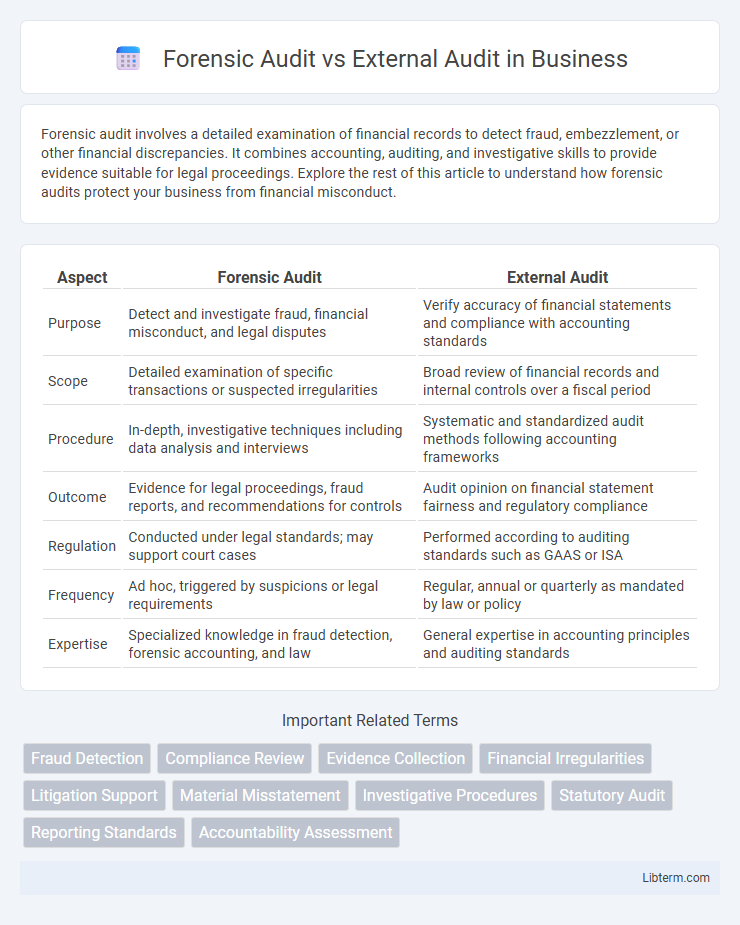

| Aspect | Forensic Audit | External Audit |

|---|---|---|

| Purpose | Detect and investigate fraud, financial misconduct, and legal disputes | Verify accuracy of financial statements and compliance with accounting standards |

| Scope | Detailed examination of specific transactions or suspected irregularities | Broad review of financial records and internal controls over a fiscal period |

| Procedure | In-depth, investigative techniques including data analysis and interviews | Systematic and standardized audit methods following accounting frameworks |

| Outcome | Evidence for legal proceedings, fraud reports, and recommendations for controls | Audit opinion on financial statement fairness and regulatory compliance |

| Regulation | Conducted under legal standards; may support court cases | Performed according to auditing standards such as GAAS or ISA |

| Frequency | Ad hoc, triggered by suspicions or legal requirements | Regular, annual or quarterly as mandated by law or policy |

| Expertise | Specialized knowledge in fraud detection, forensic accounting, and law | General expertise in accounting principles and auditing standards |

Introduction to Forensic Audit and External Audit

Forensic audit involves the detailed examination of financial records to detect fraud, embezzlement, or other financial misconduct, often used in legal investigations and dispute resolutions. External audit primarily focuses on evaluating an organization's financial statements for accuracy and compliance with accounting standards, providing assurance to stakeholders about the financial health of the entity. While forensic audits are investigative and often triggered by suspicion of fraud, external audits are routine assessments conducted annually to ensure transparency and accountability.

