Exchange-traded products offer investors the ability to buy and sell securities on public stock exchanges with real-time pricing and high liquidity. These products include exchange-traded funds (ETFs), exchange-traded notes (ETNs), and exchange-traded commodities (ETCs), providing diversified exposure across various asset classes. Discover how exchange-traded instruments can enhance your investment strategy by exploring the full article.

Table of Comparison

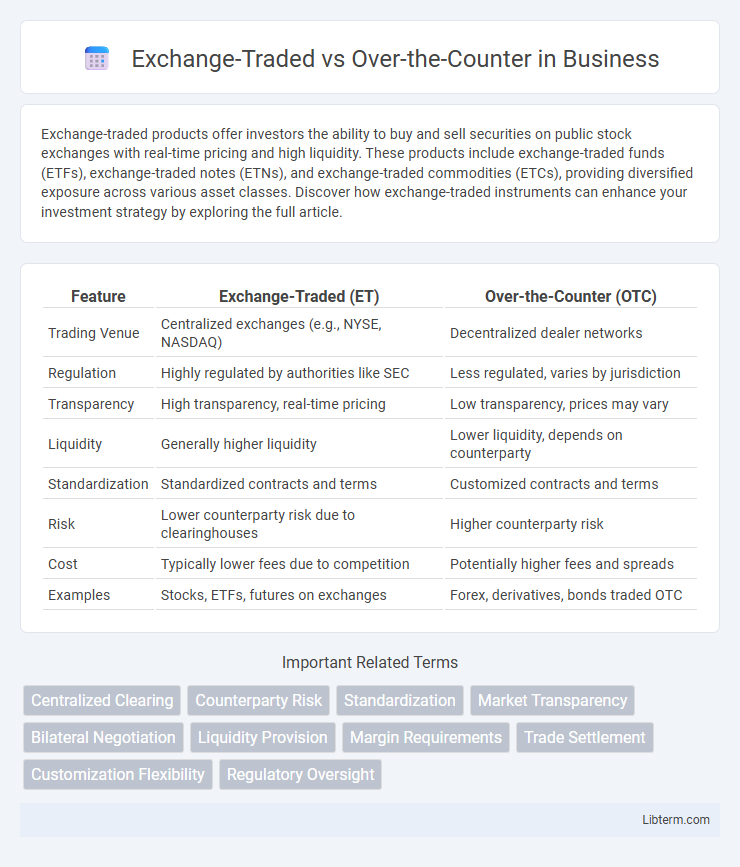

| Feature | Exchange-Traded (ET) | Over-the-Counter (OTC) |

|---|---|---|

| Trading Venue | Centralized exchanges (e.g., NYSE, NASDAQ) | Decentralized dealer networks |

| Regulation | Highly regulated by authorities like SEC | Less regulated, varies by jurisdiction |

| Transparency | High transparency, real-time pricing | Low transparency, prices may vary |

| Liquidity | Generally higher liquidity | Lower liquidity, depends on counterparty |

| Standardization | Standardized contracts and terms | Customized contracts and terms |

| Risk | Lower counterparty risk due to clearinghouses | Higher counterparty risk |

| Cost | Typically lower fees due to competition | Potentially higher fees and spreads |

| Examples | Stocks, ETFs, futures on exchanges | Forex, derivatives, bonds traded OTC |

Introduction to Exchange-Traded and Over-the-Counter Markets

Exchange-Traded Markets involve securities or derivatives traded on centralized, regulated exchanges such as the NYSE or NASDAQ, providing transparent pricing and standardized contracts. Over-the-Counter (OTC) Markets operate through decentralized networks where transactions occur directly between parties, often involving customized contracts and less regulatory oversight. These fundamental differences impact liquidity, risk, and transparency for market participants.

