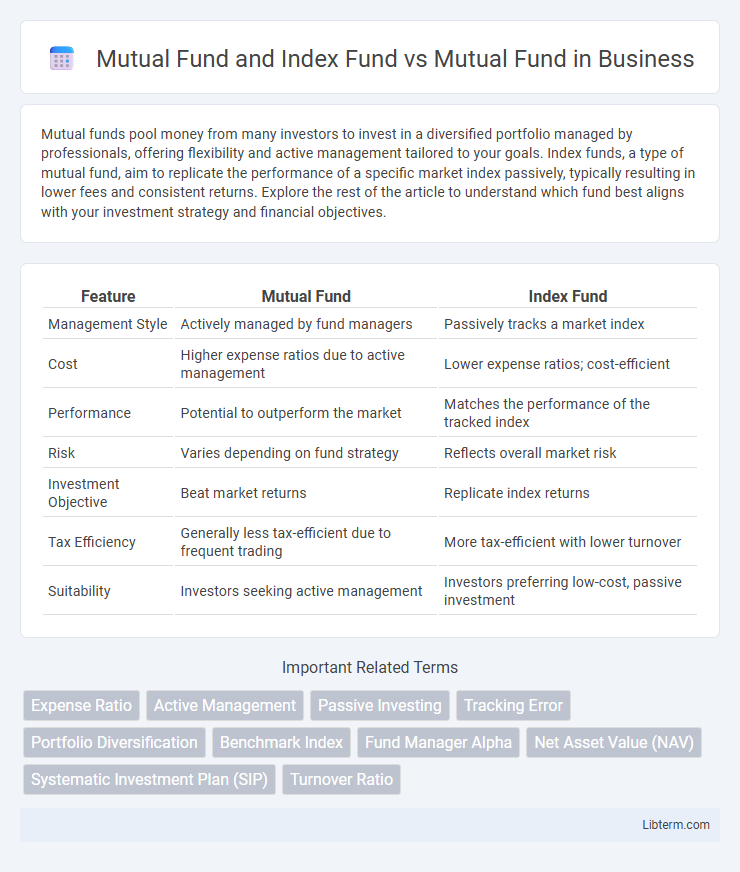

Mutual funds pool money from many investors to invest in a diversified portfolio managed by professionals, offering flexibility and active management tailored to your goals. Index funds, a type of mutual fund, aim to replicate the performance of a specific market index passively, typically resulting in lower fees and consistent returns. Explore the rest of the article to understand which fund best aligns with your investment strategy and financial objectives.

Table of Comparison

| Feature | Mutual Fund | Index Fund |

|---|---|---|

| Management Style | Actively managed by fund managers | Passively tracks a market index |

| Cost | Higher expense ratios due to active management | Lower expense ratios; cost-efficient |

| Performance | Potential to outperform the market | Matches the performance of the tracked index |

| Risk | Varies depending on fund strategy | Reflects overall market risk |

| Investment Objective | Beat market returns | Replicate index returns |

| Tax Efficiency | Generally less tax-efficient due to frequent trading | More tax-efficient with lower turnover |

| Suitability | Investors seeking active management | Investors preferring low-cost, passive investment |

Understanding Mutual Funds: An Overview

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by professional fund managers. Index funds are a type of mutual fund designed to replicate the performance of a specific market index, such as the S&P 500, by holding the same securities in similar proportions. Unlike actively managed mutual funds, index funds typically have lower fees and aim for consistent market returns rather than trying to outperform the market.

What Is an Index Fund?

An index fund is a type of mutual fund designed to replicate the performance of a specific market index, such as the S&P 500, by holding the same securities in the same proportions. Unlike actively managed mutual funds, index funds offer lower management fees and reduced turnover due to their passive investment strategy. This makes index funds a cost-effective and diversified option for investors seeking market-average returns.

Key Differences: Index Funds vs. Mutual Funds

Index funds are a type of mutual fund designed to replicate the performance of a specific market index, such as the S&P 500, by holding the same proportions of stocks within that index. Mutual funds can be actively managed, where fund managers select securities to outperform the market, leading to higher management fees and potential for greater returns or losses. Key differences between index funds and mutual funds include cost efficiency, with index funds typically having lower expense ratios, and investment strategy, where index funds follow a passive approach while mutual funds often employ active management.

Investment Strategies: Passive vs. Active Management

Mutual funds employ active management strategies where fund managers actively select securities aiming to outperform the market, involving frequent trades and comprehensive market analysis. Index funds utilize passive management by replicating the components of a specific market index, minimizing trading activity and reducing management costs. The choice between active mutual funds and passive index funds impacts risk, expense ratios, and potential returns based on the investment strategy.

Cost Comparison: Fees and Expense Ratios

Index funds typically have lower fees and expense ratios compared to actively managed mutual funds due to their passive investment approach, which reduces management and operational costs. Mutual funds often incur higher fees as fund managers actively select securities to outperform benchmarks, increasing administrative expenses. Investors seeking cost-efficiency often prefer index funds, which can significantly enhance net returns over time by minimizing fees and expenses.

Performance Analysis: Historical Returns

Mutual funds offer a diversified portfolio managed by professionals, often resulting in variable historical returns influenced by the fund manager's strategy and market conditions. Index funds replicate market indexes, providing consistent returns closely aligned with the overall market performance, typically outperforming many actively managed mutual funds over long periods. Historical data shows index funds generally yield lower fees and more stable returns compared to mutual funds, making them a preferred choice for cost-conscious investors seeking reliable growth.

Risk Factors: Volatility and Diversification

Mutual funds generally offer broad diversification by pooling investments in various assets, reducing individual stock risk, while index funds specifically track market indices, providing consistent exposure to market volatility with lower expense ratios. Index funds typically exhibit lower volatility due to their passive management and wide market representation, whereas actively managed mutual funds may carry higher risk depending on portfolio concentration and management decisions. Both fund types mitigate individual security risks, but investors seeking minimized volatility and predictable diversification often prefer index funds over actively managed mutual funds.

Accessibility and Minimum Investment Requirements

Mutual funds typically have lower minimum investment requirements, often starting around $500, making them accessible to a broader range of investors. Index funds, as a subset of mutual funds, sometimes impose slightly higher minimums, especially in direct index fund offerings, but still remain affordable compared to other investment vehicles. Accessibility remains high for both, with many platforms offering no-load funds and automatic investment plans.

Tax Implications: Mutual Fund vs. Index Fund

Mutual funds typically generate higher taxable events due to frequent trading and active management, resulting in short-term and long-term capital gains distributions that can increase your tax liability. Index funds, by contrast, usually have lower turnover rates, leading to fewer capital gains distributions and greater tax efficiency for investors. Understanding the tax implications is crucial when choosing between actively managed mutual funds and passively managed index funds to optimize after-tax returns.

Choosing the Right Fund for Your Financial Goals

Mutual funds pool money from investors to invest in a diversified portfolio managed by professionals, offering broad market exposure and active management. Index funds are a type of mutual fund designed to replicate the performance of a specific market index, such as the S&P 500, typically featuring lower fees and passive management. Choosing the right fund depends on your financial goals, risk tolerance, and preference for active versus passive strategies, where mutual funds may suit investors seeking potential outperformance and index funds appeal to those prioritizing cost-efficiency and market-matching returns.

Mutual Fund and Index Fund Infographic

libterm.com

libterm.com