Definition of Forensic Audit

Forensic audit is a specialized examination aimed at detecting fraud, financial misconduct, and legal discrepancies by analyzing financial records and transactions with investigative techniques. Unlike external audits that primarily assess financial statements' accuracy and compliance, forensic audits provide detailed evidence for legal proceedings and dispute resolution. This type of audit combines accounting, auditing, and investigative skills to uncover hidden frauds and support litigation processes.

Definition of External Audit

External audit is an independent examination of a company's financial statements conducted by certified auditors to ensure accuracy and compliance with accounting standards and regulations. This process provides stakeholders with an unbiased assessment of the organization's financial health and internal controls. Unlike forensic audits, which investigate fraud or financial misconduct, external audits focus on validating the fairness and reliability of reported financial information.

Key Objectives of Forensic Audit

Forensic audits primarily aim to detect and investigate fraud, financial misrepresentation, and embezzlement by meticulously examining financial records and transactions. They serve as critical tools in legal proceedings by providing evidence-based findings for litigation and dispute resolution. Unlike external audits, which focus on verifying the accuracy of financial statements and compliance with accounting standards, forensic audits emphasize uncovering intentional wrongdoing and irregularities within an organization.

Key Objectives of External Audit

External audits primarily aim to provide an independent assessment of an organization's financial statements to ensure accuracy, transparency, and compliance with accounting standards and regulations. These audits focus on verifying the fairness of financial reporting, identifying material misstatements, and enhancing stakeholder confidence. Unlike forensic audits, external audits are not designed to detect fraud but rather to confirm the overall integrity of financial disclosures.

Methodologies Used in Forensic vs External Audits

Forensic audits employ investigative methodologies including detailed transaction tracing, fraud detection techniques, and data analytics to uncover discrepancies and financial misconduct. External audits focus on systematic sampling, risk assessment, and compliance verification to ensure financial statements adhere to accounting standards. Forensic processes prioritize evidentiary documentation and legal scrutiny, while external audits emphasize materiality and financial accuracy.

Differences in Scope and Approach

Forensic audits concentrate on detecting and investigating fraud, financial misconduct, and legal violations, employing detailed transaction analysis and evidence gathering for potential litigation. External audits focus on assessing financial statements' accuracy and compliance with accounting standards to provide an opinion on their fairness. The forensic approach is investigative and retrospective, while external audits are systematic and forward-looking to ensure overall financial transparency.

Legal Implications and Outcomes

Forensic audits are designed to detect and investigate fraud, providing legally admissible evidence for criminal or civil proceedings, while external audits primarily assess financial statement accuracy and regulatory compliance without the intent of legal prosecution. The outcomes of forensic audits often lead to legal actions such as lawsuits or criminal charges, whereas external audits typically result in audit opinions and recommendations to improve financial controls. Legal implications in forensic audits involve detailed documentation and expert testimony, contrasting with external audits that focus on adherence to accounting standards and financial transparency.

Required Skills and Qualifications for Auditors

Forensic auditors require expertise in fraud detection, investigative techniques, and knowledge of legal procedures, alongside certifications such as Certified Fraud Examiner (CFE) or Certified Forensic Accountant (CrFA). External auditors must possess strong financial accounting skills, proficiency in auditing standards like GAAS or ISA, and qualifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA). Both roles demand analytical thinking and ethical integrity, but forensic auditors emphasize investigative skills while external auditors focus on financial statement accuracy and compliance.

Choosing Between Forensic Audit and External Audit

Choosing between a forensic audit and an external audit depends on the primary objective: forensic audits focus on detecting and investigating fraud, financial discrepancies, and legal violations, while external audits aim to provide an independent opinion on financial statements' accuracy and compliance with accounting standards. Organizations facing suspicions of fraud or legal issues typically require a forensic audit conducted by specialists skilled in forensic accounting and investigative techniques. In contrast, routine financial transparency and regulatory compliance necessitate an external audit performed by certified public accountants or audit firms following standardized auditing procedures.

Forensic Audit Infographic

libterm.com

libterm.com