Key Differences Between Exchange-Traded and OTC Instruments

Exchange-traded instruments are standardized contracts such as stocks, futures, and options traded on regulated platforms like the NYSE or NASDAQ, offering high liquidity and transparent pricing through centralized order books. Over-the-counter (OTC) instruments, including swaps, forward contracts, and bespoke derivatives, are privately negotiated directly between parties, resulting in lower liquidity, customized terms, and increased counterparty risk. Regulatory oversight differs significantly, with exchange-traded instruments subject to stringent market regulations and reporting requirements, while OTC markets operate with less transparency and varying degrees of regulatory scrutiny.

Market Structure and Functionality Comparison

Exchange-traded markets operate through centralized platforms with standardized contracts and transparent pricing, ensuring high liquidity and regulated environments for securities like stocks and futures. Over-the-counter (OTC) markets involve decentralized, direct transactions between parties, offering greater flexibility in contract terms but exposing participants to higher counterparty risk and reduced price transparency. The market structure of exchange-traded venues supports formal settlement processes and regulatory oversight, whereas OTC markets emphasize bespoke agreements and rely on bilateral credit assessments for transaction security.

Transparency and Price Discovery

Exchange-traded markets offer higher transparency by providing real-time price quotes and standardized contract terms that facilitate accurate price discovery. Over-the-counter (OTC) transactions, conducted privately between parties, often lack immediate public price visibility, resulting in less transparent pricing mechanisms. The centralized nature of exchange-traded platforms enhances market efficiency, while OTC markets may experience wider bid-ask spreads due to limited transparency.

Liquidity Considerations

Exchange-traded securities typically offer higher liquidity due to standardized contracts and centralized marketplaces facilitating abundant buyer and seller activity. Over-the-counter (OTC) securities often experience lower liquidity, as they are traded via decentralized networks with fewer participants and less transparency. This difference in liquidity impacts trade execution speed, pricing accuracy, and potential bid-ask spreads between exchange-traded and OTC instruments.

Counterparty Risk and Credit Exposure

Exchange-traded securities significantly reduce counterparty risk by utilizing a centralized clearinghouse that guarantees trade settlement and enforces margin requirements, thereby minimizing credit exposure. In contrast, over-the-counter (OTC) transactions involve direct agreements between parties without a centralized intermediary, increasing credit risk due to potential default by counterparties. Robust risk management and collateral arrangements are essential in OTC markets to mitigate the heightened credit exposure inherent in these bilateral deals.

Regulatory Oversight and Compliance

Exchange-traded securities operate under stringent regulatory oversight by entities such as the SEC and FINRA, ensuring standardized compliance, transparency, and investor protection through formal listing requirements and continuous disclosure obligations. Over-the-counter (OTC) markets, regulated less intensively and often by the Financial Industry Regulatory Authority (FINRA) or through state-level agencies, carry higher compliance risks due to less transparency, variable reporting standards, and limited centralized supervision. Understanding these regulatory distinctions is crucial for assessing risk exposure and compliance responsibilities in securities trading environments.

Cost and Fee Structures

Exchange-traded markets typically feature lower and more transparent fee structures due to standardized trading protocols and high liquidity, resulting in tighter bid-ask spreads. Over-the-counter (OTC) transactions often incur higher costs, including wider spreads and added dealer commissions, reflecting customization and lower market transparency. Understanding these differences is crucial for investors aiming to optimize trading expenses and overall cost efficiency.

Product Availability and Flexibility

Exchange-traded products offer standardized contracts and greater liquidity, ensuring consistent availability and ease of trading with transparent pricing. Over-the-counter (OTC) markets provide customizable contracts, allowing tailored terms and conditions that meet specific client needs, but may face less liquidity and higher counterparty risk. Product flexibility in OTC markets is higher, while exchange-traded instruments benefit from strict regulation and uniformity, impacting availability accordingly.

Choosing Between Exchange-Traded and OTC: Factors to Consider

Choosing between exchange-traded and over-the-counter (OTC) markets depends on factors such as liquidity, transparency, and regulatory oversight. Exchange-traded instruments offer higher liquidity and standardized contracts, making them suitable for investors seeking price transparency and regulated environments. OTC markets provide flexibility in contract terms and access to a wider range of assets but come with increased counterparty risk and less stringent regulation.

Exchange-Traded Infographic

libterm.com

libterm.com